Oil prices will be likely to fall as a result of the prospect of increased supply in the months ahead from the Organization of the Petroleum Exporting Countries (OPEC) and its allies.

Oil prices have been under renewed downward pressure recently, as evidenced by Brent crude futures briefly dropping below $60 per barrel on Thursday.

The recent drop in energy prices adds to the existing concern about this volatile market. It raises questions regarding the possible implications of the volatility for the global economy and energy producers.

Analysts often view the sub-60 level as an important threshold that can be used to gauge macroeconomic sentiment, supply and demand dynamics.

Barbara Lambrecht is a commodity analyst with Commerzbank AG. She said that the hopes for a quick resolution of the US-China Trade dispute were dashed.

In the two largest oil-consuming countries, there is a renewed concern about demand.

OPEC+ Plans

OPEC+ may increase production. A decision is expected on May 5th.

The previous discussion of supply constraints is a contrast to this.

Commerzbank reports that the eight OPEC+ nations who have reduced their output could increase production for the third month consecutive in June – and by a substantial amount, just as they did in May.

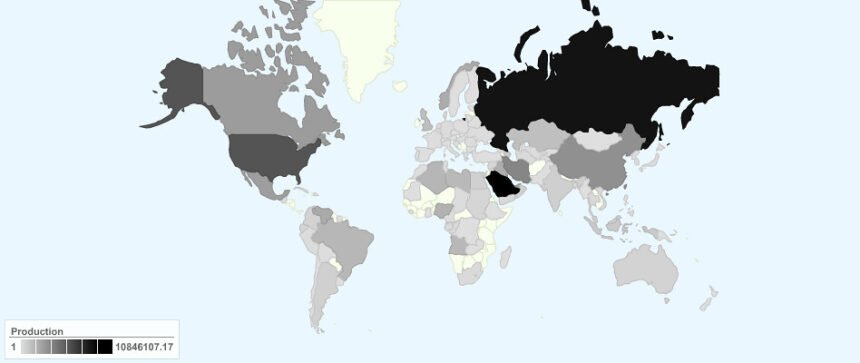

Saudi Arabia is one of the eight nations, as well as Russia, which is the leader de facto of OPEC.

Lambrecht said:

It is possible that there are disagreements in the cartel.

It is evident that certain countries are unwilling to accept production standards of specific members states.

Kazakhstan’s oil production has increased in the last few months. This trend is directly contrary to compensatory reductions it announced previously as part of an agreement between oil producing nations.

Kazakhstan is facing a steep uphill battle

The non-adherence of Kazakhstan to production limitations raises questions about its commitment to collective efforts to stabilise global oil markets.

This surge could offset production cuts made by the other countries participating in the accord, thus undermining its intended effect.

The Kazakhstani government has faced resistance in its efforts to reduce excessive oil production and align itself with OPEC targets, which could strain relationships with major players within the global petroleum industry.

Although it may be necessary to lower oil production in Kazakhstan to meet OPEC targets, this is not entirely within the control of the government.

Kazakhstan is home to oil majors like Shell, Eni, EnxonMobil and Chevron.

These companies have been in contact with the country to discuss a reduction of production. It may not be the best interest of these companies.

Kazakh Energy Ministry has not made public any details of the discussions or agreements that may have been reached.

What concrete actions Kazakhstan takes to reduce its oil production and the impact of these steps on the broader market will be interesting to see, particularly in the context of OPEC+.

Kazakhstan’s Government attributed in March the increase of production to an expansion of Tengiz Oil Field, which is a major project spearheaded by Chevron.

Increased speed

An increase in OPEC+ output could create a significant surplus on the oil markets.

The US Energy Information Administration had previously predicted a significant oversupply. Their updated projections are scheduled to be released on Tuesday.

Media reports indicate that the eight countries in OPEC+ plan to increase oil production at a faster pace in June.

Market participants were taken by surprise when the group announced that they would increase their production by 411,000 barrels a day in May.

In April, OPEC+ had planned to increase output by 135,000 barges per day. This was by reversing some voluntary production reductions of 2.2 millions barrels a year.

OPEC will publish April production numbers in a report published later this month.

David Morrison is a senior analyst with Trade Nation and he said that there have been reports that Saudi Arabia has said they are willing to accept lower oil prices.

The OPEC+ cuts in production have been a major factor for supporting higher prices over the past couple of years.

Prices are falling despite temporary demand

Oil prices are likely to rise as a result of the increase in OPEC production.

Lambrecht explained that “therefore, any tentative signs of demand recovery, like the small increase in prices for Saudi Arabian crude oil sold to Asian buyers at the start of this week are not likely to have an impact on the oil price.”

There is still uncertainty about whether China’s crude imports will continue to produce disappointing results.

Lambrecht expects a substantial drop after a jump of over 12,000,000 barrels per day was recorded in March.

Imports from Iran were likely a major factor in the high import numbers for March. These purchases took place prior to stricter sanctions being implemented.

Kpler’s analysis of tanker data shows that despite indications for decreased imports in April, import volumes were still high.

Lambrecht says that the low price appeal is probably what drives this high level of imports.

Morrison said that Saudi Arabia’s remarks are unlikely to stop the downward trend in oil prices, given the continued pressure on demand worldwide.

It is important to remember that the market eventually will be unable to find buyers. There will then be a rally regardless of the fundamentals.

The post Analysis: OPEC’s accelerated production plan could keep oil prices volatile will be updated as new information becomes available.

This site is for entertainment only. Click here to read more