Samsung Electronics has requested that ASML Holdings postpone delivery of the equipment to its new Texas factory. This move has revealed the manufacturing problems at the company.

It is still not enough for the company to justify operating its factory.

This company desperately needs customers to fill its $17 billion factory.

Some of the company’s staff has been sent home in order to reduce the cost associated with this facility.

It could be a serious risk for the financial stability of the business if it cannot find any customers to buy its products.

What is Taylor City factory and why does it matter?

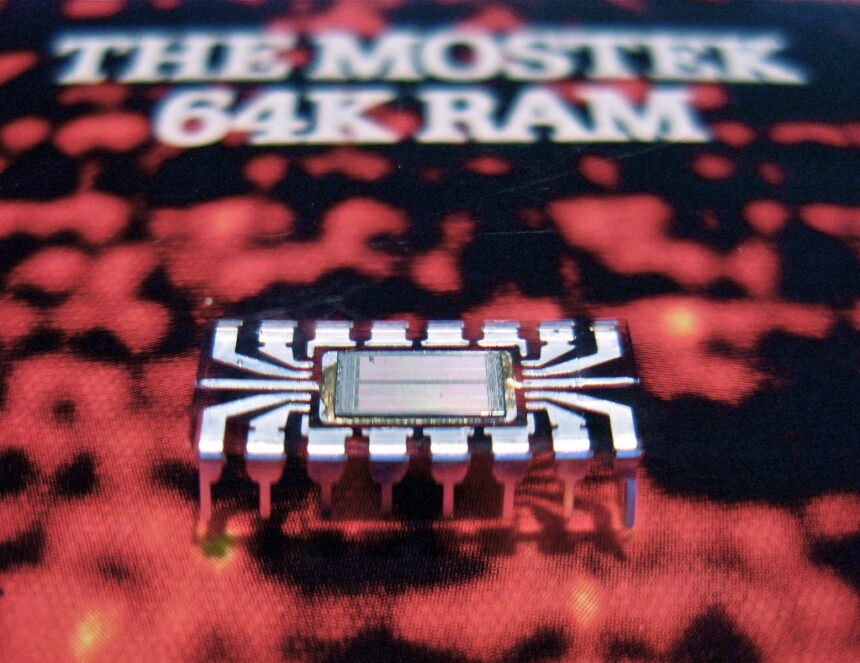

Samsung chairman Jay Y. Lee is looking to grow his company from a mere memory chip maker into a chip manufacturing giant.

Taiwan Semiconductor Manufacturing Company is the current leader in chip manufacturing.

SK Hynix, another Samsung competitor is ramping up its AI chip production.

Samsung is in a difficult position, and runs the risk of falling behind competitors as they dominate new technologies.

ASML stock fell earlier this week after it lowered its guidance citing low non AI demand.

The company also said that they expect some revenue delays due to a few factories experiencing delays.

One of these factories appears to be Samsung’s Taylor City facility.

Industry has already predicted that the plant will be delayed until 2026.

If Samsung fails to attract enough clients, a write-off of assets is not impossible.

Samsung, of course, has denied this development and stated that the return of staff was a normal rotation.

What is the catch rate for TSMC?

Taiwan is a tiny country. It’s hard to believe that it will become the epicenter of the AI revolution.

Everyone wants to be part of the team because it has a unique, reliable and innovative technology.

The topic of this over-reliance is also a controversial one in the political world. TSMC is a vital supplier of defense equipment to countries like China and the US.

Samsung’s progress shows that both countries are still unable to come up with alternatives.

Samsung’s share of the contract manufacturing market has dropped from 19% in 2005 to 11% today.

TSMC controls 62% market share. Anyone who has attempted to close this gap will find it difficult.

Intel has also entered into the contract manufacturing industry in an effort to diversify their business.

US Government also welcomed this move. It funded its US Fabs to try and reduce the reliance on companies from abroad.

Intel’s story has already been told by many. Its expansions are causing the company to crumble.

Samsung is now delaying further investment in its foundry line inside Korea. The 3nm production of its chips is facing issues with low yield, a problem other chip manufacturers have also faced.

Until the secret ingredient of TSMC is revealed, other chip makers will find it difficult to compete with them.

What is the market share of TSMC? The post Samsung’s hard-earned lesson may change as new updates are released