Goldman Sachs, Amundi and other financial institutions are increasingly confident in UK government bonds. This is a sign of their optimism about the ability of the new UK government to manage its finances with responsibility while also focusing on stimulating economic growth.

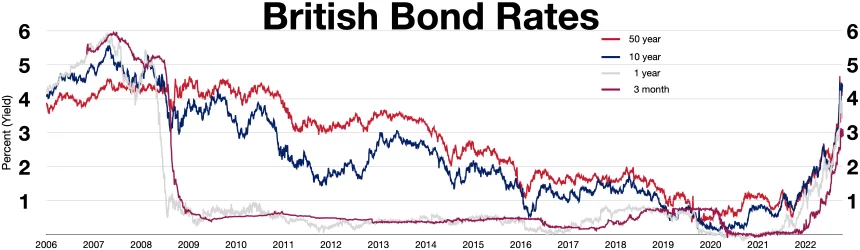

The bond market is betting that UK will not experience a fiscal crisis similar to the mini-budget of Liz Truss in 2022.

Bloomberg reported that Amundi, Europe’s largest asset management company, had shifted away from European debt to concentrate on UK bonds.

Goldman also advised its clients to purchase gilts before the announcement of budget.

BlackRock also increased its exposure to UK bonds, from neutral to overweight. Legal & General Investment Management as well as Aviva Investors have added to their UK debt.

Bet on market discipline and fiscal responsibility

Investors are confident that Reeves can balance her budget and close the PS22 billion gap in public finances.

Reeves will exercise fiscal discipline despite the fact that national debt is continuing to rise.

Daniel Loughney is the head of Fixed Income at Mediolanum Funds. He said: “She’ll want to keep some sort of impression of fiscal discipline.” This also explains why his company has a large exposure to UK Bonds.

A part of the optimism surrounding UK bonds stems from the expectation that the Bank of England is soon to begin cutting rates more aggressively.

Recent data revealed a marked slowdown in the inflation rate. John O’Toole expressed his confidence by stating:

Slowing inflation, fiscal discipline and a reduction in the UK’s debt should be beneficial to Britain.

Strategists say that the underperformance of gilt won’t continue.

Many believe that despite a difficult month for UK bond prices, the yield on 10-year bonds has risen over 30 basis point since mid-September.

Goldman Sachs’ strategists including George Cole remain convinced that an “almost gilt-friendly budget” will aid in the recovery of bonds.

BNP Paribas’ economists also expect that the government will use this budget to convey a clear message about fiscal responsibility to the market, which may ease concerns.

Mark Dowding is the chief investment officer of RBC BlueBay Asset Management. He warned that fixed income markets would likely balk at anything near half this amount, given the effect of the issuance of bonds on yields.

Market expectations and fiscal changes

Investors expect some financial maneuvers in Reeves’ budget. This includes possible tax increases and changes to self-imposed rules which currently limit borrowing by the government.

Sunil Krishnan is the head of Aviva’s multi-asset fund. He reassured Aviva investors that they are not concerned with moving “fiscal goals”.

The Office for Budget Responsibility is expected to play a key role in ensuring that government plans are not distorted by the shifting of fiscal goals.

A possible move would be to exclude the Bank of England balance sheet when calculating national debt, and thus free up PS16 billion more for borrowing.

The bond market would be concerned if a more aggressive borrowing option was chosen. This could result in 67 billion PS in additional borrowing capacity.

Citigroup economist Ben Nabarro warned recently of the possibility of a “buyers’ strike” if Reeves’ budget results in borrowing increases around PS50 billion the following year. This is because the bond market has already been dealing with record debt levels this year.

Balance between investor confidence and borrowing

Investors remain cautiously positive, but they know that Reeves will tread with caution.

Many believe that she will borrow modestly in order to maintain investor trust.

Barclays Plc also echoed the sentiment and suggested that Reeves could wait as long as 2025 before adjusting fiscal rules. This would give him more time to make a thorough assessment.

Moyeen Ahmed, Barclays’ rates strategist, said, “It might have been a mistake to have one gilt crisis caused by fiscal expansion, but two would look careless.” He also recommended that German bonds be replaced with gilts.

The post Goldman Sachs, Amundi support UK bonds before Reeves debut budget could be updated as new information becomes available

This site is for entertainment only. Click here to read more