Tokyo’s inflation rate rose dramatically in December. This led to expectations of an interest rate increase by the Bank of Japan in 2024.

According to data from the government, consumer prices in Tokyo increased 3.0% year over year, compared with 2.6% in November.

The core inflation rate, which does not include fresh food or energy prices, increased to 2.4% in the month of August from 2.2%.

Now, the BOJ is finally noticing signs of inflation. It has been maintaining a loose monetary policy over many years.

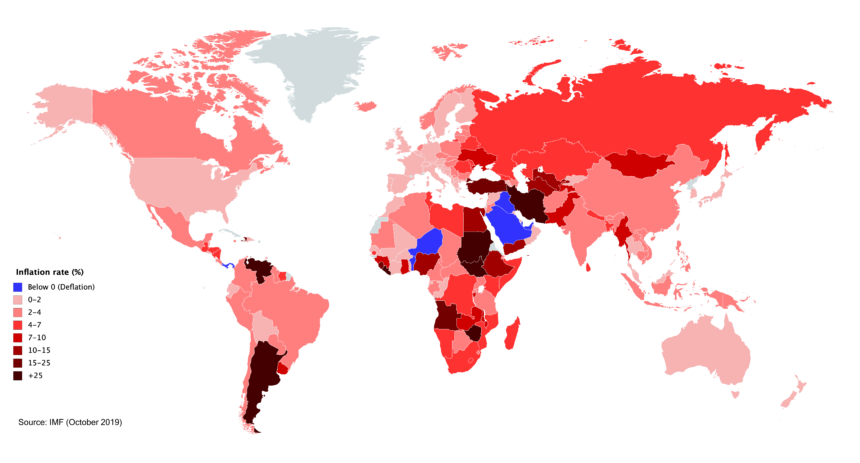

Japan, while the rest of world continues to fight higher inflation rates, is considering whether tighter policies will lead the way.

Key factors that drive inflation

Tokyo’s inflation rate in December was largely driven by energy prices.

After the end of subsidies in 2023, energy prices rose by 13.5%.

The subsidies will return in January 2024 and likely cause inflation to rise.

Prices of services rose slightly by 0.9% to 1.0% from 0.9% last November.

This is viewed by economists as an indication that rising wages have begun to drive up service prices.

Increased wages, backed by tightening labour markets, may increase inflationary pressures.

In November, the ratio of jobs to applicants remained constant at 1,25. This means that there were 125 available jobs for every 100 people looking for work.

Are you ready to raise rates in Japan?

These latest figures are in line with the BOJ’s inflation target of 2%, which the central bank is struggling to consistently meet.

The December data indicates that BOJ might finally be able to see enough momentum for further policy normalization.

Kazuo Ueda, the BOJ’s governor, has stated that it will take its next step based on data received. This includes wage trends as well as global economic conditions.

Tokyo CPI is a good indicator of inflation in the country.

The BOJ’s short-term interest rate has been lowered to 0.25 percent, despite the fact that Japan’s CPI is nearing multi-decade-highs.

The BOJ may decide to raise rates at its January or March meetings.

Japanese economy: mixed signals

Other economic indicators paint a very different picture. While the BOJ may raise rates based on inflation and conditions of the labour market, some other data points to a completely opposite scenario.

The factory output dropped by 2.3% last November, the first drop in three months.

The economy of Japan, which is heavily dependent on exports, has been impacted by the weak global demand for automobiles and semiconductors.

However, retail sales showed a slight improvement, increasing 1.8% from the month before.

The growth rate was slightly higher than the inflation rate at 2.8%. This is due to increased expenditure on consumer goods and clothing.

What will the yen do?

Japanese yen is under pressure. It has traded near its lowest level in five months against the US Dollar.

USD/JPY recently hovered at 157.70. This is down from the monthly high of 158.08,

The weaker yen fuels inflation, especially by raising import prices for raw materials and energy.

The BOJ continues to be concerned about currency movements.

Katsunobu Kato, the Finance Minister of Japan, has cautioned against sudden and one-sided movements in the foreign exchange market. He also hinted that he may intervene if yen depreciation becomes more rapid.

When will BOJ raise rates?

It is expected that the BOJ’s next meeting of monetary policy on January 23-24 will be an important event in Japan’s future economic prospects.

The central bank is divided in its analysts’ opinions on the issue of whether it will raise interest rates quickly or wait until wage growth trends and global economic trends are more clear.

The annual wage negotiation in Japan, which usually concludes around the beginning of January.

The BOJ may feel more confident if wages grow significantly compared to the inflation target if they see a significant increase in their wage growth.

Governor Ueda repeatedly stressed that a wage-driven, durable inflation rate is essential for tightening.

Japan’s changing monetary policy may affect the global market.

Due to its commitment to maintaining low interest rates, the BOJ is a major source of liquidity on global financial markets.

The global bond market could be affected by a shift towards higher interest rates.

The yen could also have a significant impact on global trade.

Stronger yens could reduce Japan’s competitiveness in exports, whereas a weaker currency would increase global inflation by increasing import costs.

Tokyo’s rising inflation may signal that Japan is finally winning its long-running battle against deflation.

Although higher energy costs and tightening labour markets indicate a possible rate increase, the BOJ is not certain of its decision due to other data.

As updates unfold, this post-Tokyo inflation jump may raise expectations for Bank of Japan interest rate hike.

This site is for entertainment only. Click here to read more