The oil market waited for weeks with baited breath to see Israel’s reaction to the attack by Iran on Tel Aviv, which occurred at the start of this month.

The oil prices fluctuated as traders were concerned that Israel might target Iran’s crude-oil facilities and limit supply.

Prices fell as much as 6 percent on Monday, after Israel avoided hitting oil and nuclear facilities in Iran during its weekend strike.

The disruption of the energy supply from Iran to the Middle East is less likely.

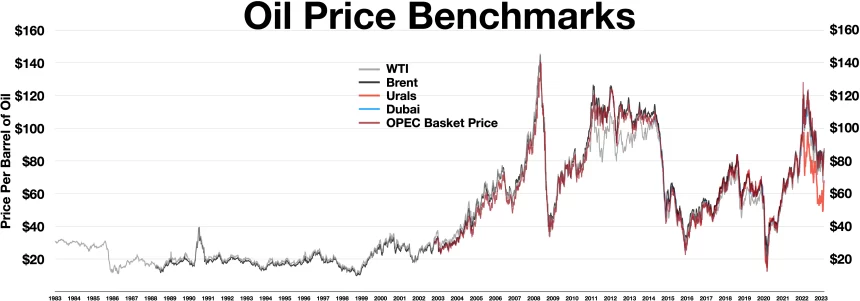

The price of West Texas Intermediate Crude Oil on the New York Mercantile Exchange at the time this article was written, had fallen to $67.94 a barrel.

Brent crude at Intercontinental Exchange fell $71.81 per barrel, or 5.1%.

The benchmarks have fallen to their lowest level since the beginning of this month.

Israel Avoids Oil and Nuclear Sites

Israel’s attack pre-dawn on Saturday was aimed at several Iranian military targets, but it avoided the oil and nuclear facilities.

In a recent note, Warren Patterson, the head of commodities at ING Group said:

Israel’s more focused response leaves open the possibility of deescalation, and the oil price movement this morning clearly suggests that the market shares the same opinion.

Israel has minimized its response to the Iranian threat, despite the fact that it’s still not clear how or if Iran will retaliate.

Iran’s Supreme leader Al Khamenei stated that the attack shouldn’t be “exaggerated”, or “dismissed”.

If we see a de-escalation, fundamentals will once again dictate the direction of prices. Patterson stated that with an excess market by 2025 oil prices will likely remain low.

Oil sell-off premature?

Due to the limited strike that Israel conducted over the past weekend, the premium for geopolitical risks on oil has been reduced.

Some analysts are questioning whether this market response was premature.

Zain Vawda is a market analyst with OANDA.

Some analysts share my opinion that a Middle East ceasefire is still, sadly, a long way off.

The war between Israel in Gaza and Hamas is still far from being over, despite the limited Israeli strike on the weekend.

Saudi Arabia has also condemned Israel’s attack on Iran, despite being one of the largest oil-exporting nations in the world.

It raises concern about a larger conflict as one of the strongest economies in the area joins the war.

Middle East is home to more than 50% of world oil reserves. This makes it vulnerable in the event of any escalation.

OPEC+ Dilemma

The oil prices currently are far below the critical level of $80 per barrel. The Organization of the Petroleum Exporting Countries (OPEC) and its allies rely on oil exports to support their economies, so the cartel is looking for prices higher than $80 per barrel, the level at which they break even.

The OPEC+ Alliance’s decision to boost production in December is complicated by the recent drop in oil prices.

Saudi Arabia, OPEC+ and other oil producers are expected to reverse their voluntary cuts in production of crude oil starting December. This will allow them to regain some market share.

OPEC may be better off if the prices fall further, but in this scenario, a production increase from December is not in their best interests.

OPEC’s increased production could further lower crude oil prices at a time of rising non-OPEC supplies, which are likely to exceed demand in the coming year.

Vawda says:

I think OPEC+ is unlikely to increase output in December if oil prices remain in the 70s.

Oil price forecasts: a technical analysis

Analysts believe the Brent crude price will support around 70 dollars per barrel in the absence geopolitical premiums.

Vawda stated that “below this, we have the low YTD just below the 69.00 mark to watch.”

As much as I’d love to see a rebound and the Oil price gap close, I don’t think we are in the best conditions at this time.

WTI is currently trading at around $65.

Fxempire.com says that a drop below $65 per barley would be extremely detrimental.

In a recent report, Christopher Lewis of Fxempire.com said that the demand for oil is the main concern.

The post Why oil prices will likely stay low following Israel’s limited strike could be updated as new information is revealed