Significant attention has been drawn to the Federal Reserve’s decision, just months ahead of a US Presidential election, to reduce interest rates by a half-point.

It is only the third occasion in the last half-century that the central banks has started a cycle of rate cuts so close to an election day.

In the past, it has been uncommon for interest rates to be decided during an election year. The Fed tends to avoid launching new cycles of monetary policy as the elections near.

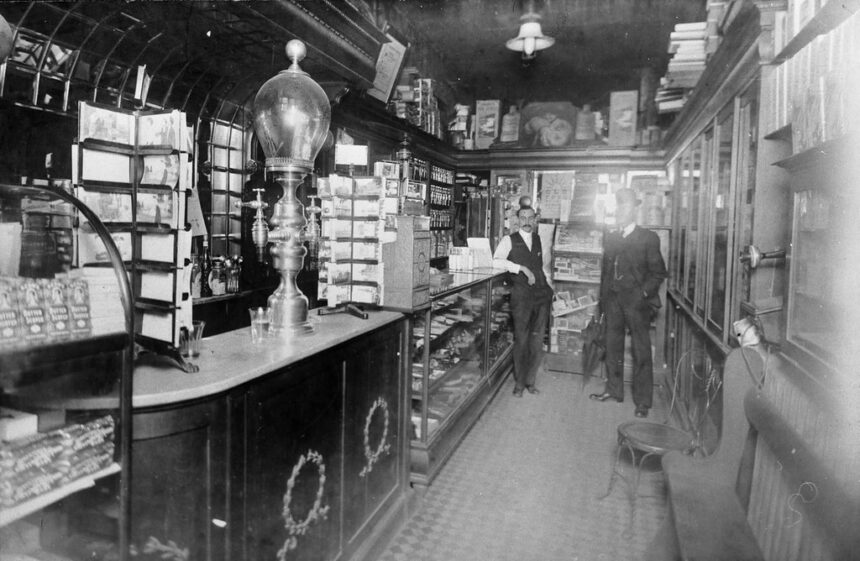

Historical view of interest rate cycles in election years

Since 1972, Fed interest rates have been adjusted in all presidential election years except two.

Rate adjustments, both increases and decreases, have become commonplace. Most of these changes are part of larger cycles that were set into motion long before an election year began.

It has only happened twice in the past to launch a new rate-reduction cycle so close before an election: in 1976 and 1984.

The Fed has been cautious in its monetary policy for months.

Jerome Powell reiterated, as the Federal Reserve chair, that the rate cut decision was not affected by the coming election, but was solely driven by economic data.

Powell said in a press conference held on July that “our decisions are made based upon data, outlook and the balance between risks, not political considerations.”

The timing of these rate reductions, less than 10 weeks prior to Election Day has prompted debate over the possible political consequences of this decision.

Rate cuts in election years: impact on elections

In the past, it has always been possible to correlate Fed actions with election results.

The data from past election years show that rates often increase when the president in office or the party controlling the White House is re-elected.

In four out of five election years where rates rose, incumbent parties retained their presidency.

Only in 2000 did Vice President Al Gore run as the Democratic Candidate fail to win the Presidency despite an earlier rate increase.

In contrast, in election years, the challengers usually do better when rates are cut. Five out of every six times that rates were cut during an election year, the opposing party won the White House.

One exception occurred in 1996, when Bill Clinton was re-elected despite an early quarter-point cut in interest rates.

Cycles of rate-cutting are rarer

It is not uncommon for rates to change during an election year, but launching a new cycle of rate cuts so close before the election only happens a few times.

Since 1970, four new rates-cutting cycle began within months after an election.

Three of these cases saw the candidate who challenged the incumbent win the election.

In response to COVID-19, the Fed cut interest rates in 2020 by 1,50 percentage points.

In March, the interest rates were cut to near zero.

Joe Biden defeated Donald Trump, the incumbent President, by a narrow margin in 2016.

In 1976, the Fed cut rates four weeks prior to Election Day.

It is not clear what impact the cut in rates had on the results of the elections, but Democrat Jimmy Carter defeated Republican Gerald Ford.

What are Trump and Harris saying?

Not everyone believes the Fed when it says that its policies are non-partisan.

The former Republican presidential candidate Donald Trump suggested in early this year that central banks might lower interest rates to assist the Democrats during the elections.

Trump has also stated that the presidents of the Fed should be able to have some input into decisions.

The Democratic nominee for president, Vice President Kamala Harris has adopted a cautious approach.

Harris, who ran for the Democratic nomination in the 2016 presidential election, avoided discussing any specific economic policy during her campaign. Instead, she focused on more general economic issues.

What do the data tell us about election rates?

The data collected over the last five decades shows that timing and direction of the rate cycle can have an indirect effect on the voter’s sentiment.

In 1984, for example, the incumbent Republican president Ronald Reagan was reelected in a massive victory when rates were raised by 2,56 percentage points.

This rate increase was part of a broader Fed strategy designed to fight inflation that had been ravaging the economy for many years.

In 2008, the Democrat Barack Obama was elected president despite the financial crisis when the rates were cut 2.75 percentage point.

In that same year, the Fed cut rates to cushion the impact of an economic recession. The electorate then focused on economic recovery.

Interest rate reductions and elections are not directly related, but the Fed is just one factor that influences voters.

The timing and magnitude of the rate changes can indicate to the public the response by the central bank to wider economic challenges. This can have an impact on voter sentiment.

Elections in 2024 and the economic policy

The impact of recent Fed rate cuts on campaigning is still to be determined.

Both political parties, while the central bank retains a neutral stance on economic issues, are aware that these conditions can influence voter behavior.

The Federal Reserve’s decision to reduce rates is a particularly double-edged weapon.

Lower borrowing costs can provide relief for consumers and business, creating a feeling of stability in the economy.

Critics argue, however, that rate reductions could be a sign of concern over the current state of the economic system, which would increase uncertainty leading up to an election.

The Fed will continue to be scrutinized as the US economy struggles with issues such as inflation, unemployment and others.

While history shows that rates cuts tend to favor challengers in elections, the final outcome of 2024 will depend on many factors including the perceptions of voters about the economic climate.

The post US Fed rate cut before election marks rare central bank move may be updated as new information unfolds

This site is for entertainment only. Click here to read more