On Monday, the Nasdaq composite index reached a new record, thanks to gains by Intel, Super Micro Computers, and Tesla.

The Nasdaq Composite Index was nearly 1% greater at the time this article was written, and the S&P 500 rose by 0.2%. On Monday, the Dow Jones Industrial Average fell by 0.3%.

On Monday, tech stocks surged as Tesla and Intel soared. Super Micro Computers shares also soared by 27% on Monday.

David Morrison is a senior analyst for Trade Nation.

It is generally expected that some sort of Santa Rally will take stocks higher throughout Christmas and New Year. There’s still quite a bit to think about before we get to this point.

Both the Dow Jones index and S&P 500 had a strong month last month. It was their best of 2024. The majority of gains were made in the rally that followed Donald Trump’s victory in this year’s presidential elections.

Both indexes closed at highs on Friday in a short trading session, with low volume.

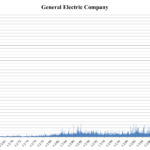

Super Micro, Intel and other companies are booming.

Super Micro Computer’s shares soared more than 15 percent after a committee found that there was “no proof of misconduct” and the financial statements of the company were “substantially accurate”.

A company that makes artificial intelligence servers announced it had appointed a chief accounting officer and was looking for a chief financial officer. Stocks of the company jumped by more than 31% Monday.

Intel shares jumped by 6% on Monday morning after it announced the retirement of CEO Pat Gelsinger.

David Zinsner, Michelle Johnston Holthaus and David Zinsner were named interim co-CEOs.

Tesla gains sharply

The shares of Tesla, a maker of electric vehicles, gained over 3% Monday following a tweet from the vice president for AI software on Saturday evening stating that some of its customers have begun receiving version 13 of “Full Self Driving”, Tesla’s driver-assistance technology.

CNBC quoted Stephen Gengaro as saying, “TSLA clearly is not an automaker. As evidenced by the current market capital surpassing that of the top ten global automakers.”

We are optimistic about TSLA’s auto business. The significant potential for value creation from the AI-based self-driving capability and Cybercab (Robotaxi), which is a full-self-driving vehicle, underpins our outlook.

Attention on Trump Tariff and Fed Policy

Trump threatened on Sunday to impose 100 tariffs on China and the BRICS group of countries.

Trump warned against BRICS countries’ attempts to create a new currency or move away from the US Dollar. Trump threatened to stop US trade with the BRICS countries, including Brazil, Russia India China South Africa.

Trump also announced last week that US tariffs would be imposed on any imported products from Mexico or Canada. Trump also said he would impose an additional 10% on top of the 60% tariff proposed for China.

Investors will be focusing on the US Federal Reserve policy meeting that is scheduled for later in this month. Market participants expect the US Federal Reserve to reduce interest rates this month by 25 basis points.

Interest rate reductions have undoubtedly been a tailwind this year for stocks, even though the Fed has tempered their cuts compared with expectations in January. Morrison stated that investors were less pessimistic for 2025.

The post Nasdaq records highs as Intel, Tesla, and Super Micro Computers surge, Investors eye Trump tariffs, Fed policy first appeared on ICD

This site is for entertainment only. Click here to read more