The coffee price surged this week in line with a recent trend. TradingView data shows that the price of coffee has increased in seven consecutive months and reached its highest level since 2011. The price of coffee has increased by more than 205% since its lowest point in 2020.

The price of Robusta coffee has risen by nearly 100% since the low point in 2020.

Corn has, however, risen for the past two months, despite remaining 40% below the highest level reached in April 2022. The price is hovering around its lowest level since April 2021.

Soybeans have also increased slightly. They are hovering around their lowest level since December 20,21, and about 25% below its highest point of 2023.

Coffee prices are on the rise

The price of coffee has increased dramatically in recent months due to the weather problems in Brazil, Vietnam and Colombia.

Major supply disruptions are the main cause of the rise in Arabica and Robusta brands. Brazil’s harvest has seen a lower-than-expected production.

The country is experiencing its worst drought for decades. Climate change has also caused significant droughts in other countries, such as Vietnam and Colombia.

The European Union has been enforcing laws to prevent coffee from being produced in areas where deforestation is taking place.

Analysts predict that the price of coffee will continue to rise for some time. It takes longer for new coffee trees to start producing beans than corn or soybeans. While many farmers have begun planting new crops, the impact on the market may take some time.

The coffee price has also risen due to the logistics problems in the industry. The Suez Canal has been a major artery for global trade and continues to be disrupted. Farmers are now adding this to their prices.

In key countries such as the United States and China, there are no signs of a rise in coffee consumption.

Price forecast for coffee

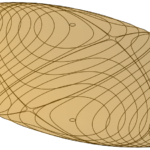

The monthly chart shows a strong upward trend for coffee prices in the last few months. The price of coffee has been rising for seven months in a row and this trend is continuing. It is the longest winning streak in many years.

The price of coffee has crossed an important resistance level at $260. This is the highest point it reached in February 2022, and the upper edge of the cup-and-handle pattern. This is a popular bullish sign in price action analysis.

The coffee price has remained above its 50-month moving mean, indicating that the bulls have control. The price of coffee will therefore likely continue to rise as bulls aim for the next major resistance level at $300.

Corn prices rise after WASDE report

The price of corn has been crawling backwards in recent days. Teucrium Corn Fund, which is closely watched, rose to $18.16, the highest level since July of this year. It has also increased by over 6.7% compared to its lowest point in this year. The fund has fallen by more than 40% since its peak in May 2022.

Last week, the US Department of Agriculture released its WASDE report. The USDA reported that the corn supply would be smaller, with starting stocks about 55 million bushels less. The US corn production is expected to increase by 55 million bushels, to 15,2 billion bushels.

Price forecast for corn

On the weekly chart, the CORN ETF reached its highest point at $30.31 by 2022. It then fell to $17 in August to reach its lowest level. The 50-day and the 200-day Exponential Moving Averages have crossed, forming a death-cross pattern.

The Fibonacci Retracement has also been lowered below the 61.8% point. The price is likely to continue dropping as sellers aim for the key support of $15.50 – the 78.2% Fibonacci Retracement.

Soybeans price analysis

TradingView’s SOYB Chart

According to the WASDE report, US production is expected to drop by 3 million bushels in order for it reach 4.6 billion this year. The report also predicts that the global soybean trade will increase to 181.6 millions tons this year, mainly due to higher imports and exports of Paraguay.

On the weekly chart we can see that on May 30th, the price of soybeans formed a triple top chart pattern.

As the spread between moving averages of 50 and 200 weeks narrows, soybeans are about to form a cross. The path of least resistance is down, and the next level to watch is $20, which is approximately 10% below current levels.

As new information becomes available, this post Robusta and Arabica coffee prices soar; corn, soybeans near death crossing may be updated.