The oil prices fell on Thursday, as US inventories rose more than expected in the last week and Chinese imports continue to be under pressure.

The prices briefly rose on Thursday after Donald Trump’s victory in the US Presidential election raised concerns about Iranian supply.

Trump will likely impose stricter sanctions on Iran’s oil exports to other countries.

A storm named Rafael, which is approaching the US Gulf of Mexico, continues to threaten the supply of goods from that region.

This negated the impact of an inflated dollar.

The dollar has surged after Trump’s victory in the 2024 Presidential elections over vice president Kamala Harris.

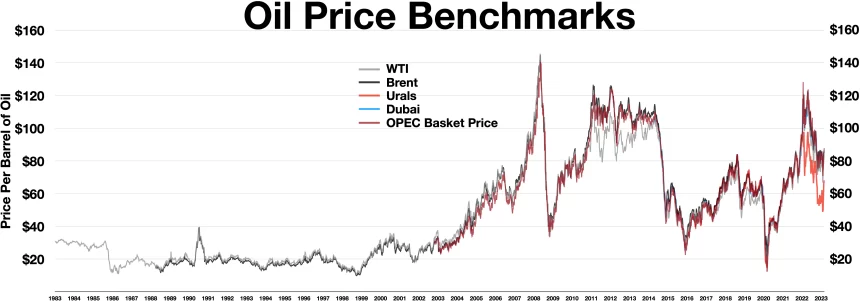

The price of West Texas Intermediate Crude Oil on the New York Mercantile Exchange at the time this article was written, was down 0.6% to $71.28 per barrel.

Brent crude at the Intercontinental Exchange closed today at $74.66 a barrel, a 0.3% decrease from its previous close.

The impact of rising inventories and weak China imports

Oil prices dropped despite the fact that the US Energy Information Administration reported a rise in US inventories of 2.1 million barrels.

Analysts had expected a rise of only 300,000 barrels in the week ending November 1.

The data also showed that gasoline and distillate inventories rose dramatically in the week ending November 1, as exports fell by over 1.4 million barrels.

In its weekly report, the EIA stated that production of crude oil by the world’s biggest producer was unchanged, at record levels, at 13.5 millions barrels per day.

Warren Patterson, the head of commodities strategy for ING Group said:

The crude oil buildup was a result of a 1.4pp increase in refinery utilisation over the past week. However, the 1.41m b/d decline in crude exports WoW would have contributed to this.

Patterson reported that China’s oil imports fell 4.9% month-on-month in October, to 10.56 millions barrels per day.

It was also 9% less than in the same period of last year.

This leaves the cumulative imports for this year so far down 3.4% YoY. Patterson said that these numbers would not do much to alleviate Chinese demand concerns.

Impact of Trump’s presidency is uncertain

After the results of the elections on Wednesday, the oil markets have continued to trade cautiously.

Oil prices could fall even though a Trump presidency will likely squeeze Iranian oil supplies. The Republican’s pro-policy towards drilling on federal US land may also contribute to this.

Patterson, noted

Oil and gas leasing could increase under a Trump administration, which was down significantly during Biden’s tenure.

The price of oil will continue to be a major factor in the growth of US supply.

Short-term, however, tighter sanctions against Iran and Venezuela may result in the loss of 1 million barrels of oil per day from global markets.

Both Iran and Venezuela have enjoyed some latitude in the past when it comes to oil exports under the administration of current US president Joe Biden.

Rafael Approaches Gulf of Mexico

On Wednesday, Hurricane Rafael in North America intensified to a Category 3 storm.

A report by ING Group states that a little more than 304,000 barrels of oil per day have been closed in the Gulf of Mexico.

ING reported that 131 million cubic foot per day of natural-gas production had also been shut down in the region.

Oil prices will likely be supported if there are further disruptions in the region. Brent prices could rise to $75 per barrel while WTI may reach $72 per barrel on Thursday.

This post Oil Prices Fall amid Rising Stocks, Weak China Imports; Market Uncertain about Impact of Trump’s Win appeared first on ICD