British employers did not make any adjustments to pay in response rising costs or an upcoming increase in payroll tax. This brings wage growth in line with the inflation rate for the first since October 2023.

Brightmine, a human resource firm, has revealed that median wage award for the quarter ending February 2025 remained unchanged at 3%. This is the lowest increase rate since December 2021.

The Bank of England will likely welcome this trend as it evaluates the inflationary pressures on the labor market.

Tax increases are coming for employers

Many British companies are reducing their wage increases because of the upcoming increase in payroll taxes.

Brightmine data shows that 25% of companies plan to freeze hiring or restructure teams as a response to tax changes.

In order to control rising costs, some businesses have decided to freeze salaries and delay salary increases.

The shift in policy reflects the need to maintain financial stability against broader economic forces, such as higher contributions for social security and wage increases.

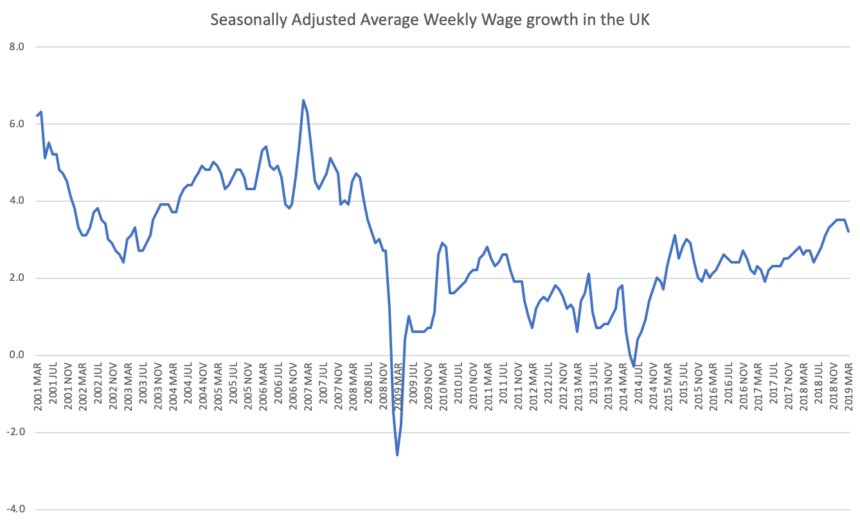

In recent months, wage growth has been consistent. This indicates that employers are cautious.

In the quarter ending in February, the median wage award of 3% remained the same as the two previous quarters.

The wage increases that were driven by inflation in 2023 are not as common.

Wage growth will not be significant in the short term as employers expect higher taxes.

Companies under pressure to raise minimum wage

The UK minimum wage will rise nearly 7% by April along with payroll taxes, adding further pressure to businesses.

Brightmine’s analysis shows that almost three quarters of employers anticipate this change will narrow the gap in pay between their lowest-paid and highest-paid employees.

If a company has a large proportion of low-paid employees, it may be necessary to change the salary structure across all departments to keep roles distinct.

It could also lead to other cost-saving measures, such as delayed salary increases for high earners and reductions of discretionary bonuses.

Retail, hospitality and the care sector are all sectors where there is a large number of low-paid workers.

These industries already operate on very tight margins, which could lead to difficult decisions regarding pricing, employee management, and workforce planning.

BoE monitors wage trends

BoE closely monitors wage growth, as it is a major indicator of inflationary pressure.

Recent data indicating a stagnation of pay increases support expectations that the inflationary risk from the labour markets may be diminishing.

The UK consumer price index was 3% in January. This is the same as the most recent wage figures.

The BoE will likely hold interest rates at their current level following the March meeting. However, the continued ease in wage pressures may strengthen the argument for rate reductions later this year.

The policymakers are cautious to lower borrowing costs prematurely, for fear of a rise in inflation.

If inflation and pay growth continue to decline, then the central bank will have a greater amount of room for manoeuvre in the next few months.

The post UK wage-growth stalls at just 3%, as employers prepare for the payroll tax increase may change as new information becomes available.