After the Bank of Canada’s latest interest rate announcement, the S&P/TSX composite index, which measures the largest Canadian companies, will likely suffer a loss for the week. Blue-chip index fell to C$25.410, just a few percentage points lower than the high for this year of C$25.790.

Bank of Canada Decision

Bank of Canada’s continued interest rate reductions was a major catalyst in the TSX composite Index.

The benchmark rate has fallen from 5,0% in the beginning of this year, to 3,25 % today. The officials hinted at more rate reductions in the future to help support the economy.

Government bonds have become less appealing due to the ongoing rate reductions.

The cuts are most important because they have devalued the Canadian dollar compared to the US dollar as well as other currencies. USD/CAD rose to a new high of 1.4240. This is its highest since April 2020. The pair has increased by nearly 20% since its lowest point in 2020.

Exporting nations, particularly those who sell their products to the United States, often benefit from a weaker Canadian Dollar.

As the economy continues to be weak, analysts expect that the BoC will continue to cut interest rates. The economic growth is slowing down because energy prices continue to fall.

Brent, the benchmark for the world, has fallen to $73 while West Texas Intermediate (WTI), the alternative, is now at $70. The price movement is noteworthy because Canada is the 4th largest energy producer on the planet.

Stocks that will move the most in Canada by 2024

The earnings of most companies on the TSX composite index continued to grow this year.

The gold mining industry has been one of the most successful companies, as its prices have soared to record levels. Agnico-Eagle Mines’ stock has increased by 66% in the past year. Franco Nevada is up by 20%. Wesdome Gold Mining’s stock rose over 80% while Equinox Gold rose 28%.

Orla Mining was the top performing company in the TSX composite. Other companies included Aritzia Gold, Kinross Gold MDA New Gold IAMGold and First Quantum Minerals.

The robust price of gold has benefited these companies, and this trend will likely continue. Analysts expect the gold price to continue increasing, which will benefit Canadian miners, as the US debt is surging.

TSX Composite Bank stocks did also well this year. Bank of Montreal (BMO) rose by 8 percent, and Bank of Nova Scotia by 21 percent this year.

Canadian Western Bank stock is up almost 90%. The National Bank of Canada stock rose 33% while Royal Bank of Canada’s share price jumped 32%. Analysts are concerned that Canadian banks have a high valuation.

Some TSX-listed companies have also seen a sharp drop this year. Tilray Brands – a major player in the cannabis sector – fell by 43 percent in 2024. Blackberry’s share price fell 17%. Richelieu Hardware BRP and Parex Resources also suffered losses.

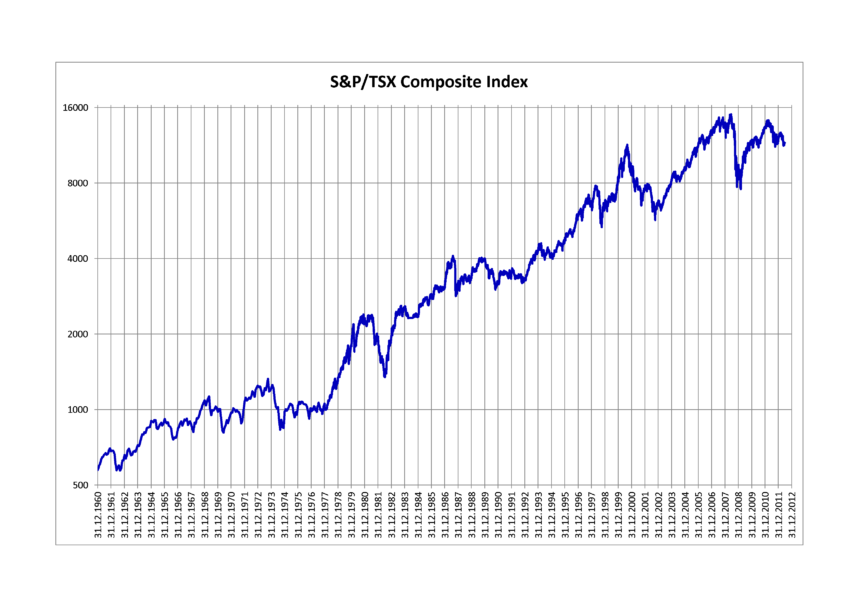

TSX Composite Index Analysis

Weekly chart of the TSX Composite Index shows it has had a bullish run over the last few months. The index has remained well above both the 200-week and 50-week exponential moving averages.

Index has risen above C$25,000, the psychologically important level. The Relative Strength Index and MACD indicators continue to indicate upward momentum.

The TSX is likely to continue its upward trend as the bulls aim for the next major resistance level at C$26,000.

The content of this post TSX Composite Index rallied in 2024 : Here are the top constituents can be updated as new information becomes available.

This site is for entertainment only. Click here to read more