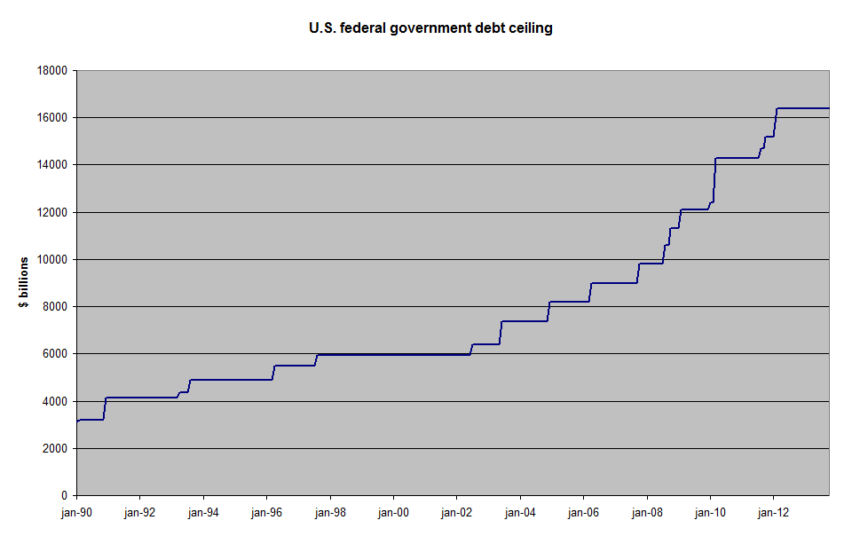

The US government has reached its borrowing limit once more.

Analysts warn of a possible default this summer if there is no plan in place to increase the debt ceiling.

As lawmakers try to find a consensus, the political divides continue to grow, and interest on debt is increasing at an alarming pace.

Can the impossible happen?

Does the debt crisis get worse?

In the first five month of fiscal year 2025, the US budget deficit soared to $1.15 trillion. This is a 38% increase from last year’s same-period figure.

The February deficit was $307 billion. This is nearly twice the January figure.

The government spends far more money than they collect in taxes, despite some reductions.

The debt interest payments have reached $396 billion in this fiscal year. This is now the third largest budget item, after Social Security.

Elon Musk, the Department of Government Efficiency under President Donald Trump’s leadership has been created to find cost-cutting solutions.

There is little evidence to suggest that the program has had any impact.

Meanwhile, Congress is debating whether or not to permanently extend Trump’s tax cuts of 2017, which could add an extra $3.3 trillion in the coming decade.

It’s not possible to add the numbers up.

Tax cuts: Can they fix the problems?

Trump and Senate Republicans are looking to extend the current tax cut while reducing their cost by zero, using an accounting method that presumes these tax breaks already exist in the tax code.

Not everyone agrees that this approach makes it easy to reduce spending without having to offset the reductions.

Republicans claim that by extending 2017’s tax cuts without making other reductions, the deficit would grow even more.

House of Representatives has passed a plan for tax cuts that will save $4.5 trillion over 10 years. This is offset by only $2 trillion worth of spending cuts.

The Senate is still divided. Some fiscal conservatives want to cut Medicaid, Social Security and other entitlement programs, while others are calling for tax incentives for business.

This debate makes it difficult to reach a resolution on the debt ceiling deadline.

Will Congress be able to raise the debt limit in time?

The raising of the debt ceiling is now a battle for political power.

Some Senate Republicans want a separate vote, forcing Democrats to publicly state their position on borrowing.

The time is ticking away.

The US may default on debt by the middle of 2025 if Congress fails to act. This scenario is becoming more and more plausible.

Treasury Secretary Scott Bessent believes a deal will be struck by the summer but that there are no specific steps to take.

Some Republican Senators never have voted before for an increase in the debt ceiling and demand major cuts to spending as a result.

Some people believe that the ceiling needs to be increased without any conditions in order to avoid economic chaos.

A lack of agreement could lead to the first ever government payment failure.

What will happen if the US defaults on its debt?

Unprecedented would be a US default.

If the government could not pay its bills it would delay payments for Social Security, federal salaries and military funding.

Financial markets will react violently.

Another big drop is expected.

In addition, the rate of interest would probably spike and the dollar’s credibility as the reserve currency for the world as a result.

Even the mere threat of default in 2011 led to market volatility and a downgrade for US credit ratings.

The situation is much worse this time around, as the economy has been flirting with recession and debt levels are higher.

Ray Dalio, the founder of Bridgewater Capital Management, has said that there is a serious supply and demand problem in the US with regards to its debt. This forces the US government to be forced to sell more than what the rest of the world will buy.

The Federal Reserve could be forced to create money in order to buy government debt if buyers stop buying. This would fuel inflation and undermine confidence in the financial sector.

The president predicts “shocking” developments, such as a possible restructuring of US debt, or pressure from foreign countries to accept more Treasury Securities, that could cause diplomatic tensions.

Borrowing costs may spiral out of control if foreign investors who own a large portion of US government debt lose their confidence and begin to sell off these holdings.

The US has once again been in the news for alarming reasons.

Investors around the world are once again anxious about debt ceiling talks.

This situation must be addressed sooner rather than later.

Is this the best administration to solve it?

The US could default on its debt in the next year. This post may change as new information unfolds

This site is for entertainment only. Click here to read more