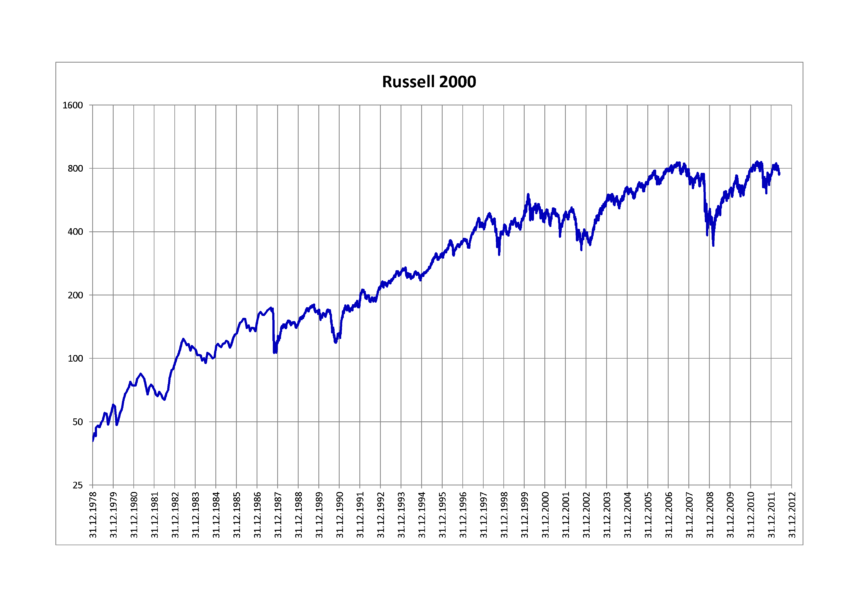

After soaring to a new record earlier in the year, the iShares Russell 2000 Index has experienced a major reversal. Fund, which tracks top US small-cap companies, has fallen to $200 from a high of almost 20 percent. The article below explains the reasons why Russell 2000 has fallen and its most significant movers in this year.

Donald Trump Liberation Day Tariffs

Russell 2000 is an index fund that focuses on small businesses in the United States. These are mostly domestic companies with little or no presence overseas.

Blackrock says that the majority of the companies included in this fund belong to the Financials sector, including banks and insurers. Other big names are found in industrials, healthcare technology and consumer discretionary. The fund also includes companies from the energy and real estate industries.

Russell 2000 is dominated by Sprouts Farmers Markets, Insmed Aviation, FTAI, Corcept Therapeutics and Southstate Corporation.

Fear of the trade war that is ongoing between the US, and the top US trading partners has been the main factor in the IWM ETF’s sharp reversal.

Donald Trump imposed tariffs on Canada, Mexico and other US trading partners. Trump has also imposed tariffs on imports of steel and aluminum, as well as imported cars.

The tariffs are going to affect many businesses. Analysts believe small companies that have a large international business will be more affected than the larger firms.

Trump claims that tariffs won’t apply to US-based companies. Many firms doing business in the US depend on raw materials and components imported from abroad, which are subject to tariffs.

Analysts predict these tariffs could lead to an economic recession in the US. The IWM ETF also fell as a result. Goldman Sachs analysts have raised their estimates of a recession to 35%. They join other companies such as PIMCO, Bank of America and others. Small-cap stocks would be hit harder by a recession.

Russell 2000 crash: The positive side

Although the current IWM ETF crashes are not good news, they do have a positive side. In contrast to the Nasdaq index, the percentage of technology stocks in the IWM ETF is tiny. It is noteworthy that these companies have a low exposure to artificial intelligence, which is slowing.

Trump’s tariffs could also lead to a downturn, which would put pressure on the Federal Reserve later in this year to cut interest rates. These stocks have historically performed well after Fed interest rate cuts, such as those that followed the Global Financial Crisis or the Covid-19 Pandemic.

Contrary to large corporations like Berkshire Hathaway, which generates tons of interest net income when rates rise, many smaller companies suffer. This is because they have higher levels of debt.

Russell 2000 Top Movers

Fubo, Root, Digital Turbine Groupon, Compass Sage Therapeutics and LendingTree are the top-movers of the Russell 2000 Index. Fubo TV has risen by 134%. All of these companies have seen a jump in value over 30%.

Other non-biotech laggards include Sunnova, Open Lending Ses AI CleanSpark and iRobot.

IWM ETF Analysis

IWM Chart by TradingView

Weekly chart of the IWM shows the ETF’s crash in recent months. The IWM ETF has fallen from $245 at its peak to $199 today. The price dropped below the bottom of the ascending channel, and also the moving average for 50 weeks.

The MACD has also moved below zero, and the Relative Strength Index is approaching the oversold levels. The stock is likely to continue dropping in the short term, and bounce back up and test its record high of $245.

The post IWM: Russell 2000 crash and next steps may change as new information becomes available.