Hang Seng has recovered in recent days and is now performing well alongside other global indexes. The Hang Seng index has been rising for eight days in a row and hovers at its highest level since June. It has also risen by more than 23% since its lowest point in this year.

HKMA interest rate cut

After the Hong Kong Monetary Authority decided last week to cut interest rates by 0.50%, the Hang Seng Index rose.

The HKMA has historically followed the Federal Reserve’s lead due to the peg which exists for more than three decades.

The USD/HKD rate will remain within the range of support and resistance at 7,75 and 7,85. Hong Kong businesses often benefit when the HKMA lowers interest rates.

Hang Seng’s recovery coincided with the rise of global central banks after Federal Reserve cut interest rates by 0.5%. The S&P 500 index and Nasdaq 100 index in the US reached a new record last week.

Hang Seng faces risks ahead

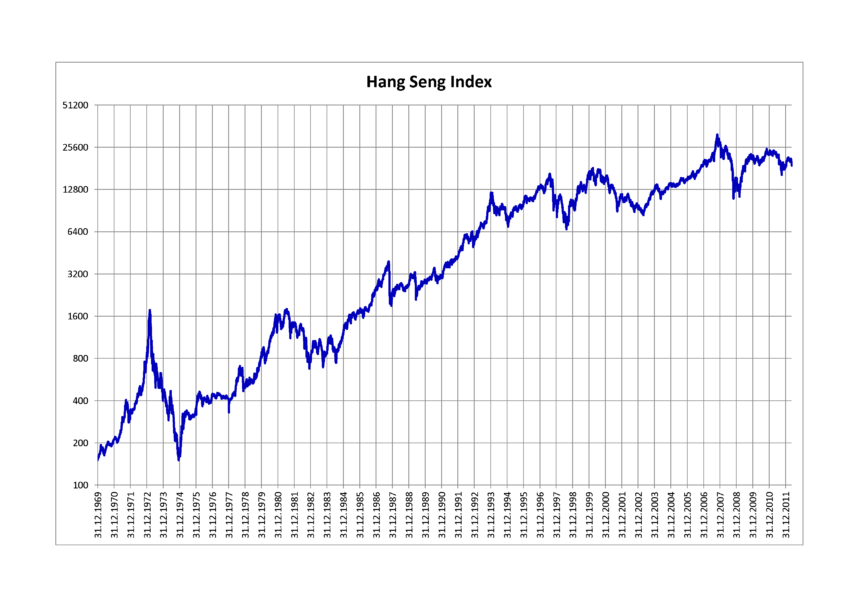

The Hang Seng Index has recovered, but it is still significantly below its previous high. The Hang Seng index has fallen by more than 20% since its peak in 2023, and 41% since its high in 2021.

There are several risks that the index will face. The index is highly vulnerable to real estate, which continues to slow down. According to the FT for example, HSBC has a high exposure to commercial property defaults in Hong Kong.

The exposure is now $3.2 billion, up from the $576 million it was six months earlier. The vacancy rate has risen, and many luxury malls have seen little foot traffic over the last few months.

Other Hang Seng Index banks such as Hang Seng Bank and China Construction Bank are also heavily exposed to real estate.

Another big concern is the fact that real estate is still facing intense pressure even though Beijing has announced measures to help the industry. In fact, the majority of companies, such as Wharf, China Resources Land and Henderson Land, have fallen this year.

These firms are most at risk from the tensions that will increase between China and the US in the next few months. The biggest risk facing these firms is that tensions between the US and China are set to increase in the coming months.

Donald Trump has a chance to win the next election. Donald Trump pledged that he would impose significant tariffs on Chinese products, restarting the previous trade war. Kamala Harris also pledged to take China on.

The US and Chinese government could take tit-for -tat actions in a new trade war, which would affect the money moving from the west to China.

As the Chinese slowdown continues, signs are emerging that China’s economy is struggling. The Chinese economy expanded only by 4.7% during the second quarter. This led to more analysts downgrading the GDP estimates for the country.

Iron ore, coal, and copper are all leading indicators that point to a country slowdown. Hang Seng is usually at its best when China’s economy is doing well, as most of the companies that make up the index have exposure to this country.

Hang Seng Index Analysis

On the weekly chart, it is clear that Hang Seng formed a Morning Star chart pattern. This chart pattern is a bullish signal. It is because of this that it rose over 1,3% in the last week. The 50-week average and the 25-week average have been reached.

It has also developed a triangle pattern that is symmetrical and nearing the confluence point.

In the short term, it is likely that the Hang Seng Index will remain within this range. The Hang Seng index will probably remain between $17,000 and $18,000 if this occurs.

The post Hang Seng Index rebounded, but still faces significant risks may change as new updates are released.