Prices will likely remain low until 2025, even though the oil market is struggling to break free of its current range between $70-$75 a barrel.

Traders are closely monitoring the Middle East situation, hoping for further escalation to boost oil prices.

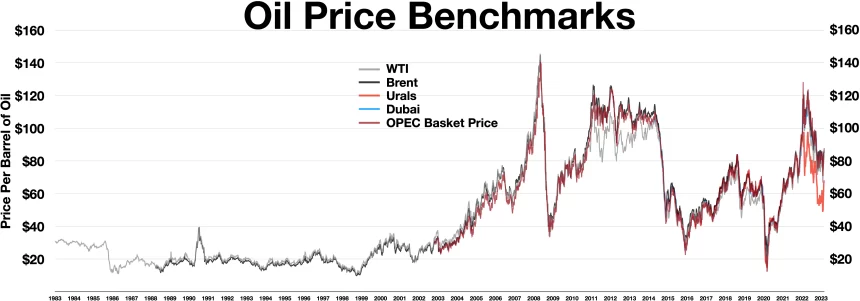

After the attack by Iran on Israel, oil prices soared by more than 10%. Brent oil prices had returned to over $80 a barrel for the very first time since August.

The rally was brief.

There has been no threat to the oil supply since the attack on Israel by Iran on October 1.

Immediate after Iran’s attack against Israel earlier this week, there was concern that the oil facilities of the former would be targeted. But those fears have now subsided and, unless Israel targets Iranian oil facilities, the prices will remain within their current range.

What will be the impact of a glut in supply by 2025?

Oil bulls are focusing on the supply and demand issues in the Middle East because there haven’t been any major supply shocks.

Prices have been kept low by the poor demand in China.

The Asian giant is one of the largest crude oil importers in the world.

According to the International Energy Agency, China’s oil demand is expected to grow by 20% this year compared to a 70% increase in 2023.

China’s oil demand growth is expected to be only 20% next year.

In its October report, the IEA stated that “Chinese demand for oil is especially weak. Its consumption dropped by 500 kb/d yo-yo in August – its fourth consecutive monthly decline.”

The Organization of the Petroleum Exporting Countries (OPEC) and its allies plan to increase their oil production starting in December.

Saudi Arabia and OPEC+ will unwind some voluntary cuts in oil production from December, to regain share of the market.

This development occurs at a moment when the demand has already been affected. Oil prices could drop further if OPEC continues with its planned increases.

Non-OPEC Supply Growth

The growth of non-OPEC supplies is likely to also weigh on sentiment.

The IEA predicts that non-OPEC oil supplies will grow by around 1.5 million barrels a day in this year and next. The growth in non-OPEC oil supply is now outpacing OPEC.

The IEA stated that “the United States, Brazil Guyana, and Canada will account for the majority of this increase. They are expected to boost output by more than 1 mb/d in both years. This will cover the growth in demand anticipated,”

OPEC+ has also increased its spare oil production capacity to historic levels, excluding the COVID-19 pandemic period.

According to the IEA, excluding Libya, Iran, and Russia, the effective spare capacity in September comfortably exceeded 5 mb/d.

The global oil stockpiles provide a buffer even though crude oil inventories have fallen by 135 mb in the last four months, to their lowest level since at least 2017. OECD stocks are also well below their average five-year levels.

However, the agency said that global refined products stocks had risen to a three-year high, putting pressure on margins in key refining centers.

IEA has a crude oil reserve of more than 1.2 billion barils, and an additional half a million barrels are held by industry under obligations.

Even if the Middle East suffers a shock to the supply, oil supplies are well established around the globe.

The US Energy Information Administration (EIA), in its Short-Term Energy Outlook of October, forecasted that the global production of oil and other liquid fuels would increase by 2,000,000 barrels per a day by 2025. This is up from a growth of only 500,000 barrels a day in 2024.

We expect that the production growth outside OPEC+ will continue to be strong throughout the forecast period. As a result, OPEC+ producers are likely to keep their production below their recently announced production targets for most of next year.

China is still key

Demand from China is the only factor that can push oil prices up if supply is sufficient by 2025.

The last few months have seen a decline in oil imports from China.

The purchasing managers’ indexes for China will be released next week. This could cause all prices to rise at the same time.

Since the announcements for the new stimulus measures mainly took place after survey period of the September indexes, it is possible that the sentiment indicators may have improved a bit in October. Barbara Lambrecht is a commodity analyst with Commerzbank AG. She said that she was not optimistic.

The rapid development of electric vehicles in China also reduces oil consumption in China, the top oil importer in the world. As the world shifts away from fossil-fuels, this trend will only grow.

Prices forecasts for the rest of 2024

Oil prices continue to be vulnerable to a decline despite Middle East tensions simmering.

“I think that oil prices will continue to fall for the rest of the year.” Rizvi, of Primary Vision Network, told Techopedia.com that although inventories are high and demand is low.

In July, Rizvi kept its oil price at $70 per barrel, citing a global economic slowdown.

ANZ Research also lowered its oil price predictions for the remainder of this year.

Brent crude oil is now expected to cost $80 per barrel by 2024, down from $87 per barrel.

ANZ has revised its estimate for WTI to $78 a barrel from $84 a barrel.

ANZ Research stated:

OPEC’s supply policies struggle to maintain prices as fears of a weaker demand persist. Investors are increasingly pessimistic about economic growth. This will likely keep sentiment low. Seasonal trends have led to a decline in oil demand.

This article Why oil prices could stall amid a looming glut of supply? This post may be updated as new information unfolds.

This site is for entertainment only. Click here to read more