Although the UK economy doesn’t seem to be in a free-fall, it is barely progressing. The UK economy is in a slump. Growth predictions are shrinking. Inflation refuses to fall. Businesses are also feeling the pinch.

British Chambers of Commerce has reduced its GDP growth forecast for 2024 to 0.8%, down from 1.1%. Meanwhile inflation will remain above Bank of England’s 2% target through 2026.

The country struggles to gain its feet due to higher taxes, weaker trade and a shaken confidence in business.

What is causing the slowdown in growth?

One of the most obvious indicators of a slowdown is the labour market. According to a KPMG and Recruitment and Employment Confederation survey, the number of job vacancies fell sharply in November. This was their highest rate for over four years.

As rising costs hit, employers are now reassessing their staffing requirements. This has led to the biggest increase in availability of staff in recent months and redundancies.

By 2025, unemployment is expected to rise slightly above previous estimates.

In 2025, 14.9% of youths are expected to find themselves unemployed.

Many businesses are reducing their hiring in order to compensate for the increased National Insurance Contributions introduced by the budget.

Taxes a stifle investment

The Autumn Budget of Chancellor Rachel Reeves introduced PS40 billion worth of tax increases, including increased National Insurance Contributions and wage hikes.

Confederation of British Industry, for example, warns that such measures reduce profits, decrease competitiveness and discourage investment.

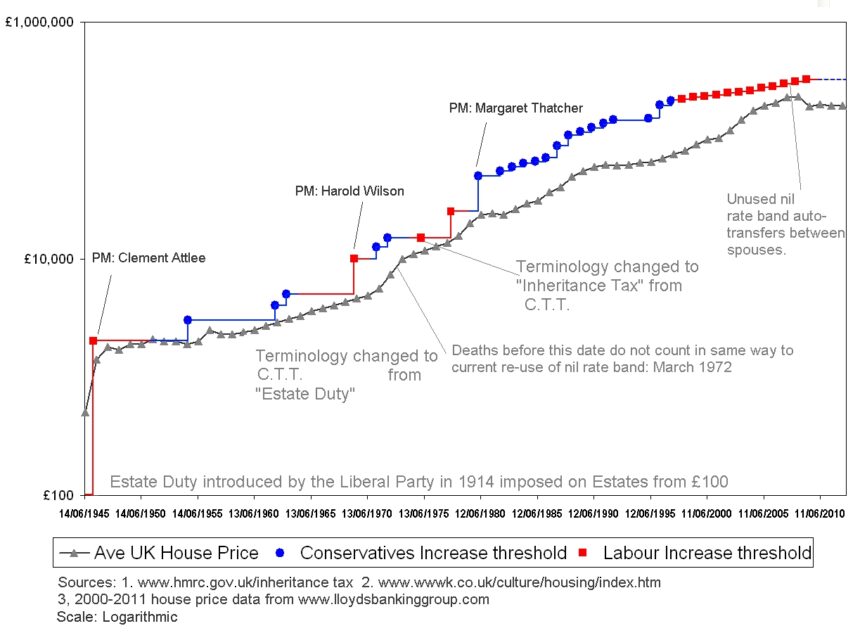

Pension savings will now be subject to 40% inheritance tax. The heirs of pension savings will be taxed on their withdrawals.

Pensions are a difficult sell when compared with alternatives such as property.

If you sell a property worth PS1,000,000, the inheritance tax is still applicable but there are no additional taxes. Pensions are no longer the most attractive option for families looking to build wealth.

According to the British Chamber of Commerce, business investments will grow only 1.5% by 2024 and then drop to just 0.9% by 2025. They are expected to recover to 2.0% by 2026.

In this climate, firms might find it difficult to finance innovation and expansion due to rising costs and regulatory obstacles.

This is an important development for economies that rely on long-term investment in infrastructure by pension funds.

How about manufacturing and trade?

UK trade prospects remain bleak due to the persistent challenges since Brexit.

Cross-border trade is becoming more costly and slower due to the EU’s barriers, which are now the UK’s biggest trading partner.

The uncertainty created by global conflicts, disruptions in supply chains, and new tariffs has a negative impact on both imports and exports.

British Chambers of Commerce expects that net trade will remain negative until 2026. They have forecasts of 1.5% in both 2024 as well as 2026.

Imports and exports will be barely in line with each other, resulting in a stale trade environment.

The manufacturing sector is not much better. The growth in this sector will remain modest. Only 0.6% is forecasted for 2025, and only 1.2% for the year 2026.

The numbers show the struggles that industries face due to higher input costs and weaker demand. Government support is also limited.

These figures illustrate the challenges of managing a post Brexit economy, while also dealing with disruptions on the international stage that are beyond the control of the UK.

Can inflation cool down?

The UK’s economy is also facing inflation.

BCC predicts that the Consumer Price Index (CPI), which is a measure of consumer prices, will remain higher than target. It should reach 2.2% by late 2025.

The cost of goods and services is increasing, while margins are shrinking.

It also leads to higher prices for the consumer and less income available, creating a vicious cycle of low demand and lack of confidence.

The government’s spending will help the GDP to recover slightly between 2025-2026. However, sustained inflation is a serious risk.

Businesses may find it difficult to grow if inflation continues. The economy could remain in low gear without targeted measures.

What is the best way to get out of this mess?

These problems are not easily solved, but you have options.

To avoid suppressing investment, the government can rethink their tax-heavy policy. Exporters would benefit from lowering trade barriers to the EU, and incentives for innovation and manufacturing could encourage businesses to invest.

Attention is needed for pensions as well.

Restaurating trust in long-term saving would stabilise the financial system, and provide funding to public projects that is much needed.

If these changes are not made, then the UK will become a country where investment is limited, growth is low, and future is uncertain.

Truthfully, the UK’s economy is not collapsing. It is losing momentum at an alarming rate.

The economy is in a state of flux. Businesses are struggling, employees are facing fewer job opportunities and investors are changing their strategy.

The next step depends on the ability of policymakers to regain confidence and realign their priorities.

The recovery has stalled for now.

The post entitled Why the UK Economy Feels Stuck and How it Could Recover may change as new information is revealed.