Nvidia Corp. was within striking distance on Tuesday of surpassing Apple Inc., the second-most valuable company in the world. Its stock rose on optimism about chip sales to Saudi Arabia as well as artificial intelligence infrastructure agreements.

Shares of the company rose 5.6%, closing at $129.93. This boosted its market cap to $3.17 billion — just short of Apple’s $3.2 trillion.

Nvidia has risen 38% since April, surpassing Apple by 23%.

Jessica Amir is a market strategist for Moomoo Australia. She says that at this rate, Nvidia will soon surpass Apple in terms of global size.

Jensen Huang’s net worth has also risen to $120 billion, up from around $80 billion just a year earlier.

This puts him outside of the top 10 in Forbes’ list of real-time billionaires, reflecting how tightly his fortune is linked to Nvidia’s explosive growth in AI.

Huang is credited with bringing Nvidia into the heart of the AI boom. He has capitalised on the demand for high performance chips that are used to create large language models, and generative AI tools.

Saudi deal signals new growth frontier

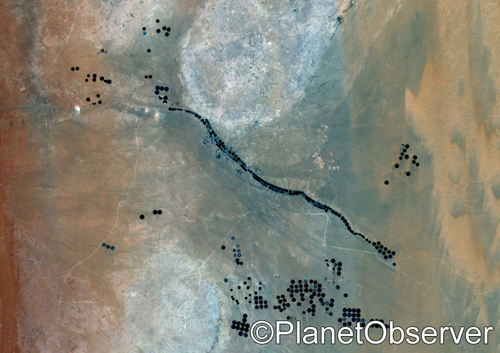

Nvidia announced a partnership with Saudi Arabia’s Humain – an AI start-up backed by Saudi Arabia’s sovereign wealth fund.

Huang announced at the Saudi US Investment Forum held in Riyadh that Nvidia will supply chips for the 500 Megawatt Data Centre Project that is central to Saudi Arabia’s AI goals.

Project will start with Nvidia GB300 Grace Blackwell Superchips. Hundreds of thousands of additional chips are expected to be added over the course of five years.

Nvidia InfiniBand technology will connect the chips, reflecting the sophistication and scale of infrastructure in the Gulf.

This development is in line with Trump’s strategy to expand semiconductor access throughout the Middle East.

Analysts believe that a potential agreement to let the UAE import more than a million Nvidia chip is under consideration. This could boost the stock price.

Amir stated that “Nvidia only needs another US$11 Billion in Market Capitalisation” to achieve the target.

Then, it can tap Microsoft on its shoulder and regain the top spot. Nvidia has more potential as the US weighs a deal that would allow the United Arab Emirates import over one million Nvidia chip, and major S&P 500 companies have reaffirmed their commitment to buying more,” added Sherry.

China still has a negative impact on earnings

Nvidia faces challenges despite the rally.

UBS analysts expect that the company will beat expectations for revenue in its next earnings report, which is due on May 28. However, earnings per share may be slightly below expectation.

UBS’s Timothy Arcuri reduced his target price to $175, down from $180. He cited continued Chinese restrictions on Nvidia’s most advanced chip.

Nvidia has reportedly been working on a version of the H20 chip that is downgraded for the Chinese market. However, the company declined to make any comments.

Nvidia is still clearly leading the way.

Nvidia appears to be on a steady upward trajectory as long as AI is at the top of tech’s global priorities.

Can this post Nvidia hits $3.1 tn and closes in to Apple’s M-cap following Saudi partnership reshape the tech rankings? This post may change as new information becomes available

This site is for entertainment only. Click here to read more