Bloomberg reported that the transition team of President-elect Donald Trump has indicated plans to prioritize development of a federal regulatory framework for fully autonomous cars. This could have significant implications on Tesla Inc. and Elon Musk as its CEO.

According to people familiar the discussions cited in the publication, these regulatory goals could reshape and accelerate Tesla’s plans for deploying driverless cars at scale.

Musk is at a crucial moment in his career. He has become a key ally to Trump and a major contributor to his campaign.

Musk has gained political leverage by being appointed to lead the Department of Government Efficiency of the President-elect, along with entrepreneur Vivek RAMASWAMY.

Plans under consideration

Bloomberg reported that according to people with knowledge of the discussions who requested anonymity because they were not authorized to speak publicly, Trump’s team is looking for policy leaders to help create a regulatory framework to govern self-driving cars.

The National Highway Traffic Safety Administration, part of the Transportation Department, can implement regulations that facilitate the deployment and use of autonomous vehicles. However, an act by Congress is required to allow for the widespread adoption of self driving cars.

According to two sources a bipartisan proposal is in its early stages to establish federal guidelines on AVs.

They said Emil Michael, former Uber Technologies Inc. executive, is a candidate for Transportation Secretary. He has spoken to Trump’s team as well as potential staffers.

They said that the work is still in its early stages, and that policy details are yet to be determined.

People said that Republican Representatives Sam Graves from Missouri and Garet Graves from Louisiana were also considered for the position.

Tesla’s AV Dream faces current challenges

The federal regulations in place pose a number of challenges to companies like Tesla who plan to produce large numbers driverless robotaxis.

Current regulations limit the number of self driving vehicles a manufacturer may deploy to 2,500 per year under special exemptions.

Congress has repeatedly failed to pass legislation to raise the limit to 100,000 due to gridlock.

The Trump administration’s support of AVs could revive hopes for legislative changes.

While the National Highway Traffic Safety Administration has some latitude in easing restrictions, a federal framework that is comprehensive requires legislative support.

Previous efforts, including a one during Trump’s initial term, advanced through House but failed in the Senate.

During the administration of President Biden, attempts to merge AV-focused legislation with other proposals also stalled. This was largely due to disagreements over liability protections for manufacturers.

Tesla’s future and the AV market competitors

Tesla’s ambitious plans are based on its Full Self-Driving system (FSD), currently classified as a level 2 driver-assist systems.

FSD, despite years of promises, has not yet achieved true autonomy. Critical safety interventions occur every 100-200 mile.

This number must be improved by several orders of magnitude to make robotaxis viable.

Musk is optimistic that Tesla will have self-driving capability in Texas and California before mid-2025. However, he has shifted his timelines historically.

The creation of an AV federal framework could open doors for other robotics developers, including Waymo and Zoox.

Amazon’s Zoox and Alphabet’s Waymo have begun testing in Las Vegas, San Francisco and Los Angeles.

Tesla’s stock price outlook amid regulatory changes

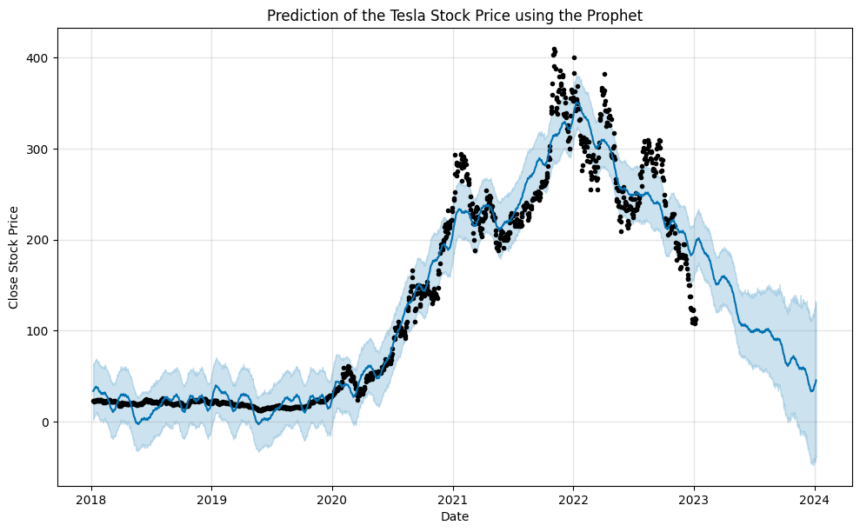

Tesla’s stock has responded positively to potential regulatory tailwinds. It surged over 5% on trading platforms such as Robinhood Sunday night, as news of Trump’s interest in self driving cars spread.

Analysts have expressed their optimism in recent times regarding Tesla’s AV Vision adding to its stock. The materialisation of Trump’s plans could unlock the opportunity.

Morgan Stanley analysts led by Adam Jonas argued that if Musk uses his political influence to the fullest, Tesla’s commitment to autonomous vehicle technology and its robotaxi platform could lead to a sustained rally.

Analysts believe Tesla’s autonomous technology could be “the great unlock” that elevates Tesla into an AI leader.

Morgan Stanley’s bullish scenario predicts Tesla’s stock to rise to $500.

The firm claims that Tesla’s expertise with AI, data and vertical integration uniquely positions the company to capitalize on AV’s growing market.

Morgan Stanley’s optimism is shared by Wedbush analyst Dan Ives.

Ives predicts Tesla’s market cap could rise from $1 trillion up to $1.5 trillion, or even $2 trillion, in the next 12-18 months, fueled by FSD technology, and the upcoming launch the Cybercab, Tesla’s driverless car.

He said that under Trump’s leadership the regulations surrounding AVs would become more favourable. This would reduce the “regulatory web” that had previously hindered Tesla’s progress.

RBC Capital Markets also raised its price target for Tesla from $323 to $387.

The bank cited their growing confidence in Tesla AV’s capabilities and operational benefits gained through vertical integration.

RBC analysts were especially encouraged by their visit to Tesla’s Giga Texas plant, which demonstrated the company’s progress on scaling up its autonomous technologies.

Tesla’s hands-on approach in software, hardware and AI development is also cited as a competitive advantage over other automakers.

This post Trump wants to relax rules on AVs: What it means for Tesla’s stock appeared initially on ICD

This site is for entertainment only. Click here to read more