Organization of the Petroleum Exporting Countries (OPEC) and its allies face a dilemma over their decision to increase the oil production from December.

OPEC+, Saudi Arabia and other members of the group are expected to increase their production by 180,000 barrels a day starting in December. This is part of a strategy to reverse some voluntary production cuts.

Since the start of this year, eight members of OPEC+alliance including Saudi Arabia have cut production by voluntarily reducing it by 2.2 millions barrels of oil per day.

It remains to be seen if the cartel’s planned increases for December are the right decision.

According to a Reuters report published earlier this week, OPEC could delay its planned increases from December due to the recent drop in oil prices below $70 per barrel.

James Hyerczyk is an author for Fxempire.com. He wrote a brief note in which he said:

OPEC+ could make a decision by the end of next week to support current prices, as market participants anticipate a tightening supply.

The decision is not always easy.

Oil prices rise again

Oil prices recovered ground in the last two sessions after plummeting by more than 6% and trading at their lowest level since October began.

The Middle East is experiencing increased geopolitical tensions.

Reports claim that Iran is preparing to attack Israel via Iraqi territory. This could be before the US elections next week.

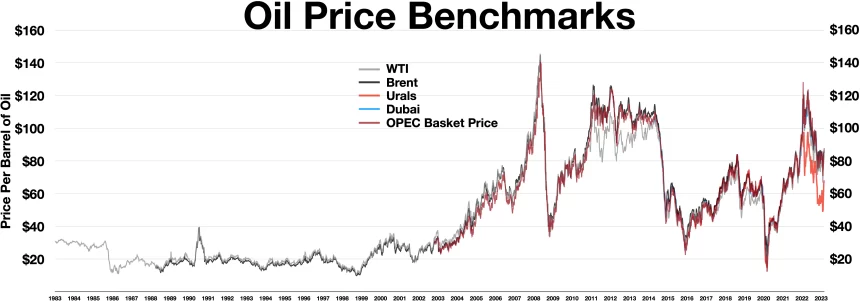

Brent oil prices have risen by nearly 3% since Friday and are now back near $75 a barrel.

West Texas Intermediate prices are back above $70 per barrel and around $71 as of this writing.

Oil prices will remain volatile in the coming weeks as tensions continue to simmer throughout the Middle East.

Israel and Iran are at odds since 1 October, when Iran launched strikes on Tel Aviv.

Israel responded last Saturday by striking Iranian military targets.

Oil supply in the region is at risk if tensions continue to escalate.

Iran provides around 4% to the world’s total supply and China eats up its majority of exports.

Experts say that if Iran attacks Israel and Israel retaliates with a strike on the oil facilities in Tehran, the price of a barrel could rise to over $80.

Market Share

Regaining market share is one of the main reasons why OPEC+ will increase production in December.

Saudi Arabia indicated last month it was willing to gain market share by lowering oil prices.

It is unclear if the kingdom would tolerate oil at mid-$60 per barrel.

Brent prices hit a low of $70.72 a barrel, a month-low earlier this week.

Barbara Lambrecht is a commodity analyst with Commerzbank AG. She said:

The short-term oil price will depend on the production plans of eight OPEC+ member countries.

Lambrecht stated that “even though most production cuts will be fixed until 2025, the withdrawal of voluntary cuts may result in a surplus of products which would further pressurize prices.”

In recent years, OPEC+ – and in particular Saudi Arabia – has lost a significant amount of market share. This is due to the US and other non OPEC oil producers.

Production cuts are hefty

Eight members of OPEC+ have agreed to voluntary production cuts, on top of the 3.6 million barrels of oil per day that has been cut.

OPEC+ is currently responsible for a total of 5.8 million barrels of oil per day.

The demand is now at its highest level in history, except for the COVID-19 pandemic when it fell dramatically.

OPEC+ also holds back around 6% of the world’s supply of oil by adhering these production cut quotas.

The majority of countries in the cartel rely on oil exports as a source of funding for their economic activities.

Experts say that Saudi Arabia could face difficulties in getting other cartel members to adhere to the production increase planned for December. Members may not tolerate a further drop in oil prices.

Breakeven is $80 per barrel. This is the desired price for OPEC producers.

Prices are significantly below this level.

Demand Concerns

Analysts at Commerzbank AG think that even if OPEC delays its planned production increases by a few months, the price may not rise significantly.

The main reason for this is the poor demand coming from China, which is the largest importer of crude.

If the postponement announcement is made at the start of next week this will support the prices.

“China’s crude imports are expected to be released on Thursday and will likely bring back demand concerns,” said Commerzbank’s Lambrecht.

China’s economy has been in trouble, and crude oil imports have dropped over the past few months.

The Chinese government’s stimulus packages have not been able to rekindle hopes for a quicker recovery of the Chinese economy.

Commerzbank is of the opinion that, for now, only geopolitical tensions can be a source of hope for an increase in oil prices.

According to the latest developments, Iran could retaliate by firing drones and missiles against Israel from Iraq.

Lambrecht noted:

Oil prices fell significantly at the start of the week after Israel’s retaliation on the weekend spared Iran’s oil and nuclear installations, which led to an expectation that there would be no further escalation. Now, this hope appears to be in question. It suggests that the pricing of the geopolitical premium on the oil market was premature.

OPEC ministers could choose to watch and wait for the moment and not make a decision immediately.

In December, the cartel will have to make a difficult decision.

This post OPEC+ is in a pickle. Should the cartel increase its oil output? This post may be updated as new information becomes available

This site is for entertainment only. Click here to read more