Jefferies downgraded Hersheys’ stock from “hold” (a safe investment) to “underperform”, based on the expectation that Hersheys will face major challenges in the coming three years due to a drop in sales, and resulting margin compression.

Jefferies has lowered the price target on Hershey stock from $184 down to $163. This represents a possible 16% drop from its last closing.

As a result of inflationary pressures, the brokerage forecasts a drop in volume sales and corresponding margin compression.

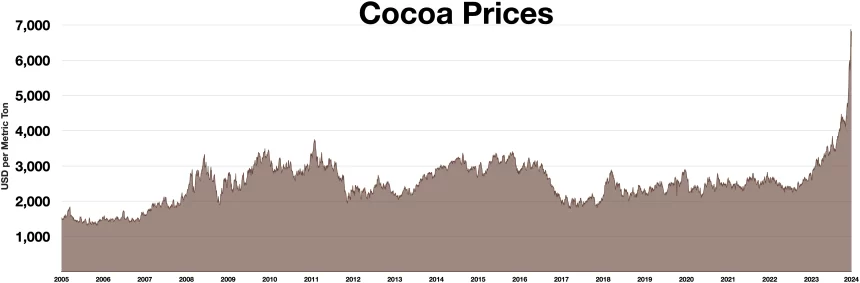

Analyst note highlights structural risk in chocolate category. This includes rising cocoa prices and generational shifts towards non-chocolate sweets.

Hershey shares fell by 0.8% Thursday.

The rising cost of cocoa and the declining demand for it pose risks

Jefferies reports that cocoa prices are up significantly in the last year. This has led to a widening of the gap between the cost of chocolate and the other snacks.

Hershey is expecting this inflation to affect its margins as it deals with an “overstretched”, already conservative US consumer market.

Hershey’s is also underinvested outside its two flagship chocolate names, Reese’s & Hershey.

Lack of diversification and the fact that the business is primarily based in the US makes the company more susceptible to changes in the confectionery industry, as non-chocolate treats like gummies gain traction.

Rob Dickerson, an analyst at Jefferies commented that “chocolate is one of the categories with the highest concern,” and noted that since 2019, chocolate’s purchase rates have been lower than other snacks.

Dickerson warned that volume would continue to decline as more consumers shifted towards alternative, cheaper snacks.

Hershey stock price performance and outlook

Hershey stock is up 2.4% for the year.

Only four of the 25 brokers that cover the stock rate the stock as “buy”, with the other 18 listing it as “hold”, and the remaining three listing it at “sell”.

Jefferies revised price target is $163. The median target for the stock now stands at $202. This is a significant increase.

Hershey’s exceeded both the top-line and bottom line estimates of its Q1 earnings for 2024, announced in May. This performance was a testament to Hershey’s resilience in the face changing economic conditions and rising cocoa prices.

Analysts were disappointed that the company did not increase earnings per share or adjusted earnings per shares, but instead maintained their projections of net sales increasing by only 2-3%.

Hershey faces increasing input costs as well as changing consumer tastes, and the ability of the company to adapt is critical for maintaining its position in an evolving snack market.

As new information becomes available, this post Jefferies Downgrades Hershey and Predicts Sweet Times Turning Sour may be updated.