The Mexican peso gained against the US dollar, reaching 20.4 dollars per peso on Tuesday.

This is a significant recovery from its recent low, which was 20.64 on the 26th of November.

The improvement is a reflection of investor optimism, fueled by positive data on the labor market and a thawing in trade tensions between the United States and Canada.

Economists are reassessing forecasts, as the economy of Mexico is showing signs of resilience.

Peso rally fueled by historic low unemployment

Mexico’s October unemployment rates, which fell to a record-low of 2.5%, are a key driver for the peso resurgence.

This rate is the lowest since March and also exceeds estimates that unemployment would be 2.9%.

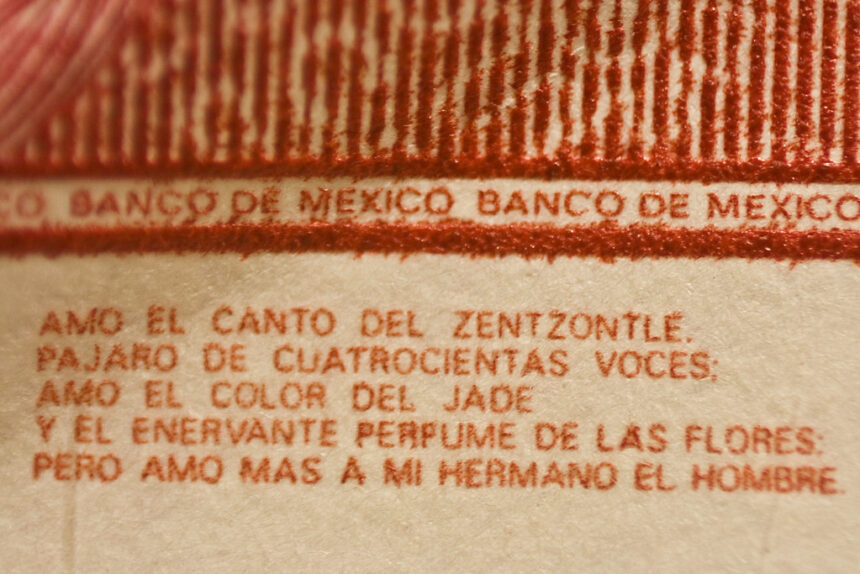

This large drop in the value of the peso boosts consumer confidence and economic activity. The Bank of Mexico (Banxico), therefore, has more flexibility in its monetary policies.

Some argue that, as the labour market tightens, the central bank should pursue an aggressive easing rate so long as economic indicators remain stable.

The decline in unemployment should encourage Banxico to be more flexible in its rate-cutting cycle. This will drive capital inflows, and provide the peso an additional buffer from volatility.

Reduce tensions in trade with the US

The peso has also benefited from improved US-Mexico commercial relations.

Positive diplomatic meetings between US-elect Donald Trump, and Mexican President Claudia Sheinbaum eased concerns over escalating conflicts in trade.

Trump’s proposal to impose a 25% tariff against immigration and drug trafficking initially put pressure on pesos, causing fears of a trade war.

The markets responded positively to their recent meeting, indicating that they trusted Sheinbaum’s commitment to solving these complex problems. Trump himself described the engagement as “wonderful.”

This diplomatic rapprochement improved investor confidence significantly.

The improvement in the currency rate today reflects an optimistic market sentiment fueled by hopes of further collaboration between two neighbouring countries.

The challenges remain: weaker peso in the year to date

It is important to remember that despite the peso’s positive rebound, the currency is still down almost 20% year-to-date.

The currency’s stability is at risk due to concerns about the increased government spending, rising debt levels and Banxico’s recent easing measures.

Sheinbaum’s budgetary policies have been criticized by some analysts, who believe that they could increase inflationary pressures as well as complicate the monetary environment of the central bank.

Investors are concerned about the impact of government debt on future economic growth. The peso could be at risk if the government continues to spend without generating economic growth.

A delicate balance

The recent rally of the Mexican peso is a positive sign in a complex economic environment.

This positive development has been attributed to a stronger labour market, as well as lower trade tensions.

The peso’s long-term stability depends on addressing issues like government spending and debt.

Investors will continue monitoring both domestic and global developments as they assess currency’s resilience.

The future trajectory of the peso will depend on how well it navigates these opportunities and challenges.

This post Mexican peso strengthens at 20.4 per dollar amid growth in the labor market, trade optimism may be updated as new developments unfold

This site is for entertainment only. Click here to read more