It’s important to look ahead to 2024 as we approach the end of this year.

The US stock market has been on a tear. Fairly, it should be noted that the most recent, and perhaps last leg, of this rally began in October 2023.

After a tough summer, equity prices stabilized and eventually bottomed out.

Interest rates and, more specifically, the date they will start to fall, was at issue.

It is not news that the US Federal Reserve has been slow to react to the inflationary pressures which have built during the pandemic of 2020-2021.

Everyone could see these trends, except for the Fed. The Fed was still convinced that inflation had risen temporarily.

In 2022, Russia will invade Ukraine.

In March, the US Central Bank raised rates for the first time since 2018.

The Fed Funds rate was raised from a maximum of 0.25 % in March 2022, to 5.50 % in July 2023.

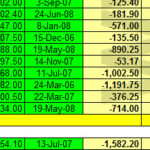

The S&P 500 reached its peak at about 4,800 at the start of 2022, whereas the tech-heavy NASDAQ peaked a few months earlier.

US stocks dropped over the following ten months.

The S&P 500 index finally reached a bottom in October 2022, just under 3,500. This represents a 28% decline.

The tech-heavy NASDAQ dropped 38% in a period similar to that of the NASDAQ, though slightly longer.

The US equity market experienced a modest rebound, even though the Fed continued to tighten its monetary policy.

In July 2023, the Fed raised rates for the last time.

The stock market’s nascent rally was brought to an abrupt halt.

The traders now believe that by raising interest rates to an unacceptably high level, the Fed is compounding their original error of not treating inflation seriously.

The next three months will see a sharp drop in the value of stocks.

They have again reached their lowest point in October.

Investors began questioning the Federal Reserve’s forecast that rates were at their peak.

Now, traders are speculating when the Fed will start cutting interest rates.

As we approached 2024 the markets began to price in rate reductions of up to 150 basis points in 2024. The first was in March.

The Fed didn’t cut interest rates until just two months earlier, in September.

In what appeared to be a mild panic or desperate effort to compensate for any delays, the cut was 50 basis points instead of 25.

It helped the markets to overcome the fallout that followed the unruly dewinding of the carry trade yen over the summer.

The 25 basis-point cut made in November also contributed to the rise of the equities.

S&P 500 gained 48% from the October low to the December high.

Over the same time period, NASDAQ gained 52 percent.

The probability that another 25 basis points will be cut by the end of the year has increased to 98% thanks to CPI figures in December. These numbers, although showing a stalling in the decline in inflation, are still in line with the expectations.

Can this, and the possibility of some cuts also next year, keep the rally moving? Soon we’ll know.

David Morrison, Senior Market Analyst for Trade Nation. His views are his. )

As new information becomes available, the post Chugging towards the finish may change.