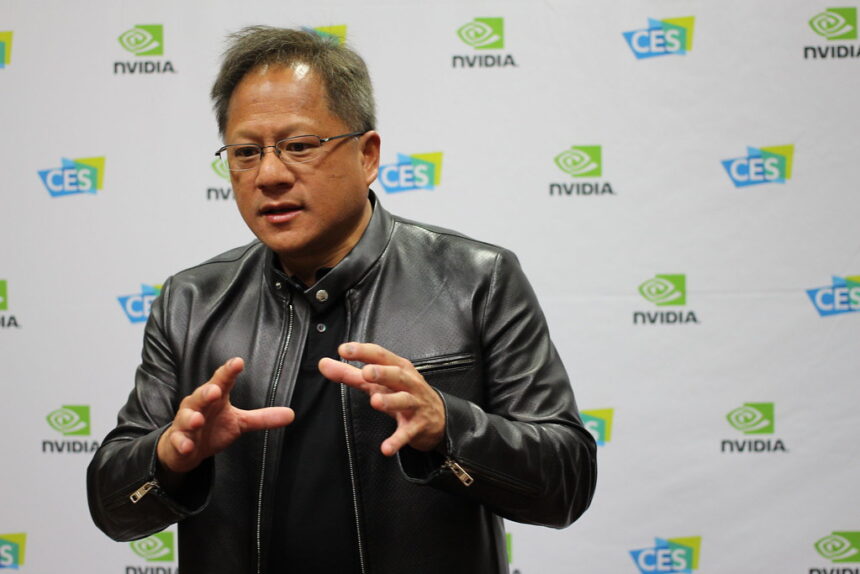

Nvidia’s annual GPU Technology Conference began today. Over 25,000 people attended to listen to CEO Jensen Huang’s keynote address.

This event will be held in a National Hockey League Arena in San Jose in California. It is intended to show off Nvidia’s most recent advancements in robotics, artificial intelligence and computing.

There will be a notable line-up of industry figures including Michael Dell CEO of Dell Technologies and Jeffrey Katzenberg co-founder DreamWorks as well as Bill McDermott CEO of ServiceNow.

We invite you to join us on Tuesday, March 18, at 10:00 a.m. Pacific Time as Jensen Huang, our CEO, unveils the next step in AI. Livestreaming of the keynote from SAP Center, San Jose will follow a pre-game with @AcquiredFM and other surprises. Get details nvda.ws/4bKNf5N

View all replies

Huang teased CNBC’s keynote, announcing that “Everyone thinks they already know what I will be talking about.” “They have no clue… incredible stuff we’re about to discuss.”

Vera Rubin and Blackwell Ultra-GB300 AI Chip Platform

Huang will introduce Nvidia’s Vera Rubin next-generation AI graphic processor and the Blackwell Ultra GB300 AI platform. Both are scheduled to be released this fall.

The announcements are made amid increased investor scrutiny. Nvidia stock has experienced notable fluctuation in the last few months.

Alice & Bob are joining Jensen Huang, @nvidia’s CEO on the stage of Nvidia GTC 2020! I’m excited to participate in a panel discussion on the future of quantum computers with other pioneers. See details here or register at bit.ly/4bu6Qaj. #GTC25#Nvidia

Nvidia will also highlight advances in AI-powered robots and humanoid systems.

It has established itself as a leader in AI, providing the chips used to power the large-scale AI systems that are employed by Microsoft, Google and other technology giants.

Huang to assure investors about AI future

Analysts are concerned about the sustainability of generative AI, even though tech giants like Microsoft, Amazon and Meta invested billions into AI infrastructure.

DeepSeek’s rise has intensified the debate on Nvidia’s limited hardware and DeepSeek’s capability to create a system that is competitive with Nvidia.

Patrick Moorhead of Moor Insights & Strategy – a technology research company – said that Mr. Huang would be at Nvidia GTC to reassure the public about AI’s potential.

It is expected that he will highlight AI agents, which are autonomous systems capable of performing complex tasks such as online shopping or personal assistance. He may also discuss the future of robots with humanoid features designed to maneuver in real environments.

Nvidia’s forthcoming Rubin AI platform will also offer significant performance improvements. It could deliver up to 30x faster processing speed.

These advancements would solidify Nvidia’s position as a leader in AI and ease investor concerns about sluggish demand.

Analysts’ forecasts and NVDA Stock Volatility

Nvidia stock experienced significant fluctuations in 2025 despite its dominance in AI.

In January, shares initially shot up to $149 before plummeting due to fears of a possible AI slowdown.

Nvidia’s market cap dropped by nearly 600 billion dollars after DeepSeek showed a model that was cutting edge, but used far fewer Nvidia processors than anticipated.

Investors will now be looking at signs of sustained customer demand and long-term commitments for Nvidia’s Blackwell AI chip.

Wall Street analysts are still largely positive, and Wedbush’s Dan Ives called the GTC event as a possible “wake up moment” for technology bulls.

We believe that this week’s Nvidia GTC Conference is a pivotal moment for the tech sector. Ives, in a recent note, wrote that the AI Revolution is refocused on and massive tech expenditures are expected for the next few years.

Will Stein, a Truist analyst, echoed the same sentiments. He maintained a rating of “Buy” on Nvidia with a price target of $205.

He acknowledged, however, that certain investors are still concerned about the potential for a downturn in case AI computing capability reaches saturation. He stated,

The biggest concern of investors (which was amplified by DeepSeek Private)) is the fact that NVDA customers deploy too much AI computing capacity now, and will then enter a digestion period, causing a cyclical decline. This dynamic is certain to us; only the timing is uncertain.

We continue to see NVDA’s AI division as the best in the business. “Its position as a leader is less due to its architecture, performance, or speed of chips and more because of the culture of innovation and ecosystem of incumbent that it has created, along with massive investments in software, services, and training models,” said he.

This article Nvidia GTC 2020: Jensen Huang will unveil AI breakthroughs while Wall Street looks for signs of sustainable growth first appeared on The ICD

This site is for entertainment only. Click here to read more