Vedanta’s (VEDL) stock price is up this year, despite the fact that prices for key commodities such as iron ore and aluminum have declined. It has reached a new record high of 470.60 rupees, which means that its price has increased by 1,453% since 2020. The market capitalization of the company has increased to $16 billion or Rs1.75 trillion.

Commodity price weakness

Vedanta ranks among the largest companies in the commodities sector. Vedanta is a major player in commodities such as aluminium, zinc and lead, silver and oil, as well as iron ore and steel.

The goal of the company is to source minerals and bring them to India, which is one of the fastest-growing countries in the entire world. India’s economy will grow at a rate of over 7% in 2014, while China struggles to reach the 5% mark.

Vedanta sells products all over the world. It is particularly successful in Asia. Vedanta is composed of many subsidiaries, including Cairn India and Hindustan Zinc.

The prices of the key commodities in which it specializes aren’t doing very well, and this is an indication of low demand. Some items have been affected by the overcapacity of China, which is a slowing economy.

Copper, which is often viewed as a barometer for the global economy, has fallen by more than 18% since its peak this year. The price of iron ore, meanwhile, has fallen by over 33% since the high reached in the first half of the year.

Aluminium, a material used in engineering and construction, has fallen by 40% since its highs of 2022 and by 11% since the highs for the YTD.

Vedanta, which produces crude oil, is a major player in the energy industry. It moved into this industry by merging with Cairn Oil & Gas, and is hoping to grow the share of domestically-produced crude oil in the country.

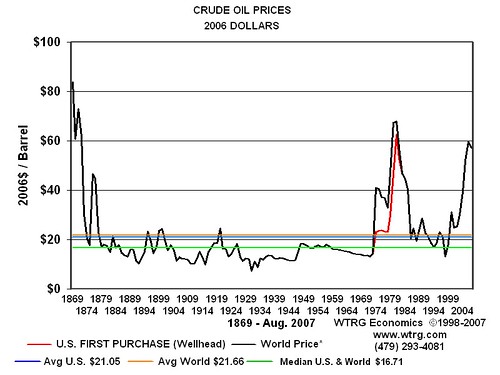

The price of crude oil has fallen in recent months, as global demand concerns remain. Its oil production dropped to 112 kboepd from 135 kboepd by the end of last quarter.

Vedanta earnings

In the most recent financial report, the company reported that it produced 596kt alumium. This is 3% more than the same period of 2023. The company’s domestic sales increased by 27%, to 268kt.

Vedanta’s mined and refined zinc production increased to 263kt each.

Vedanta’s total revenue increased by 6%, to Rs35.239 crore, or more than $4.2 billion. The EBITDA of Vedanta rose by 47%, to Rs10 279 crore. Its EBITDA margin was at 34%.

Its total debt, however, has increased in recent months. The net debt was Rs56,338 in 2023, and Rs613,324 at the end last quarter. 83% of that debt is in INR, and the rest in USD.

Vedanta: A New Outlook

Vedanta forms a major part of India’s economy. It is similar to Japan trading firms like Mitsubishi, Mitsui and Marubeni who buy and ship resources to Japan.

India’s limited natural resources allow the company to do this. In theory, the company is likely to continue performing well so long as India continues its growth.

The firm faces a number of challenges. China is overproducing in certain areas, and flooding the market. Vedanta will suffer a loss of profits if prices for key products like copper, aluminium, and steel continue to fall.

As long as these concerns persist, the company’s value is overvalued. Fintel data shows that the company’s price-to earnings ratio is 33.7, which is higher than the five-year average of 5x.

Vedanta Share Price Analysis

On the weekly chart we can see that Vedanta’s stock price reached Rs470 at the beginning of this month, as the bull run intensified. The stock price then formed a double top pattern at this level. This is usually one of the more bearish patterns on the market. This pattern’s neckline was Rs387.

Vedanta’s stock is still above the Exponential Moving Averaging (EMA) of 50 and 200 weeks, indicating that bulls have control.

Vedanta’s short-term outlook is therefore bearish. The next thing to watch is the neckline of the double top at Rs387. If it breaks below this level, the company will move down to its 50-week moving median at Rs350.

Bulls will target the next major resistance level, Rs 500, when they move above the double top level of Rs 468.

The Vedanta post-share price pattern is a dangerous one, as the commodities retreat could be altered as new updates are released.