Rivian Automobile Inc. (NASDAQ: RIVN), which reported its first quarter gross profit today, is the focus of attention. Its success in reducing variable costs while improving its overall operations can be seen in its report.

Rivian’s earnings report is putting pressure on Tesla Inc. (NASDAQ: TSLA), this morning, because the Irvine-based firm was ahead of TSLA in a critical metric.

Rivian’s future guidance failed to impress investors, resulting in the stock of EV falling 4.0% in Friday premarket.

Tesla’s per-vehicle profit drops, while Rivian is gaining ground

Tesla’s shares have fallen today because Rivian beat Street expectations for top and bottom line in Q4.

Elon Musk, the billionaire’s company, missed both goals in its most recent reported quarter.

Tesla’s investors are disappointed because RIVN, with less resources and a smaller brand name can still beat the expectations. Why couldn’t Tesla do that in its fourth quarter?

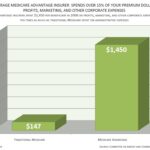

TSLA also takes a loss at the writing table because Rivian made $12,000 profit per vehicle delivered during its recent quarter.

Tesla’s Q4 fiscal year 2016 was a $6,600 increase in this metric alone.

Tesla’s profit per car was down from the previous year.

It earned an average of $8,400 per delivery in the fourth quarter 2023.

Rivian’s view may be conservative

Rivian expects to only sell 48.500 electric cars this year, a far cry from the 55,000 analysts predicted.

Investors in the company were also disappointed because this number suggests that RIVN will sell fewer vehicles than it did five years ago, when they sold 52,000 cars.

Rivian’s approach may be too conservative.

Why? The EV company recently began accepting orders for their commercial van, which was previously an Amazon-exclusive product.

Rivian’s stock has dropped more than 20 percent from its high point for the year.

What is the best time to invest in Rivian Stock in 2025?

Rivian could be a great investment for 2025, as the price to sales ratio is currently well below that of its competitors such as Lucid or Tesla.

The EV manufacturer also plans to introduce three mass-market cars next year that will all be priced under $50,000.

Its affordable products could boost its sales, just like they did in 2020 for Tesla.

Investors, on the other hand, could see the benefit of the new stock in Rivian much earlier, possibly as early as the second half of the year.

This is because the markets tend not to react retroactively, but rather are more forward-looking.

RIVN is not a dividend-paying stock, so it remains unattractive to income investors looking for supplemental passive income.

As new information becomes available, this post Rivian beats Tesla in key Q4 performance metrics may change.