Two consecutive days, the CAC 40 Index declined as traders awaited this week’s European Central Bank decision. The CAC 40 index fell to EUR7 395, down from the high EUR7 510 of this week.

ECB decision ahead

In the near future, the European Central Bank’s (ECB) announcement will have the biggest impact on the CAC 40 index and other European indices.

The latest economic data from France and its region indicates that rate cuts will be required. Manufacturing and service PMIs remained under 50 in October. This indicates that the recovery of the country is slowing.

The ECB is expected to continue its rate reductions. Analysts expect the bank to cut rates by 0.25 percent, which would bring the benchmark rate up to 3.25 percent.

In order to prevent a crash in the economy, this bank has already cut rates by 0.75 percent.

The French bond yields have fallen as a result of the hopes that rates will be cut. The yield on the ten-year bond dropped to 2.89 %, its lowest since October 3. The five-year rate also dropped to 2.4%.

ECB’s decision is made at a moment when France is in a state of political crisis. Michel Barnier’s government fell apart last week due to disagreements over the budget. The collapse of the government has increased concerns over the economy.

Investors are also on edge as they await the Donald Trump presidency. In his election campaign, Trump focused mainly on trade, and hinted at a resumption of his trade war. This will have a negative impact on many French businesses.

China risks remain

CAC 40 is also reacting against the economic slowdown in China where many businesses do business.

This week, data released by the Chinese government showed that exports from China and imports from China both dropped. Beijing officials continued to discuss boosting economic stimulus.

Beijing is resigned that it may not achieve the target of 5% economic growth set for earlier in the year.

The majority of companies with the lowest performance in the CAC 40 are heavily exposed to China. This is a place where the consumer’s spending has been slowing down.

Kering, parent company to Gucci, fell by nearly 40% in this year’s CAC 40 Index, placing it as the second worst performer. The company warned of weak spending by consumers in Canada.

LVMH’s parent company, Dior, and Louis Vuitton has seen its sales fall by 13% in this country.

STMicroelectronics’ stock price has fallen by 45 percent this year. It is now the lowest-performing firm in the CAC 40 Index. STM is a major contract manufacturer in the European chip market.

The CAC 40 Index also shows that other companies with exposure to China, such as L’Oreal and Pernod Ricard are among the top losers.

Safran, Publicis Groupe EssilorLuxottica Saint Gobain and Schneider Electric are among the biggest gainers on the CAC 40.

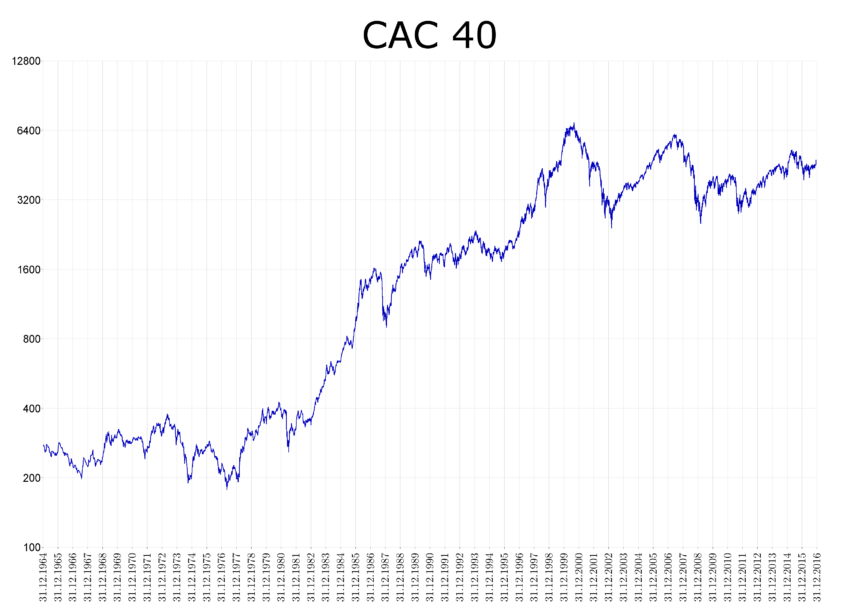

CAC 40 Index Analysis

CAC 40 Index Chart by TradingView

On the daily chart, the CAC 40 has remained stable in recent days. The index has been below the trendline that links the largest swings from May 14 to the downward trendline.

It is currently consolidating between the Exponential Moving Averaging (EMA) of 50 and 100 days. It has also dropped below the Fibonacci retracement of 23.6%.

Earlier, at EUR7,033, the index had formed a pattern that looked like a “double bottom”.

There is therefore a high probability that the index continues to rise as long as the bulls continue to flip the trendline descending. The next level to monitor is EUR8,000 which is approximately 8.3% higher than the current price. The bullish outlook will be invalidated if the price drops below EUR7,200.

This article CAC 40 Index Forecast Ahead of ECB Decision: Is it a Buy? The post CAC 40 index forecast ahead of ECB decision: is it a buy? appeared first on COINPAPER.COM

This site is for entertainment only. Click here to read more