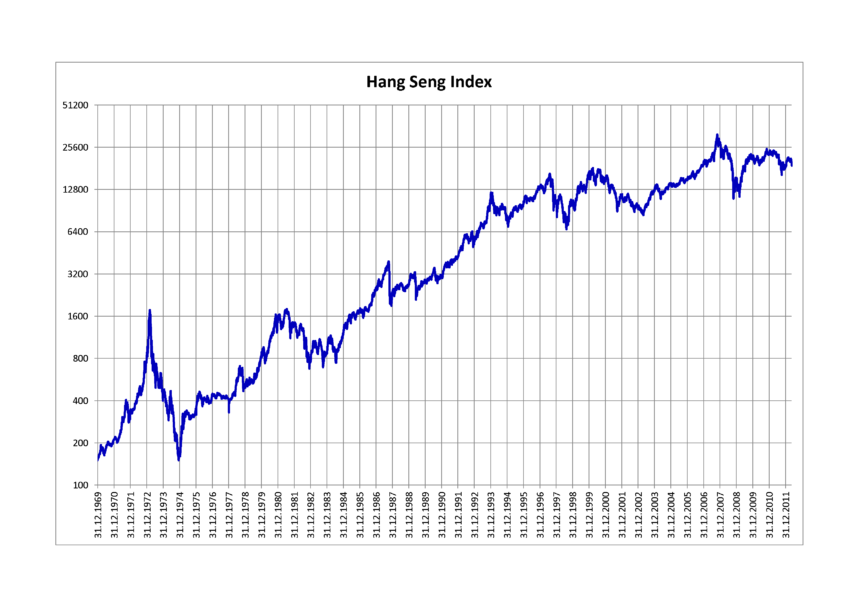

Hang Seng has been soaring lately. It is now one of the best-performing indexes in the world. The Hang Seng index climbed to H$22.620, the highest since October 7 and a 50% increase from its low point of 2024. Why is the HSI Index surging? What will be next?

The Hang Seng Index is on the rise

Three main factors have largely accounted for the recent rise in Hang Seng. The first is that the rise coincided with global equity markets’ ongoing recovery. In the last few months, the S&P 500 and other major indices such as the Nasdaq, DAX and CAC 40 all saw a surge. Global indices can be highly correlated in some cases.

The Hang Seng Index has also risen because recent data showed the Chinese economy to be doing well. The numbers showed that China’s economy grew by 5.4% during the fourth quarter. This brings the growth rate for 2024 to 5.0%.

The Chinese government’s $1.4 trillion stimulus program, announced in late 2013, was responsible for the majority of Q4 growth. This package is designed to help local governments who have been struggling since the collapse of the real estate market.

The Hang Seng Index has also risen as investors have bought the dip, since the Hang Seng was among the lowest-performing indexes over the last few years. There is an overall view that this index is undervalued.

The top HSI Index constituents by 2025

Alibaba’s stock price has soared by more than 50% this year. Its strong technicals are the reason why it has surged. As we have written here ,the stocks formed a triangle ascending pattern that pointed to a significant surge in the stock over time.

Alibaba also prospered when the company advanced in artificial intelligence. Recently. Apple announced that its AI models will be used in China. This is a big deal from the largest company on the planet.

Alibaba Health Information has been the most successful Hang Seng Index constituent in this year, with a jump of over 77%. Beijing has completed its evaluation of the group and its performance last year, which is largely responsible for this rebound.

This year, other technology companies like Meituan Xiaomi JD Health Kuaishou Technology BYD Tencent and BYD have performed well.

The worst performers in the index include Sands China Henderson Land and New Oriental.

Hang Seng Index Analysis

TradingView HSI Index

Weekly chart showing the Hang Seng Index has performed well over the last few months. It has risen from H$14.845 to H$23,000 in 2023. The mini-golden cross has been formed as the 50-day and 100-day moving averages have crossed.

It is also approaching the key resistance level of $23,230, its highest point in 2024. The index is also nearing the important resistance level of $23,230. This was its highest point since 2024.

Bulls will therefore continue to push the index upwards as they aim for the next psychologically important point of H$23,000 If the index breaks above this level, it will rise to the level of 61.5% at H$24.878.

The post Hang Seng Index outlook: Why Hong Kong stock surged was modified in light of new developments.

This site is for entertainment only. Click here to read more