US President Donald Trump will meet with some of America’s most powerful businessmen on Tuesday, as concerns about tariffs, economic unrest, and the recent stock market drop continue to grow.

Reuters reported that around 100 chief executives of major corporations will attend the meeting in Washington. These include Apple, JPMorgan Chase and Walmart.

Other attendees include Chuck Robbins (CEO of Cisco Systems, and the group’s new chair), Jamie Dimon, JPMorgan Chase CEO, and Citigroup CEO Jane Fraser.

The White House is yet to release an official statement regarding the agenda of the meeting, but it’s expected to focus on economic policies, trade, and regulatory actions.

Investors are worried about a possible recession, as Trump described a “period in transition” for the US economy.

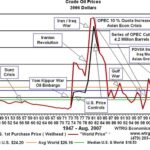

The unpredictable trade policies of the president, including the possibility that new tariffs could be implemented as early as this Wednesday, have rattled the market.

Trump’s meeting will take place amid low confidence in the business sector

Trump’s America First economic approach–characterized by tax cuts, deregulation, and tariffs–has drawn both praise and criticism from business leaders.

While some executives have welcomed the policies aimed at increasing domestic investment, other executives have voiced concern that trade restrictions could harm growth and increase inflation.

Chief Executive magazine conducted a survey recently that revealed CEOs’ confidence about the US business climate has dropped to the lowest level since the COVID-19 pandemic began in early 2020.

The CEOs’ assessment of the current business climate in the US dropped 20% from January. From 6.3 to 5 on a 10-point scale, where 1 is Poor and ten is Excellent.

This is the lowest level seen since the spring of 2020 when the pandemic closed down businesses all over the world.

This is in stark contrast to the more optimistic assessment made by the Conference Board a month ago.

Delta Air Lines cut its first-quarter forecast on Monday due to a “recent drop in consumer and corporate trust” amid increasing economic uncertainty.

American Airlines warned of even greater losses as the demand for leisure travel declines.

Reuters reported that Kush Desai from the White House spokesman dismissed any negative talk about the outlook.

The New York Fed’s consumer survey revealed that households are becoming more pessimistic about their financial outlooks for the coming year.

Stock market reeling due to trade war fears

The financial markets have been struggling in recent days. The S&P 500 fell 2.7% on Monday and the Nasdaq plunged 4%.

Investor confidence has been shaken due to Trump’s changing stance on tariffs. He suggested over the weekend that tariffs “may increase” instead of going down.

Analysts warn that further escalation could worsen the situation.

“Trump has a great start. It’s disappointing that his ‘dumb,’ (as the Wall Street Journal called it) tariff policy is muddying up the waters for where the US and the world economies are heading,” Don Ochsenreiter told Chief Executive.

There is fear that the “Trump boost” in the market has turned into a “Trump crash”. This is because of the expectations of a trade conflict reigniting inflation.

Inflation and policy changes remain key concerns

Goldman Sachs economists have revised their forecasts. They have reduced US growth projections until 2025, while increasing inflation estimates due to more aggressive assumptions about tariffs.

David Solomon, the bank’s CEO is a member of Business Roundtable.

Morgan Stanley lowered its 2025 GDP forecast from 1.9% down to 1.5%, citing that trade policies were more aggressive than expected.

Morgan Stanley economists said in a client note that “While we had expected growth-constricting policies like tariffs, and immigration controls would come first, the severity of their implementation has exceeded our expectations.”

Trump’s economic strategy, in general, remains under scrutiny. This includes his commitment to tax reductions and deregulation.

While many investors hoped for more stimulus, legislative obstacles make it difficult to implement sweeping tax reforms.

Trump acknowledged at the weekend that it could take “a bit of time” for his tariff strategy to produce economic benefits.

“I think that if we are all becoming a little bit more nationalistic, and I am not saying that that is a bad thing – you know, it resonates with me – that it will have elevated inflation,” said BlackRock’s CEO Larry Fink at a conference for the industry on Monday. Fink is also a member of Business Roundtable.

This post Trump talks to top CEOs amid low trust, recession risks could be modified as new information unfolds

This site is for entertainment only. Click here to read more