Stock market volatility has been heightened by President Donald Trump’s recent executive orders that imposed tariffs and the threat of a trade conflict. Inflation, interest rate cuts, and the spectre a war on trade have also been mentioned.

According to the American Association of Individual Investors’ latest survey, 47.3% of investors expect a decline in the stock price over the next six-month period.

This is the highest level recorded since November 2023.

The crypto market has not been unaffected by the Trump presidency’s pro-crypto sentiment, but investors have shifted to safer assets, and profit-taking triggered a selloff.

ICD spoke to James L Koutoulas to learn how macroeconomic shifts are affecting hedge fund strategies, how Typhon Capital’s crypto investment strategy evolved, and why he believes that markets will not be fooled by Trump’s tweets this time around, instead taking tariff talks to be a negotiating tactic.

Excerpts of an email interaction:

Hedge funds are also investing in grains and oilseeds.

Invezz : What do you think of the current macroeconomic climate and how it affects commodities and hedge fund strategy?

We believe that the increased volatility under Trump makes risk-management strategies of hedge funds more valuable, if they are effective.

Commodity prices (food) have been rising over the past six months and will continue to rise.

Hedge funds would have been wise to invest in these traditional commodities long ago.

Prices have increased as a result of the weather and diseases that are affecting animal proteins around the world.

Look at the prices of cocoa, coffee, and oil seeds as examples.

Funds have been re-engaged.

Invezz: What impact do you think Trump’s proposed tariffs on steel and aluminum will have on commodity markets and supply chain? How can investors navigate the tariff phase and possible retaliation?

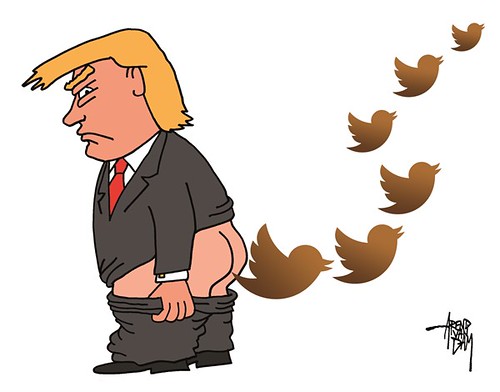

The markets took Trump’s tweets at face value the first time, to their detriment.

This time they are channeling The Who’s “Won’t Get Fooled again,” using tariff talk as a negotiation ploy.

Typhon Capital’s crypto-investment strategy has evolved

Invezz – How does Typhon Capital approach crypto investments today compared to previous years?

We have always adhered to our core strategy of thorough counterparty due diligence and coin due diligence. This has allowed us to never invest even a dollar in an exchange or a coin that later failed.

We have also maintained our relative-value, risk-adjusted-return focus, which led us to achieve 4 Sortino and one-third the maximum drawdown of BTC in eight years.

Last year, we added a systematic BTC/ETH futures trend-following to the fund. This year, we have added a limited exposure to DeFi through CoinBase Prime’s On-Chain Wallet.

Crypto will continue to be a “risk on” asset with a strong correlation to stocks

Invezz :Will hedge funds and traditional asset management companies allocate more capital to crypto by 2025?

Absolutely. Gary Gensler’s departure, coupled with a crypto-friendly, meme-coin-supporting President Trump, has lifted the regulatory stigma and created a new era of optimism.

Invezz Given recent correlations between Bitcoin and tech stocks do you think institutional acceptance will further align crypto markets with equity markets or will it decouple in the future?

We believe that crypto will continue to be an asset with a high correlation to stocks.

This post, Interview: Typhon Capital’s James Koutoulas, on commodities, crypto and Trump-era market changes, may be modified in the future as new developments unfold.

This site is for entertainment only. Click here to read more