The gold and silver price surged on Friday after the mixed US inflation data paved the way to a volatile session.

The US labor market report came in weaker than expected despite the fact that the US inflation data exceeded expectations.

In a recent report, Fxstreet’s editor, Joaquin Monfort said that the Federal Reserve has a higher chance of maintaining a proeasing stance, given its avowed priority to employment security.

Gold and silver are both non-yielding investments, unlike bonds.

Gold edges higher after US CPI data

After the US consumer prices index data was released, gold prices rose 0.5% on COMEX.

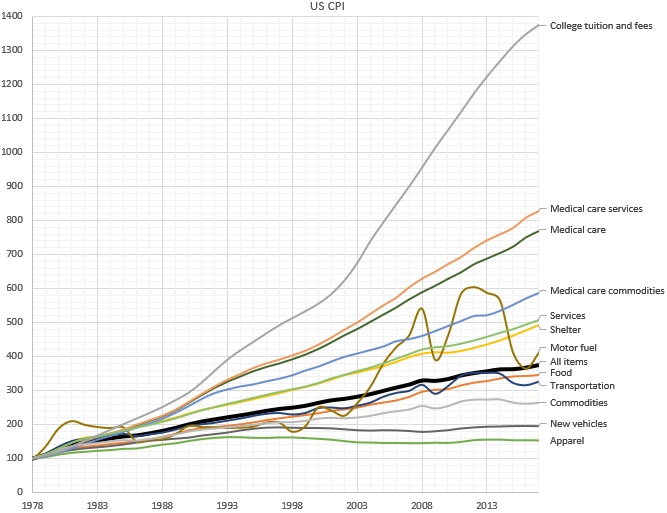

The US CPI Index showed an increase of 2.4% in September, compared to 2.5% in August. The reading was however higher than the 2.3% economists had predicted.

The CPI, excluding energy and food, increased 3.3% in the past year, compared to 3.2% last August. This was also higher than economists’ expectations of 3.2%.

The data on jobs showed that the number of people who filed for unemployment benefits for the first in the US increased to 258,000 during the week ending February 2nd from 225,000 the previous week.

Analysts had predicted 230,000 claims, but the actual number was a little more than 200,000.

Mary Daly, the president of the Federal Reserve Bank of San Francisco, said that she expected the Fed to cut interest rates by one or two before the end of this year.

She said the US inflation rate was not as important to her as the US labor market.

This change was influenced by the Fed minutes that were released last night. It was revealed that many policymakers had doubts about a cut of 50 basis points in September.

Zain Vawda is a market analyst with OANDA.

The recent employment report will only strengthen their resolve in November.

As of the time this article was written, the price for gold on COMEX stood at $2,641.70 an ounce. This is a 0.6% increase. Analysts say the $2,600 level per ounce remains a psychological hurdle for gold prices.

Vawda said that if prices fall below $2,600, it will create a great buying opportunity for investors.

Demand for safe-havens supports bullion

Safe-haven demand, despite the fact that the US inflation rate is still high and the Fed has not yet announced any rate cuts, has helped to keep bullion prices up.

The ongoing tensions in the Middle East are boosting sentiments among investors who seek safe haven assets, such as precious metals.

Israel has continued its assault on Lebanon while the market waits for the latter’s retaliation to Iran.

Last week, Iran fired more than 100 missiles at Israel’s Tel Aviv in an attempt to escalate the conflict.

Reports also claim that US President Joe Biden urged Israel not to disrupt the oil supply coming from Iran, but to restrict its retaliation to military targets.

Silver gains after US CPI data

Silver prices increased by more than 1% Thursday following higher-than-expected US CPI figures.

According to a Fxstreet article, “the white metal struggles to find direction as market players take time to digest inflationary numbers and adjust expectations regarding the Federal Reserve’s (Fed) rate outlook for the remainder of the year.”

Silver prices rose by nearly 8% in the third quarter of 2018 and are now more than 30% higher than they were at the end 2023.

Barchart.com reports that silver’s 1980 high of over $50 is the ultimate technical upside target.

The most active silver contract at COMEX is currently $31.062 an ounce. This represents a 1.3% increase from the previous closing price.

Palladium prices rise by 2%

The New York Mercantile Exchange’s palladium futures contracts rose by more than 2% to $1 066.53.

Barchart reports that palladium has been trending in a sideways manner since August.

The sideways pattern of trading could indicate that palladium is nearing a bottom after the steep drop from its record high in March 2022.

Palladium futures traded on the NYMEX dropped 76.2%, from $3.425 in March of 2022 to $813.50 this August.

The prices have slightly increased by 2.3% in the third quarter, but are still almost 10% lower than they were from January to June.

The decline in price was caused by the increasing penetration of battery-electric vehicles and an uninspired automobile industry. Palladium can be found in the catalytic convertors of petrol and diesel engine to reduce carbon emission.

The World Platinum Investment Council stated:

The market is convinced that the above-ground stocks will be sufficient to meet the current supply/demand balance, despite the fact that 2024 represents a third consecutive shortfall (and the largest deficit in the last 10 years).

This post Mixed US CPI and weak labor market keeps bullion shining. Palladium up by 2% since bottoming out may be updated as new information becomes available.

This site is for entertainment only. Click here to read more