US equity benchmarks rose on Monday as traders awaited the earnings results of megacap tech companies later this week.

A sharp drop in oil prices and a cooling of geopolitical tensions across the Middle East also helped to boost sentiments on Monday.

The Dow Jones Industrial Average rose 0.8% at the time of this writing, while the S&P 5oo Index rose 0.5%.

The Nasdaq composite index also gained 0.6% in the earlier session.

Wall Street is recovering from the steep losses of last week.

The benchmarks recovered some of their losses on Monday.

Reuters reported that the main focus was the events of the week ahead. This included corporate results. Around 169 S&P500 companies were scheduled to report throughout the week.

Israel’s limited attack on Iran

Israel’s predawn attack on Saturday was aimed at military installations in Iran. It avoided nuclear and oil sites.

This eased concerns of a larger conflict between the two nations.

The market was expecting that Israel would target Iran’s oil and nuclear facilities, thereby crippling its supply.

The market, however, viewed the limited strike of Saturday as a calming of tensions.

Iran also downplayed its impact on the Israeli strikes which helped to calm down tensions further in the region.

Oil prices fell 6% on Sunday as traders saw geopolitical risks premiums diminish after the limited Israel strike.

Middle East oil prices have lost all their gains since the October 1 missile attack by Iran on Tel Aviv.

Brent was trading at $71.65 a barrel, down 5.3% since the previous close.

Earnings are the focus

This week, we will also be seeing the earnings of several top technology companies in America.

Five of the seven magnificent companies, namely Alphabet (Alphabet), Microsoft, Meta Platforms (Meta Platforms), Amazon and Apple are scheduled to announce their latest financial results.

Apple shares rose 0.6% Monday, while Alphabet’s shares climbed over 1%.

Mike Dickson, Horizon Investments’ head of research and quantitative strategies, told CNBC that:

Due to the high valuations, it will be important to see if they can continue to grow.

Aaon shares rise by more than 8%

Aaon’s shares jumped by more than 8% Monday after the company announced that it had received an order worth $175 million on Friday.

The company reported that it received a $175 million order from a data center customer for liquid cooling equipment.

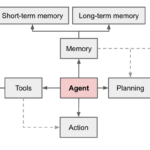

Artificial intelligence has fueled the development of data centers.

Companies that can keep their chips cool while training AI models will benefit.

Aaon shares are up nearly 60% since the start of the year.

If the stock reaches $130, its price will have increased 17% since Friday’s closing.

Spotify Technology SA shares rose by nearly 2% after Wells Fargo rated the stock as a top pick.

The bank has increased its target price and given the audio streaming giant an overweight rating.

CNBC quoted analyst Steven Cahall in a recent report.

Spotify’s increasing Premium gross margins indicate that Spotify is improving its bottom line through the evolution of its product mix and Label relationship.

McDonald’s shares rebound

McDonald’s shares rose on Monday following the announcement that the company’s Quarter Pounder hamburgers will be returning to restaurants this week.

Last week, the Quarter Pounder burgers from the restaurant menu were removed after a deadly E. Coli outbreak.

The fast food chain announced on Sunday that tests showed the beef patties were not linked to the E. Coli outbreak.

Restaurants will serve the burgers without sliced onions, which is suspected to be the cause of the outbreak.

McDonald’s shares dropped nearly 8% in the last week. This was its worst performance since 2020. Shares were up about 1.5% on Monday.

This post Dow, S&P500 jump as tensions ease, Aaon gains and McDonald’s stages comeback could be modified as new developments unfold.

This site is for entertainment only. Click here to read more