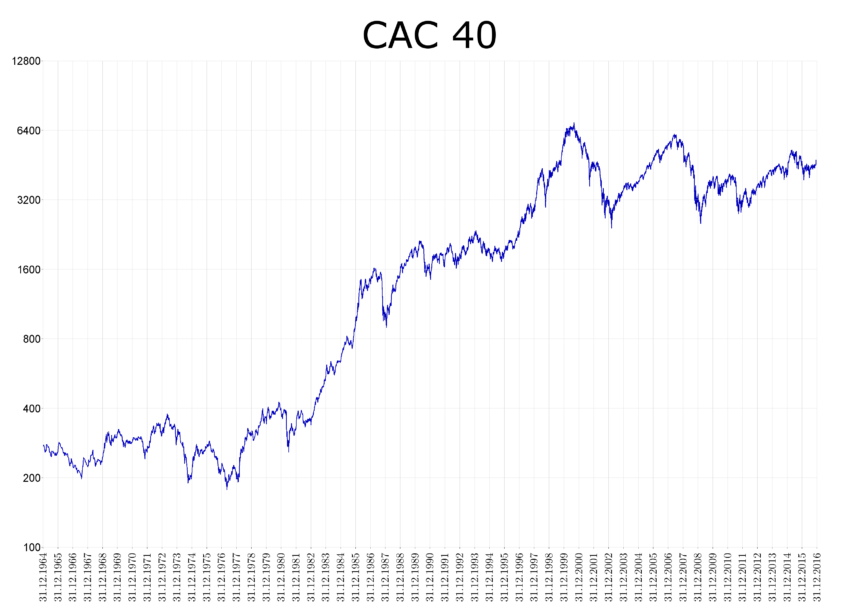

In 2024 the CAC 40, an index that tracks France’s largest companies, performed poorly, falling behind most global counterparts. The CAC 40 index fell over 3% in 2024, whereas the German DAX rose 18% and S&P 500, Nasdaq and S&P 500 jumped over 20%. Is it safe to invest in French stocks by 2025?

Why French stocks plunged

The CAC 40 fell for three reasons, despite the fact that the European Central Bank cut interest rates four times in the past year.

In 2024 France experienced a major political crisis, which led to the downgrading of France’s credit rating by Moody’s. The company noted that France’s finances were weak. This crisis caused the fall of Michel Barnier’s government.

The French government’s substantial budget deficits are a major concern. Budget deficits are expected to reach 6.1%, a higher figure than expected (4.4%). The figure is higher than EU guidelines and France may face a serious debt crisis within the next 10 years.

The weakening Chinese economic situation had an impact on French firms, as many companies generate the majority of their revenue in China. China’s retail sale struggled. This affected companies such as LVMH Kering and Pernod Ricard which are heavily weighted in the index.

There are concerns regarding the European economy where most of these companies’ sales come from. Four cuts were made by the ECB in order to boost growth.

CAC Index laggards, leaders and laggards

In 2024, most companies on the CAC 40 were losing money. The stock of Kering, the parent company for Gucci, Bottega Veneta and Brioni plunged more than 40% by 2024. This was due to the fact that the company had issued several profit warnings.

Analysts think that Kering faces a greater crisis, as the Gucci flagship brand is losing its appeal to wealthy consumers. Kering could suffer long-term if the Gucci brand fails to recover.

Stellantis’ stock fell by 40 percent during the past year, as the company was hit with a crisis which led to its CEO being fired. Stellantis faces the same problem as other European competitors: cheap Chinese cars are slowly taking over market share.

Stellantis’ shares have also fallen due to its underinvestment for a long time in marquee brands such as Chrysler, Jeep Alfa Romeo and Maserati. These brands no longer have the same appeal as they did in the past. Stellantis is being called upon by a US politician to separate its American brand.

Edenred’s stock fell over 40% as well, and the company blamed this on the macro-environment. The firm responded by increasing its share purchases to more than 600 million euros, and reiterating its commitment to reach 10 billion euro in revenue by 2030.

Dassault Systemes (down over 10%), L’Oreal (down over 10%), Bouygues and LVMH are the other major laggards.

The best performing companies among the CAC 40 are Accor and Essilor Luxottica.

CAC 40 Index Analysis

On the daily graph, the CAC 40 has had a downward trend for the last few months. The index reached its peak at EUR 8,257 back in May of this year. The index’s lows have been constantly lower since then.

Since May, the CAC 40 has been below the trendline that separates the largest swings. The index has moved also below both the 100-day and 50-day moving averages.

Investors will buy up the recent dips in the laggards, and the index should rebound by 2025. The rebound is confirmed when the stock moves above the trendline. The next level to monitor is EUR7.800. This was the high point in September.

The post CAC 40 forecast: Will French stocks recover in 2025? This post may be updated as new information unfolds

This site is for entertainment only. Click here to read more