US Bitcoin and Ether ETFs saw a net outflow in March of more than $1.5 billion, continuing a losing streak now reaching $5.09 billion.

Inflows of 13.3 million dollars on 12 March suggest that investors are likely to be returning as Bitcoin continues to remain above $80,000.

Farside Investors’ data indicates that Bitcoin spot ETFs experienced inflows totaling $35.4 Million over two days during March. Meanwhile, Ether spot ETFs registered a one-day inflow on the 4th of March of $14.6 Million.

The total outflows of funds have exceeded $1.5billion since 3 March, resulting in a loss net for the entire week of $727.09million.

Bitcoin ETF performance

ARK 21Shares Bitcoin ETF ARKB led the inflows, bringing its total up to $2.55 Billion. It is now ranked third in terms of cumulative inflows.

Grayscale Bitcoin Mini Trust was next with inflows of $5.51 millions, increasing its assets to $3.34 Billion.

BlackRock’s iShares Bitcoin Trust IBIT (IBIT), which lost $47.05 millions, was the biggest single-day outflow.

IBIT, despite this, remains the leading Bitcoin ETF with a total of 39,39 billion dollars in net inflows, and assets worth $47.02 million.

Grayscale Bitcoin Trust’s (GBTC) outflows reached $11.81million.

The worst performing Bitcoin ETF, it has $22,49 billion cumulative net outflows with $16.09 trillion in net assets.

Ethereum ETFs struggles

Ethereum ETFs have extended their six-day losing streak, with net inflows of $10.4 million reaching on March 12th.

ETFs have seen outflows for the third week in a row, totaling now $524.68 millions.

Fidelity’s Ethereum Fund (FETH) led with $3.75 million in outflows, though it remains the second-best-performing ETH ETF, with $1.43 billion in cumulative inflows and $778.92 million in net assets.

ETH has fallen 29.6% in price over the last 30 days, lagging behind Bitcoin which fell 15.21%.

Crypto markets:

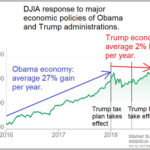

Following Donald Trump’s election victory in November, several new investors purchased Bitcoin at high price levels.

Bitcoin, however, has already entered a bearish market just six weeks following his election, due to a global selloff of stocks.

The cryptocurrency fell by nearly 25 percent to $80,000 after reaching a high of over $100,000.

Some investors, especially those who used leveraged investments at peak times, are now suffering losses.

Glassnode is a crypto-analytics firm that claims to have created approximately 20,000,000 new Bitcoin addresses in the last three months, which represents about 1.5% all addresses.

Geopolitical tensions and trade wars have been blamed for the broader decline in cryptocurrency prices.

Analysts also point to the uncertainty around President Donald Trump’s Strategic Bitcoin Reserve Plan as another factor that adds selling pressure.

Recent ETF inflows suggest that investors may view the dip more as an opportunity to buy than a sign for further weakness.

This article BTC ETFs End 4-day Outflow Streak with Modest $13.3M Inflow on March 12, appeared first on The ICD