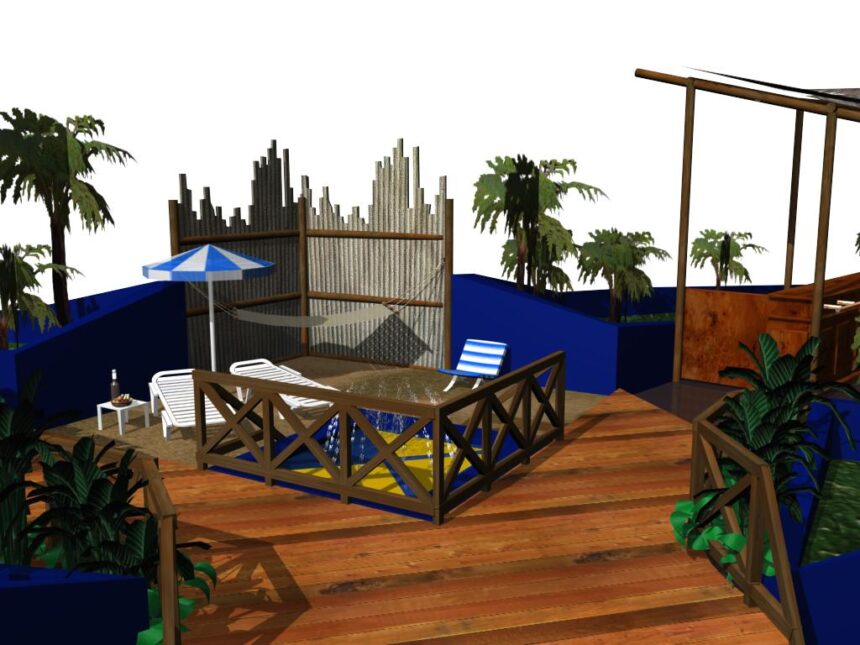

Hyatt Hotels Corp. has strategically turned to the bond markets to secure financing for its ambitious $2.6 Billion acquisition of Playa Hotels & Resorts. Playa Hotels & Resorts is a prominent owner and operator of all-inclusive Caribbean resorts.

This move is a bet on all-inclusive tourism’s growing popularity and an expansion of Hyatt’s already extensive portfolio.

Hyatt will launch a bond offering on Monday that includes fixed-rate notes for three and seven years.

This dual-tranche strategy allows the hospitality giant to attract investors with different risk appetites and investment time frames.

Bond market busy today

Hyatt’s bond issue comes at a moment when the investment grade primary bond market is anticipating a surge of activity.

Around six issuers will tap the debt markets on Monday. This creates a competitive environment, where issuers have to offer attractive terms to attract investors.

The three-year notes have a yield that is 1.3 percentage points higher than the benchmark Treasuries. The seven-year bonds offer a yield that is approximately 1.75 percentage point higher.

Both tranches have solid investment grade ratings. Moody’s Ratings expects ratings of Baa3 and S&P Global Ratings expects ratings of BBB-.

Hyatt’s offer includes a special redemption clause that is mandatory, giving investors a certain level of protection.

This clause states that if Playa Hotels fails to close the acquisition by October 9, 2025 or if there is a termination of the purchase agreement, Hyatt must redeem the notes for 101 percent plus any interest accrued.

This feature is a safeguard that reduces the risk to investors in the event the acquisition does not go as planned.

Hyatt is confident in the deal, as evidenced by the fact that the bond sale is not conditional on the acquisition being completed.

This post Hyatt checks-in with bond sale to fund $2.6B Playa Resorts purchase may be modified as new developments unfold

This site is for entertainment only. Click here to read more