-

Bitcoin is vulnerable to price drops due to a $12,000 hole.

-

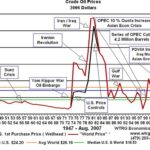

Analysts expect a correction of 17%-19%, closing the gap between $80K and $77K on the CME.

-

Historical Trends suggest Bitcoin could experience a -15% drop in Week 7.

Analysts are trying to predict what will happen next. As of press, Bitcoin (BTC), is currently sitting at $94,077.17. Ali Martinez, an on-chain analyst who is well known, says that there’s a huge $12,000 gap between $87,000 to $75,000. This means that there is not much support within this range, which could leave Bitcoin vulnerable to further price drops.

Martinez believes this could make Bitcoin’s price even more volatile. EGRAG CRYPTO also agrees, and has provided two scenarios for the upcoming months.

Bitcoin: A correction or a surge ahead?

According to EGRAG CRYPTO, Bitcoin could either experience a correction or surge higher levels. The first scenario is that Bitcoin could fall by 17%-19%, which would fill the CME’s gap between $80K-$77K. This could trigger a corrective phase before Bitcoin starts to move up again.

Bitcoin could also surge to $120K if “The Yellow Line” is followed on a nonlogarithmic chart. If this happens, we could see a correction later, perhaps in March.

Historical Trends Indicate a Correction Is Coming

Bitcoin’s price has a long history of rapid increases, followed by corrections. Rekt Capital is another famous analyst who points out that Bitcoin has a history of rapid price increases followed by corrections.

Read also: Bitcoin price crash? Arthur Hayes Predicts March Meltdown

In 2013, the first major price correction occurred after six consecutive weeks of price increases. In 2017, Bitcoin fell 34% after seven weeks. In the 2020/2021 cycle it experienced a 16% drop after six weeks. This cycle is doing the same. Bitcoin is in the 7th week of its current rally and a 15% fall could be on its way.

This site is for entertainment only. Click here to read more