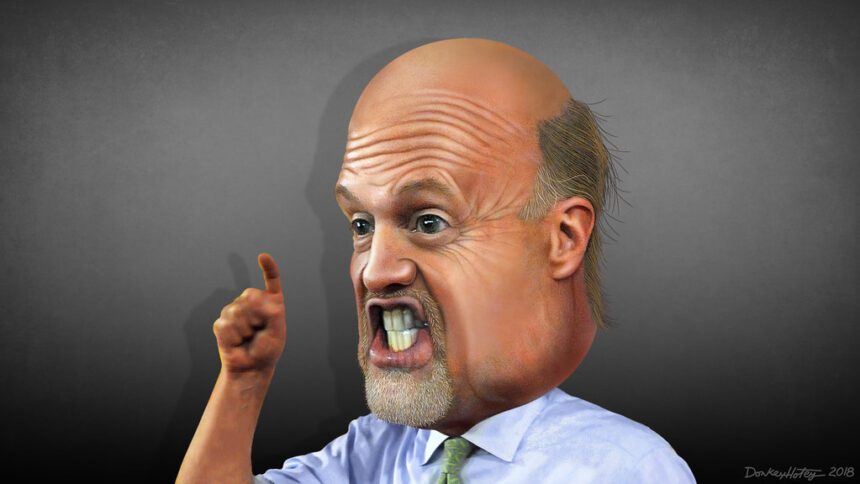

Jim Cramer, a famous investor and television personality has stated that he would buy more Walt Disney Co. shares if the stock drops below $90.

Cramer is optimistic about Disney’s future despite a difficult year since April for investors. He cites potential rate reductions as an important factor which could help consumer-oriented businesses such as Disney.

Cramer, who spoke to his Investing Club members on Thursday, said: “I advocate patience.”

While there is no immediate solution, the situation has been improving.

The Disney share price is expected to rise by 35%, reaching $130.

Why is Jim Cramer bullish about Disney?

Cramer’s belief in Disney stems primarily from the theme parks segment. This has been historically a major profit generator.

Cramer believes that this is a temporary slowdown. Although Florida and California parks experienced weakness last quarter as consumers pulled away due to the economic uncertainties, Cramer sees it as a temporary one.

The company expects to see flat attendance over the next few quarters, despite Hurricane Milton.

Cramer recommends that investors buy Disney shares during the current period of weakness. He believes the theme parks are likely to rebound in the future and generate significant growth.

He is particularly confident that Disney’s stock price will rise if it can articulate a strategy for long-term expansion beyond films and ESPN.

Disneyland recently raised its ticket price from $7 to $12. This is a sign of confidence about the future potential earnings.

Disney’s emphasis on experience

Cramer wants Disney to expand its theme parks now that it has made a profit in the streaming division.

He argues that a recovery in Disney’s experiences segment would boost the stock price by a significant amount.

Disney’s plans to invest 60 billion dollars in its experience business in the coming decade confirmed Cramer’s belief that the sector would play an important role in the growth of the company.

Analyst expectations and earnings

Disney will report its earnings for the third quarter in mid-November. Analysts expect earnings to be $1.09 a share, up from just 82 cents per share a year earlier.

UBS analysts share Cramer’s optimism. They predict synergies with Hulu and the deconsolidation its India assets. Additionally, they forecast cost-efficiencies which could push the stock to $120 in the coming year.

UBS expects Disney to earn per share a mid-single digit increase in the fiscal year of 2025. This adds further confidence to the bullish outlook.

Disney offers investors both income and growth with its current dividend yield.

The post Jim Cramer eyed Disney below $90 and predicted 35% potential upside may be updated as new information becomes available.

This site is for entertainment only. Click here to read more