After Jefferies analysts noted the potential for a surge in demand, Teladoc Health is set up to be a great short-term investment opportunity.

Brokerage house increases price target for the stock to $10 from $8.

BetterHelp, the mental health website of BetterHelp’s parent company, is a good indicator for the short term.

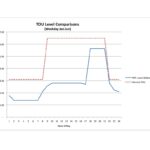

In the past 12 months, web traffic has been declining. The company has seen an increase in traffic for its mental health services between July and August.

Analysts have already predicted a 11% drop in revenue for BetterHelp’s third-quarter division.

They expect an overall 5% decline in revenues. They have reevaluated their earnings expectations after reviewing the web traffic data.

If you combine the information above with Teladoc’s 16% short position, it is possible that the stock could rally on a short term basis.

When interest rates begin to fall, stocks that have been beaten down could rally because cheaper money is available.

New leadership is driving optimism

Charles Divita was appointed CEO of Teladoc on the 10th June. Normalerweise, this would be considered a good thing. The stock continued to fall despite the good news.

The new CEO retracted guidance for fiscal year 2024, and dropped a 3-year forecast. This move would normally be viewed as high-risk. Many would call this a sign that the manager is incompetent.

It wasn’t that big of a deal for a company that had fallen over 95% since its highs.

After three months, a change is noticeable. The stock has recovered.

The web traffic data shows that Teladoc is being used more. What the new CEO has done in his three-month tenure seems to have worked.

A manageable debt situation

There are currently convertible notes worth $1.6 billion outstanding. The company has outstanding convertible notes worth $1.6 billion.

Cash position of 1,16 billion dollars would cover $800 millions due in the next year. If the free cash flow is positive, it should cover the remainder of the payment.

Investors need to be aware of one important thing. The convertible notes may also be turned into equity. Existing shareholders would be diluted if this were to happen.

Teladoc should be able to recover quickly from its terrible stock decline due to the healthy cash position it has, a positive cash flow and a determined management.

Short interest and the changing trend are good reasons to encourage traders to push up stock prices.

A safe entry could be made at this stage due to the triggers that are short-term. Holding the stock over the long-term will become much easier if they happen, even though it will still be volatile.

Should you invest in this high-risk play? This post may change as new information unfolds