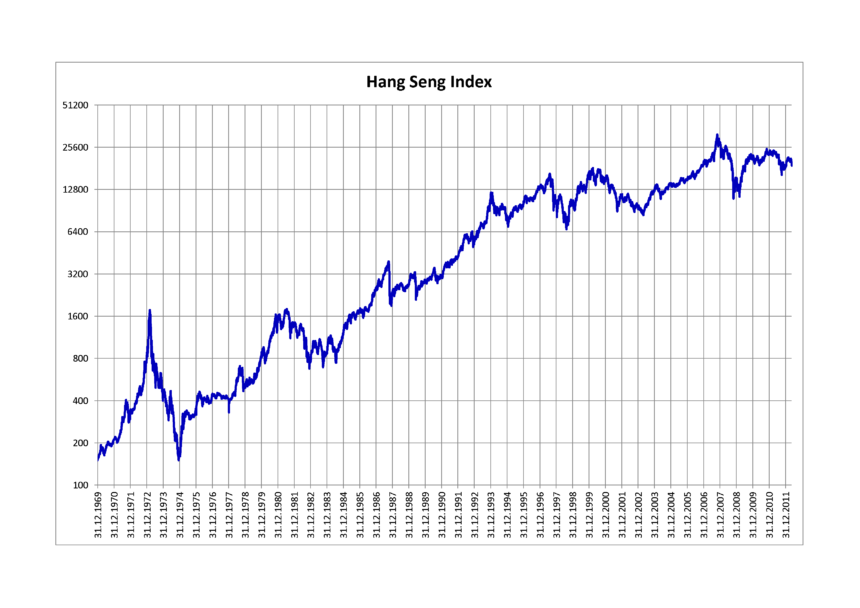

This year, the Hang Seng Index has risen and has surpassed some of its global counterparts, such as Dow Jones, Nasdaq 100 and S&P 500. The Hang Seng index has increased by more than 22% since 2025, and now is at its highest point since February 2022. From its low point in 2023, it has risen by more than 68%.

The American indexes, on the other hand, have seen a major reversal. Both Dow Jones and S&P 500 lost most of their early-year gains.

Hang Seng Index ignores tariff wars

In the last few months, Hang Seng as well as other Chinese indexes such A50 and Shanghai Composite all soared.

China is a major reason for this rally. The government expects the GDP to reach the target of 5% this year. The manufacturing and service PMI numbers remain above 50.

Beijing’s stimulus package will have a positive impact on the economy in 2024. The stimulus package will cost over $1.4 trillion within the next five years. Most of this money is going to local governments that are struggling.

Beijing also suggested that it would boost its stimulus package, now that US trade war has been launched with China. Donald Trump increased tariffs by around 20% on Chinese products this year. The tariffs are in addition to those that he implemented during his first term.

Analysts think that China can still do well with the tariffs. In the past, Chinese producers have avoided tariffs on their products by routing them to the US via other Asian countries.

The volume of imports from China is also likely to continue growing as companies raise prices. It is unlikely that companies will relocate their business from China to America because the cost of doing so there is high.

Hang Seng technology companies are booming

Beijing’s support for the tech sector is another reason the Hang Seng has increased. Xi Jinping met some of the most prominent tech executives including Jack Ma, founder of Alibaba.

China wants to increase its competitiveness with the United States by supporting the tech sector. It is showing signs of achieving these goals in some areas, such as the artificial intelligence sector. DeepSeek’s launch just a few weeks ago sent shockwaves around the world. Leading firms such as Alibaba and Tencent now make advanced AI models.

This year, the technology sector helped support the Hang Seng Index. The Hang Seng index has been led by the technology sector, including Alibaba, BYD Lenovo SMIC Alibaba Group Alibaba Health Xiaomi and Kuaishou Technology.

Golden cross analysis of the Hang Seng Index

Source: TradingView

Hang Seng has risen in recent years, as can be seen from the weekly chart. The Hang Seng index has risen from H$14,538 in 2022 up to H$24,505 now. Recently, the index soared over the H$23230 key resistance level, which was the largest swing since October 7.

The price has also moved over the Fibonacci Retracement 50% level of H$24.040. It is also about to form a gold cross as the difference between the 200-week and 50-week moving-averages has narrowed.

The Relative Strength Index and MACD have both continued to rise, a clear sign of momentum. The index is likely to continue rising, as the bulls aim for the next important resistance level of H$26290. This level represents a 61.80% level retracement, and it’s about 7.5% higher than the current level.

Post Hang Seng Index could be parabolic if a chart pattern rare nears. This post may change as new updates are released.

This site is for entertainment only. Click here to read more