The US consumer confidence index has dropped to the lowest level it’s been in 8 months. This is due to inflation continuing and unrest surrounding the election.

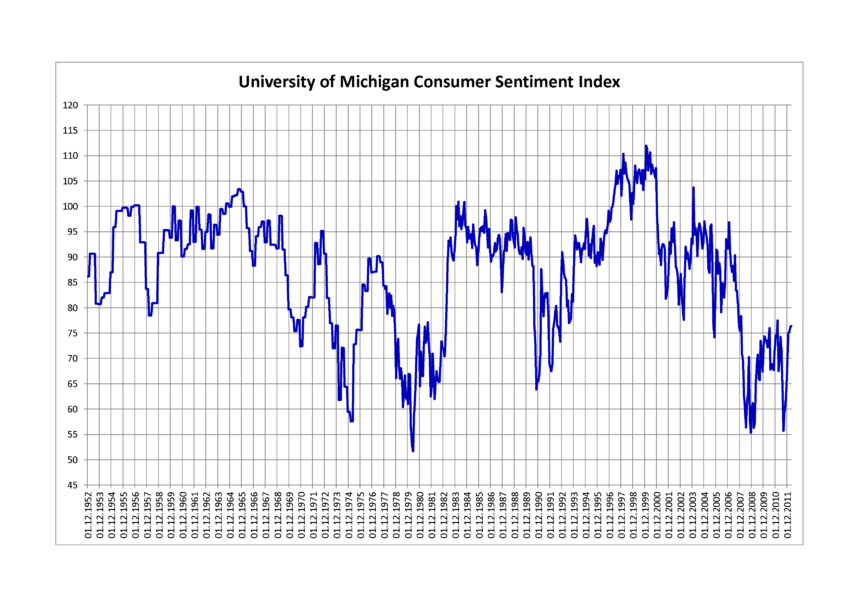

The latest University of Michigan report shows that the Consumer Sentiment Index registered a final score of 66.4, down from the June reading of 68.2, marking its lowest level since the November of last year.

The Consumer Sentiment Index drops to 66.4

Consumer sentiment is declining, indicating that Americans are becoming more concerned about the current state of the economic situation.

The index was expected to be 66 but it came in a little lower than predicted.

The drop in consumer confidence is significant because it is an important indicator of the health of the economy, and reflects consumers’ willingness to spend.

Joanne Hsu is the director of University of Michigan’s consumer survey.

The mood has risen 33 percent from the historic June 2022 low. However, it is still cautious as high prices are continuing to dampen attitudes. This affects those on lower incomes most.

Hsu pointed out, “As long as the election is uncertain, it will likely cause volatility to continue in the economy in months to come.”

Inflation expectations decline

The report provided some good news about inflation expectations despite the overall drop.

Inflation expectations for the year ahead fell again in July, from 3.0 to 2.9 per cent.

The consumer is beginning to feel some relief after the recent high inflation rate that has plagued the economic system.

In July, however, the long-term inflation expectation remained at 3,0 percent. This is a stable rate compared with the month before, but it’s still high compared to the range of 2.2 to 2.6 percent seen two years prior to the pandemic.

It is clear that, while the short-term concerns about inflation may have eased, expectations for long-term inflation are still elevated.

High prices and consumer attitude

High prices continue to affect consumer sentiment, especially among households with lower incomes. The high inflation rate has reduced the purchasing power of many Americans and increased their difficulty in affording basic needs.

The declining index of consumer sentiment reflects this economic pressure, with consumers expressing concerns over their own financial situation and the economy as a whole.

Consumer spending in the US is a major part of economic activity. The relationship between sentiment and consumer spending is crucial. If consumer sentiment is poor, they are likely to reduce their spending. This can lead to a slowdown in economic growth.

Consumers may feel hesitant about the future of their finances, and this could affect the economy.

Uncertainty about the election and its impact on economic prospects

The upcoming elections, in addition to rising inflation, are contributing to an uncertain economy outlook. Consumer confidence is often affected by political uncertainty, because people are wary about potential economic policy changes and their consequences.

Hsu’s remarks on the likely volatility of economic attitudes highlight the complex interaction between political events, consumer sentiment and Hsu.

Inflationary pressures combined with election uncertainty create a difficult environment for both policymakers and business.

The potential shifts in the economic policy may further affect consumer spending and attitudes as the elections approach.

What’s next for the US economy?

Monitoring consumer sentiment is crucial to understanding how the US economy will evolve as it navigates through these economic challenges.

The slight drop in expectations for short-term inflation is a sign of optimism, despite the fact that the University of Michigan consumer sentiment index fell to 66.4 points in July.

The policymakers must address the inflationary pressures and longer-term uncertainty associated with the coming election.

In the coming months, efforts to improve consumer confidence could be made by stabilizing prices and providing clarity about economic policies.

As new information becomes available, this post US consumer confidence drops to an eight-month low amid concerns about inflation and elections may be updated.

This site is for entertainment only. Click here to read more