Moody’s, a credit rating agency, just reported second quarter earnings which exceeded consensus estimates. Is it worth buying?

Moody’s, one of Warren Buffett’s favorites stocks (NYSE:MCO), had a wild increase on Tuesday following its second quarter results.

The leading credit rating agency exceeded consensus revenue and earnings expectations and posted strong gains year-over-year in the quarter. Revenue increased 22% over the previous year to $1.8 billion, while net income soared by 46% to $552 millions or $3.03 a share.

The stock price fluctuated a lot after earnings. It dropped from $450 to $440 at the opening bell, then soared to $456 in the afternoon. This was an increase of about 1%. The stock price has risen by about 16% in the last year.

The stock was likely moving lower along with the market after the opening bell, and not because of anything specific to Moody’s.

Investors were happy with the results after looking at Moody’s second quarter numbers. The stock price moved higher.

What makes Buffett such an admirer of Moody’s Financial?

What makes Buffett such an admirer of Moody’s Financial?

Moody’s has been a top 10 holding of Warren Buffett’s Berkshire Hathaway portfolio (NYSE:BRK.A), (NYSE:BRK.B), since 2000. Only two stocks have he held for longer: Coca-Cola, (NYSE:KO), and American Express, (NYSE:AXP).

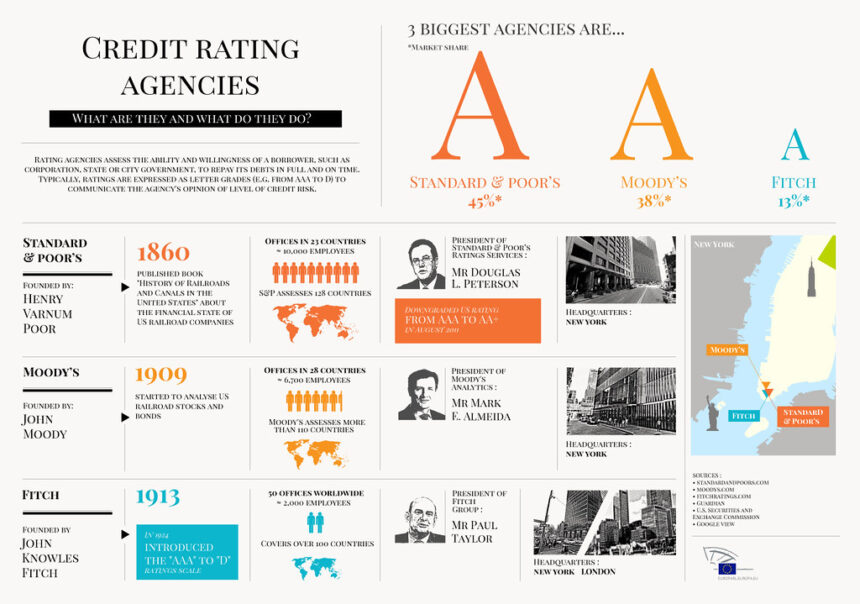

The moat that surrounds its business and earnings is the primary reason. Moody’s, a rare business, is a dominant market leader and player in an essential industry, credit rating, with few competitors. There are only three major rating agencies: Fitch Ratings, Standard & Poor’s Global, and Moody’s. The barrier to entry is high, and it is unlikely that any new competitors will emerge anytime soon.

Moody’s Investors Service, the company’s credit rating business, is its bread and butter. It provides a steady stream for subscribers and fees as the biggest player in a small market. In the second quarter of 2016, revenue was $1 billion, up 36% from the previous year. Revenue is up 35% in the first half of this year to $2 billion.

There are periods of less activity, but this has been a busy period.

Moody’s Analytics is a fast-growing business that often booms when markets are down. It is a great balance to MIS, which thrives when markets are up. This is a rapidly growing business that surges often when markets are down. It provides a great balance to MIS, which usually thrives when the markets are up.

Moody’s Analytics generated $802 million of revenue in the second quarter. This is a 7% increase over last year. In the first half of 2016, it generated $1.6 billion, an 8% increase.

Outperforming the S&P 500 and raising its guidance

Outperforming the S&P 500 and raising its guidance

Over time, Moody’s has been able to produce returns that are superior to the market. In the last 10 years it has generated an annualized rate of 17.4% and in the past 5 years 17.6%. Moody’s stock has returned 16% in the past year, which is a testament to its consistency.

The company has also raised its guidance on revenue growth for the entire year. It now expects a growth of the low teens. This is up from the range of low single-digits to low double-digits. This is partly due to its projections of a 20% to a 25% increase in credit issuance by 2024. Previous expectations were for a mid-to-high single digit increase.

Its outlook on EPS has also been raised, and now ranges from $9.95 to $10.35, up from $9.55 to $10.15. It also raised its guidance on free cash flow from $1.9 billion up to $2.1 billion to $2.0 billion.

Should you buy?

Should you buy?

Moody’s has a P/E Ratio of 49, and a Forward P/E Ratio of 41. Investors should keep a close eye on its valuation, which is the highest since 2016.

Moody’s stock is a good long-term investment. However, investors may want a better entry point or a dip in the price before investing.

This site is intended for entertainment only and does NOT offer financial advice.

Read more

Here is a link to the article