Bernstein’s analysts predict that the market for wafer-fabrication equipment will remain flat next year, after a 10% increase in growth estimated by 2024. This is due to the continued Chinese demand.

The investment firm still likes to buy two European semiconductor companies: BE Semiconductor Industries NV, and Infineon Technology AG in the coming year.

Bernstein’s bullish outlook on European stocks is explained, along with what investors can expect from each one in 2025.

BE Semiconductor Industries NV (AMS: BESI)

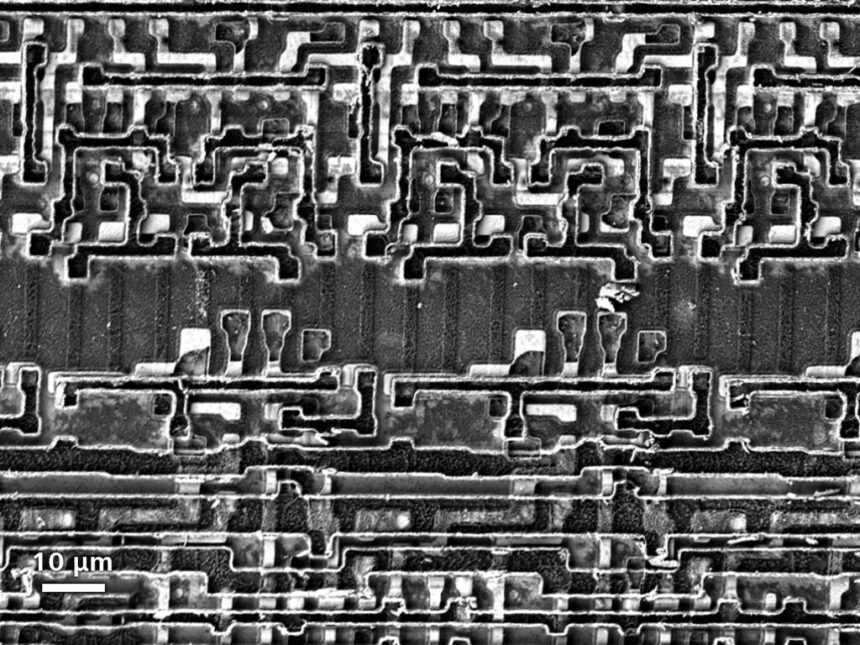

BE Semiconductor, or as the company is commonly known “Besi”, is an equipment manufacturer for semiconductor assemblies based in The Netherlands.

Analysts at Bernstein see an opportunity with the shares of this Dutch company, as they are currently trading for a discounted price. BESI has fallen more than 25 percent from its high for the year.

In its latest research report, the investment firm named BE Semiconductor as a “top pick” for 2025. It said that BE Semiconductor continues to offer a very attractive story on a fundamental level.

Bernstein acknowledged that BESI will require patience from investors, but was confident in the future that both [cyclical recoveries and hybrid bonds] would contribute to growth.

BE Semiconductor announced a 27 percent increase year over year in their quarterly revenues, largely due to the strong demand for computing products from end users.

A Dutch company improved their net profit by over 33%, also due to better controlled operating costs.

BE Semiconductor’s stock pays out a current dividend yield of 1.61 percent, which is another reason why it makes sense to hold the stock for the long-term.

Wall Street shares Bernstein’s view. BESI’s consensus rating is currently “overweight”.

Infineon Technologies AG

IFX shareholders have been disappointed by the company’s performance over the last six months, but Bernstein analyst expects that this will change in 2025.

Infineon, Europe’s biggest chipmaker, supplies Apple Inc. with a variety of semiconductor technologies. Bernstein says:

The indicators are indicating that we may be nearing the bottom of the cycle. This increases the probability of a strong rerating of IFX. This, coupled with secular growth factors, make them our number one pick of IDMs.

Bernstein believes Infineon’s stock is a good investment, despite its revenues being down by about 8.0% year over year in fiscal 2024.

This is because IFX has a major role to play in the AI data centers. Statista predicts that the market for artificial intelligence will be worth $1 trillion in 10 years.

Infineon Technology expects to reach $500 million of AI revenues in the fiscal year 2025, and then roughly double that amount over the following two years.

IFX stocks, like BE Semiconductor shares currently yield a dividend of 1.10%. This makes them attractive to income investors.

The post Bernstein’s Top 2 European Semiconductor Stocks 2025: Bernstein picks two European semiconductor stocks may change as new information becomes available.