This week, the Swiss National Bank’s (SNB’s) interest rate announcement will put the Swiss Market Index and Swiss Franc (CHF), in the spotlight. USD/CHF has fallen by nearly 8% since its peak this year, while SMI is down by more than 4.4%.

SNB interest rate decision

In the past few days, central banks were in the spotlight as they delivered most of their rate decisions.

The Federal Reserve announced a massive rate reduction last week while the Bank of England delivered a cautious pause. Analysts anticipate that these banks will continue to cut interest rates, now that the inflation rate is decreasing and the economy has slowed.

SNB will likely deliver a further interest rate reduction when they meet on Thursday. The SNB will then reduce interest rates by 0.25 to 1 %. This will be the third rate reduction this year.

Banks are dealing with an extremely complex issue. Swiss inflation is stubbornly high, even by Swiss standards. Meanwhile the economy has been slowing.

Moreover, this year some strategic key sectors have also struggled. The luxury watchmaking sector, for example, is experiencing a tough patch due to a slowdown in international demand. This is especially true of China.

It has gotten so bad that the government intervened in order to relieve some of the pressure on the companies.

The Swiss Franc’s strength against the US Dollar and Euro is one of the main reasons for the slowdown in the Swiss economy.

The Swiss are a country that is primarily export-oriented and have accumulated a surplus in trade of more than $56 billion. A stronger franc increases the price of Swiss products abroad, particularly in Europe.

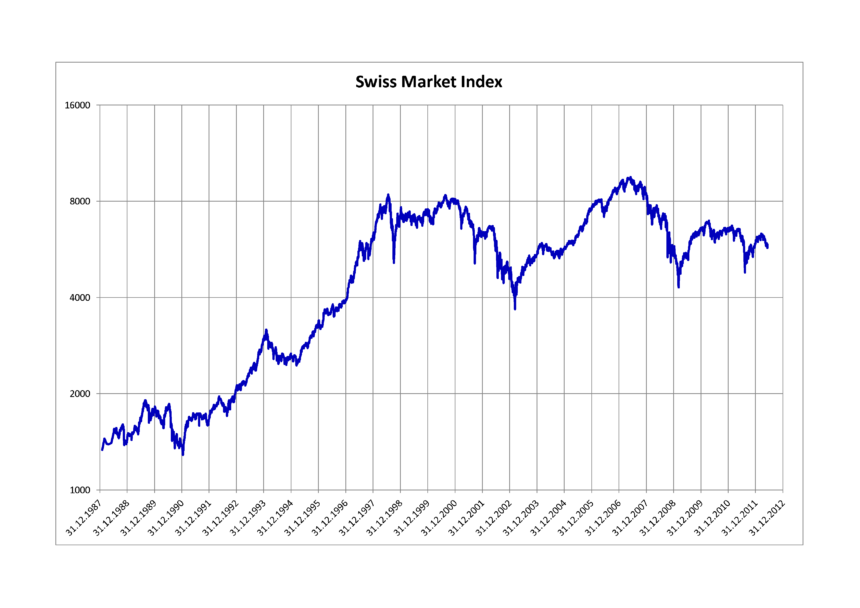

Swiss Market Index Analysis

In the last few weeks, SMI has been struggling. It has increased by more than 16% since its low point in the current year. However, it is down by over 4% compared to this year’s high.

The strong Swiss Franc has affected the majority of top exporters.

Nestle is a good example. The world’s largest food company has seen its stock fall by more than 15% in this past year. Kuehne & Nagel is a leading company in logistics. Its stock has dropped 12% over the past year.

Richemont has fallen by more than 15% over the past 30 days.

Some Swiss companies, like ABB Holcim Swiss Re Givaudan Alcon and Holcim have performed well this year, with a rise of over 20%.

On the daily chart, it is clear that earlier in this year, at CHF 12.435 (the Swiss Market Index), a chart pattern of a double top was formed. This is one of most common bearish signals in most markets, and this explains the pullback.

The SMI Index has fallen below both the 50-day and 100-day Exponential Moving Averages and hovers at the Fibonacci Retracement of 23.6%.

The chart has formed a negative bearish-flag pattern. The index is likely to have a negative breakout, as the sellers will target the Fibonacci Retracement 38.2% point, CHF 11,600. This level is approximately 2.7% lower than the current value.

USD/CHF Technical Analysis

It peaked earlier in the year at 0.9222 and now has plunged over 7%, to 0.8500. The USD to CHF exchange rate bottomed out at 0.8375, and now has risen back up to the psychological level of 0.8500.

In August, the Exponential Moving Avg. 200 day and 50 Day crossed.

The chart has formed a pennant pattern that is bearish. The pair is therefore likely to have a negative breakout. Its next target will be at the 0.8376 level, which represents its lowest point of the year. If the pair breaks below this level, it will indicate further downside. The next target is at 0.8376.

This article Swiss Market Index (SMI), USD/CHF Analysis and SNB Decision appeared first on the ICD