Saudi Aramco, the state producer of crude oil in Asia has raised the official price for its main Arab Light grade and reduced the prices for Europe and the US.

Divergent views on oil prices in different regions indicates local imbalances.

Bloomberg reported that Saudi Arabia’s state-owned Saudi Aramco had raised the official price for crude oil in Asia by $0.90 per barrel for November.

The Kingdom has reduced prices for all grades and landings of oil by $0.90 per barrel for Europe and the US.

In a recent report, ING Group said that the prices had been reduced to regain share of market in these two areas.

High prices for Asia hint at higher demand

Saudi Arabia hopes that the demand for oil in Asia will increase this month as the price of its oil exports has increased.

In recent months, the world has become increasingly concerned by the growth of oil demand in China.

The Asian giant is still the biggest oil importer.

According to the World Oil Outlook 2024 of the Organization of Petroleum Exporting Countries, India, China, and other Asian countries are expected to drive the demand for crude oil from 2023 to 2050.

According to the report, India’s oil consumption is expected to increase by 8 million barrels a day between 2023 and 2050. China’s oil demand will grow by 2.5 million barrels a day.

In the next 27-year period, India and China will be responsible for almost half of the increase in oil demand in Asia, Africa and Middle East.

The demand from OECD countries will decline

Saudi Arabia’s decision is based on two main reasons: lower demand, and gaining market share.

As part of the agreement with OPEC+, the Kingdom has adhered to hefty cuts in production. The country has also cut oil production by 1 million barrels per day, voluntarily, since late last.

The Middle Eastern countries’ market share has been reduced, especially in the West.

ING Group stated in a recent report:

The OSPs (official sales price) of all grades for Europe were reduced by US$0.9/bbl in November, perhaps in an attempt to regain market shares in the European market.

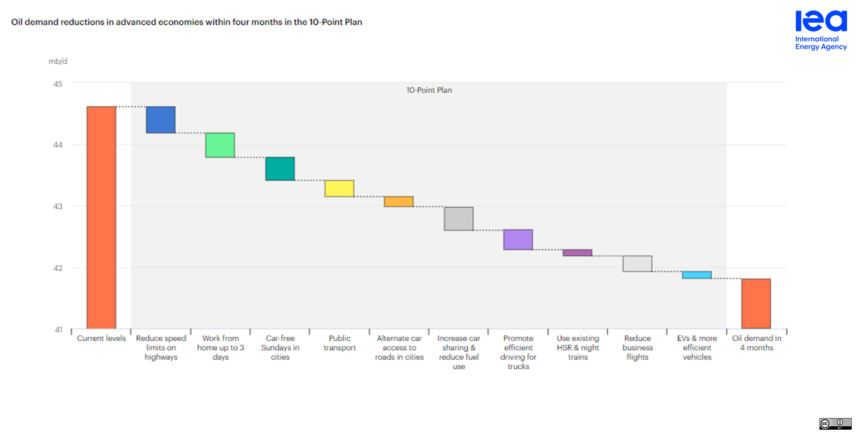

OPEC also predicts that oil demand in the Organization for Economic Cooperation and Development countries (OECD), will decrease over the next two decades.

According to OPEC data, the oil demand for OECD nations will be 35,6 million barrels aday by 2050. This is a significant decrease from the 45.7 million barrels / day projected in 2023.

Brent crude barrels near $80

The oil prices have continued to rise since last week, as fears of a more violent conflict in the Middle East increased.

Media reports claim that Hezbollah, a militant group supported by Iran, fired rockets at Israel’s Haifa in the early hours of Monday.

The traders believe that Israel will likely attack Iran’s oil installations, which could wipe out 4% of world oil supplies.

Brent crude oil had risen 2% at the time this article was written, to $79.60 a barrel.

As tensions in the Middle East continue to rise, prices are expected to surpass $80 per barrel. This is the first time this has happened since August 30.

This post Saudi Aramco cuts oil prices in Europe and the US to try to gain market share first appeared on ICD

This site is for entertainment only. Click here to read more