CVS Health, NYSE: CVS (CVS), reported earnings for the fourth quarter that were above analyst expectations Wednesday. This was due to strong sales of its insurance and pharmacy businesses.

Aetna’s insurance division continues to be hit by rising medical costs, which has a negative impact on the profits.

Healthcare giant has recently changed leadership and provided an updated earnings forecast of between $5.75-$6 per share by 2025. This is in line with Wall Street expectations.

CVS has not released a forecast of its revenue for this year due to the uncertainty in each business segment.

Stocks of the company rose by 10% before market opening following earnings release.

Earnings from CVS: Strong growth, but Insurance Business Struggles

Although CVS’s insurance division saw a strong growth in revenue, it struggled to keep up with rising medical costs.

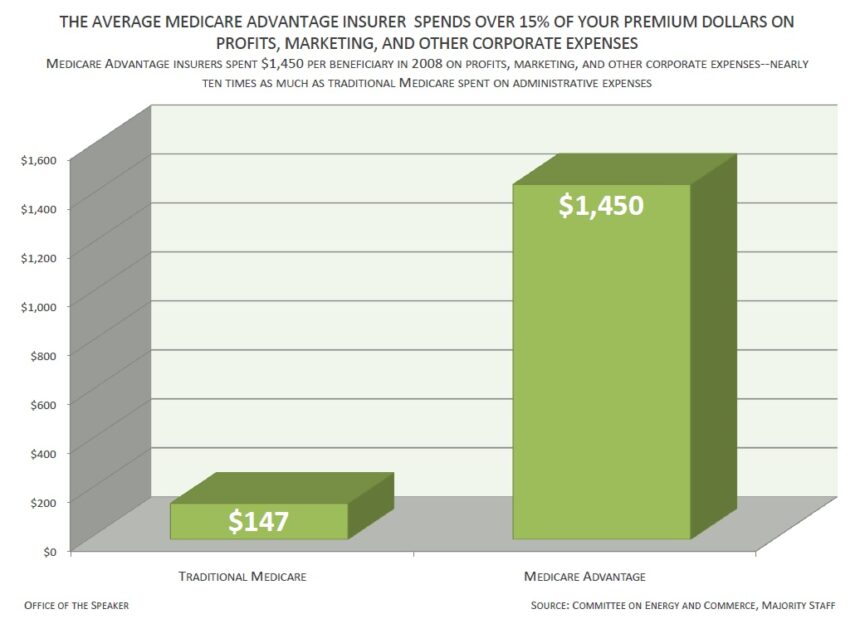

In the company’s fourth-quarter revenue, its insurance division, which includes Medicare Advantage Plans, grew by 23% compared to a year ago.

The segment, however, reported an operating loss adjusted to $439 millions, as opposed to the $676 million operating profit in the same time period of last year.

Medical costs were higher than expected as Medicare Advantage patients returned for delays in procedures.

CVS’ lower Medicare Advantage stars ratings for 2024 also affected reimbursements and put further pressure on the performance of this segment.

Medical benefit ratios, a measure that shows how much insurance companies pay out in medical claims relative to premiums collected, rose to 94.8% a year ago from 88.5%.

This ratio is slightly higher than analysts’ expectations of 95.9%.

CVS retail pharmacy services and CVS health service see mixed results

CVS’ pharmacy and consumer wellbeing division reported revenue of $33.51 billion for the fourth quarterly, an increase of more than 7 percent from a similar period last year.

The segment saw its performance improve as prescriptions increased, but lower reimbursement rates at pharmacies and generic drug competition impacted margins.

The company’s Health Services unit, including pharmacy benefit manager Caremark generated revenue of $47.02 Billion, down 4% from the same period in 2023.

Tyson Foods confirmed earlier that they had changed pharmacy benefit managers.

CVS still processed 499.4 million claims for pharmacy services in the third quarter. This shows that its Pharmacy Benefits Management business is in good shape.

Changes in leadership and plans for cost cutting

CVS is undergoing a wider turnaround.

David Joyner is a senior executive who has been in the business for a number of years. He replaced Karen Lynch as CEO last October. This management shake-up was part of a plan by the company to improve its stock performance and stabilize profits.

CVS also announced that it would be cutting costs by $2 billion over the course of several years in order to reduce expenses and streamline its operations.

While navigating the challenges of lower Medicare reimbursements for Medicare Advantage and pressure on pharmacy prices, the company is focused on improving its efficiency within both insurance and pharmacy.

The post CVS Stock Rises 10% As Company Beats Revenue Estimates Despite Insurance Cost Pressures will be updated as new information becomes available.

This site is for entertainment only. Click here to read more