Prices of natural gas continued to increase on Monday, as tensions between Russia & Ukraine and strong fundamentals supported the sentiment.

The Henry Hub price of natural gas was $3.484 per million British Thermal Units (mBtu) at the time this article was written. This is a 6% increase.

Christopher Lewis, a Fxempire.com analyst, said that the price surge came after a 50% Fibonacci Retracement was completed near $3.12. This was followed by a sharp recovery.

He said:

The pivot level of $3.36 has been a crucial support level for buyers, helping them regain momentum.

Forecasts to 2025

According to Investing.com, analysts are “cautiously confident” about natural gas prices in the coming year. This is due to a combination of global demand trends and supply constraints, as well as weather-related uncertainty.

According to Investing.com, natural gas prices will continue to rise in the coming year.

Analysts at BofA Securities expect Henry Hub natural gas to cost around $3.30 per MBtu in 2024.

This is a dramatic increase from levels in 2023.

In its report, Investing.com stated that “natural gas prices in 2024 will be characterized by low trading. Prices will largely fluctuate between $2 and 3/MMBtu. This is the weakest year in natural gas since the pandemic caused slump in 2020.”

New Terminals in the US

In 2025, several factors will likely tighten natural gas markets and increase prices.

Demand from other countries will rise as LNG exports increase from US facilities at Corpus Christi Stage 3 and Plaquemines Stage 3.

The increased exports of US feed gas could increase local prices and strain the domestic supply.

Investing.com stated that “the continued growth in exports of U.S. natural gas to Mexico via pipeline which reached record levels in the year 2024 further highlights the international pull for U.S. Gas.”

US weather

Forecasts suggest that the winter of 2024-25 in the US may be 2 degrees colder than last year.

According to a report by Investing.com, the potential harsher weather conditions during the winter in the US may drive up the demand for gas 500 billion cubic feet.

Lewis from Fxempire said: “There is also the possibility this could have something to do with what has been happening in Ukraine.”

The simple transmission of US natural gas to Europe, for which you are trading, will increase demand from Europeans.

If temperatures are warmer than expected, the demand for gas may be reduced, which could limit price increases.

The structural change in the US electricity generation mix may also be a factor that supports gas demand.

Investing.com stated that “the retirement of coal-fired plants and the growth of renewable energy have cemented natural gas as a crucial bridge fuel.”

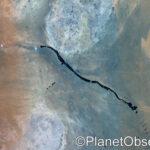

Russian gas via Ukraine flow stable

Reuters reported that despite the conflict between Austrian OMV and Russian Gazprom, Russian gas exports through Ukraine to Europe remained stable Monday.

In a dispute about payments, Russia stopped gas supplies to Austrian OMV in the first half of this month. Gas flows into Europe, however, remained constant.

The current gas transit agreement between Russia and Ukraine, which runs for five years, is due to expire December 31. Kyiv said earlier that it would not enter into talks with Moscow regarding a renewal.

Gazprom, according to Reuters, said that it will send 42 million cubic meters (mcms) of gas via Ukraine to Europe on Monday. This is the same as Sunday.

This post Natural Gas continues to surge, experts are ‘cautiously optimistic’ about 2025 first appeared on The COINPAPER.COM

This site is for entertainment only. Click here to read more