Asia-Pacific stocks traded in a mixed manner on Wednesday, as investors responded to Wall Street’s overnight losses. This was largely due to a drop in consumer confidence and the pullback of tech shares.

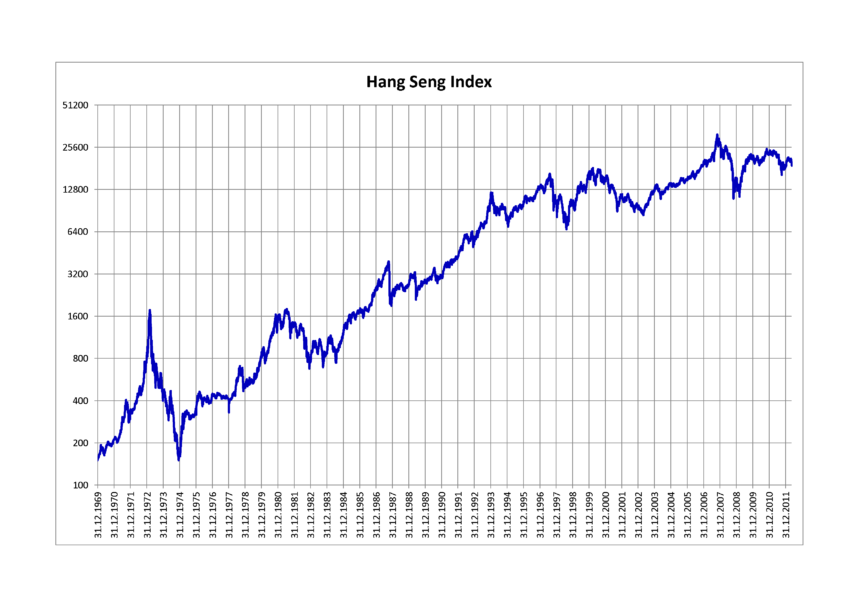

The Nikkei and ASX 200 indexes in Australia and Japan both extended losing streaks. Hong Kong’s Hang Seng index, however, surged due to optimism before the announcement of Hong Kong’s city budget.

Japan, Australia and China decline

Investors weighed global economic worries as they assessed Japan’s Nikkei 225, the benchmark index. Nikkei 225 dropped 1.09% for a 2nd straight session. Topix fell 0.99%.

The S&P/ASX 200 index in Australia fell 0.26% due to persistent inflation concerns.

In January the country’s Consumer Price Index rose by 2.5% on an annual basis, in line with expectations of the market and reinforcing a cautious mood.

The Kospi, the South Korean stock index, rose 0.11%. Meanwhile, Kosdaq, which is a component of Nasdaq, gained 0.52%. China’s CSI 300 also opened 0.16% up.

Hong Kong’s Hang Seng led gains in the region, climbing 1.71 percent ahead of government’s budget announcement for 2025-2026.

Wall Street’s downturn affects sentiment

Investors fretted about the Federal Reserve and its monetary policy as they retreated overnight.

The S&P 500 dropped 0.47% marking the fourth consecutive session of losses, and the Nasdaq Composite fell 1.35% due to a drop of 2.8% in Nvidia shares.

However, the Dow Jones Industrial Average bucked this trend by rising 0.37 percent.

This continued the sell-off of tech stocks. The “Magnificent 7” tech mega-cap stocks fell 3% and had their worst session in December 2024.

Palantir’s shares fell 4% Tuesday. This is a continuation of the 15% drop last week, following an announcement by CEO Alex Karp about a plan to sell stock and after concerns were raised over possible defense budget cuts.

Treasury yields fall; Dollar dips and oil and gold recover

The US Treasury yields fell further on Wednesday, as the growing expectation of Federal Reserve rate reductions pushed up the market.

The benchmark yield on the 10-year note fell to its lowest level in more than two months, at 4.2830%. Meanwhile, the yield for two years dropped by one basis point to 4.0860%.

Dollar was impacted by the weaker yields, especially against the yen.

After hitting a low of four months in the prior session, the greenback fell 0.13% at 148.81yen.

The euro was trading near its one-month-high of $1.0522 and the British Pound, which last traded at $1.2675, was close to its two-month-high.

Brent crude recovered some ground following a 2 % drop the previous session.

After Tuesday’s 25% drop, US West Texas Intermediate crude (WTI), followed the trend and rose 0.36% to $71.8 per barrel.

Investors sought to protect themselves from economic uncertainties by buying gold, which saw a modest 0.1% increase.

The post Asia Markets Mixed as Wall Street Slides; Japan’s Nikkei Drops, Hang Seng Rallies may change as new developments unfold.

This site is for entertainment only. Click here to read more