Investors retreated from the FTSE 100 for four days in a row as they came to grips with Donald Trump’s win and its implications for UK and world equities. Investors also focused on interest rate reductions by both the Federal Reserve and Bank of England.

Footsie fell to PS8,140 (down 4%) from its peak this year. The US, however, saw the Nasdaq and S&P 500 indexes reach record levels.

Bank of England has announced its second rate reduction of the year, and indicated that more will be made in coming months. The bank is expected to cut rates three or four times before December of next year, according to analysts.

The top FTSE 100 stocks to watch this week

The FTSE 100 Index reacted in response to several significant corporate earnings by UK companies. BT Group ,one the UK’s top telecom companies, published a weak set of financial results. It also lowered its forecast. The BT stock price fell by more than 1% Thursday as a consequence.

National Grid, another major player in the utilities industry, also made headlines after publishing mixed results. Its earnings per share rose to 28.1 pence from the 25.9 pence it had in the prior period. The company also kept its investment and guidance plans.

Asos is the second top UK-based company to have published mixed results. Fast fashion firm Asos reported that sales fell by 12 percent in the UK in the first nine month of this year. The company’s revenues dropped 16%, to PS2.9billion. However, the management said that they were still on the right track.

Next week, as the top companies of the FTSE 100 publish their results, it will be the FTSE 100 that is in the spotlight.

Vodafone is one of the largest companies in the global telecom industry.

Vodafone will continue to execute its turnaround strategy as it continues to release results. In order to achieve this, Vodafone has left some of its key markets, such as Spain and Italy, in favor of Germany, UK and other countries.

Vodafone’s share price is affected by its performance in Germany, and its ability to continue growing its services. The Vodafone share price is likely to bounce above the 200 day moving average of 71.60p if this occurs.

Earnings of Intermediate Capital Group ICG

Intermediate Capital Group is another important FTSE 100 stock to keep an eye on. It’s one of Europe’s largest private equity firms. ICG has performed well, as have other companies within the industry. Its share price is up 33% since January.

These gains were made after the private credit fund was raised by billions. These results provide more information about the current state of the business and the future.

The management is expected to provide more details about the impact of the Trump Administration on business. Analysts believe the Trump administration will result in more business activity over the long term.

Aviva is another major FTSE 100 firm to keep an eye on next week. Aviva is one of the largest insurance companies in Britain. The company will announce its results next Tuesday. Aviva is a UK top dividend stock that has fallen by more than 8.5% since its peak this year due to tighter insurance regulations.

Aviva’s share price dropped below its 200-day moving median and formed a flag bearish pattern. There is therefore a high probability that Aviva will experience a negative breakout within the next few months. The next level to monitor will be 400p if this occurs.

The spotlight will shine on more FTSE 100 stocks. Land Securities, Great Portland Estates and Flutter Entertainment are the most prominent. Flutter Entertainment is the parent of brands such as Fanduel Sportsbet Pokerstars and Sky Betting.

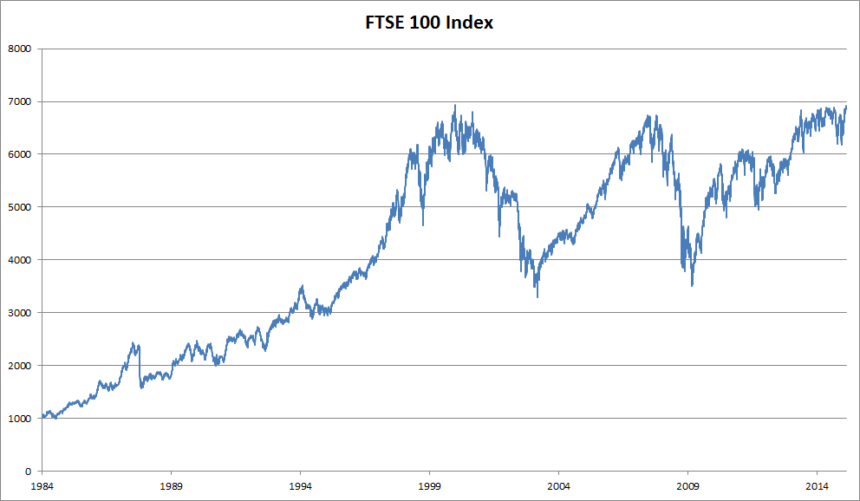

FTSE 100 Index Analysis

On the daily chart we can see the FTSE 100 has been stuck in a narrow range for the last few months. Since May 15, it has been stuck between the important support and resistance points at 8,115p, and 8,472p.

At PS8,100, the index is still above the Fibonacci Retracement of 23.6% and the moving average for the last 200 days. It has also formed a bullish chart flag pattern. This is a positive market sign.

Investors will react positively to Trump’s administration and Fed cutbacks in the next few months. The next level to monitor is PS 8,400. If you break through that level, it will take you to PS8,472.

The post FTSE 100 Index shares to watch: Aviva Vodafone ICG Flutter Flutter could be updated as new information becomes available

This site is for entertainment only. Click here to read more