Gold price has held steady above the crucial resistance-turn-support zone of $2,600 per ounce after momentarily dropping below it in mid-November. The bulls are still in control and the bullion is likely to trade in a range in the short term.

Gold is also under pressure due to a stronger US Dollar and higher Treasury yields. Despite this, the renewed tensions between Israel & Syria support gold as a traditional safe haven. China has also recently purchased gold after a six-month break. The precious metal is currently trading at $2.647 per ounce, down over 5% since its all-time peak in late October.

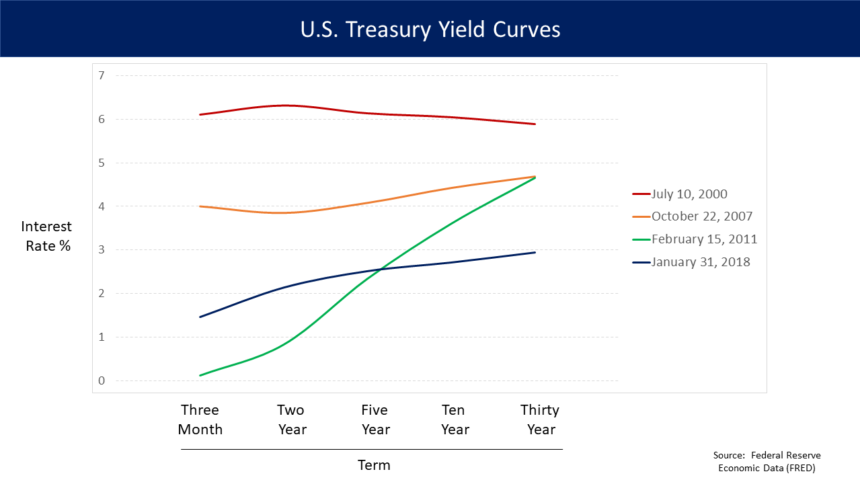

The rising yields of Treasury bonds weighs down on non-yielding gold

The 10-year US benchmark government bond yields are in the green since a week. This has weighed on the gold price and boosted the US dollar. Treasury yields, at 4.41% are close to their 6-month high of 2.50% in mid-November. The opportunity cost of holding non-yielding gold tends to rise when Treasury yields increase. In addition, higher yields tends to boost the US Dollar.

Investors’ expectation of a rate cut of 25 basis points during the Fed’s last policy meeting in this year has fueled the surge in Treasury yields. This is the third successive interest rate cut, after the central banks announced cuts of 25 and 50 basis points respectively in November and September.

Investors expect the US central bank, beyond December’s rate reduction, to adopt a hawkish tone going forward. Investors are hesitant to take major steps ahead of the FOMC’s statement on Wednesday because they have these expectations. Jerome Powell had stated earlier in December that the Fed could be “cautious’ in its interest-rate cuts due to the stable US economy.

Analysts are also concerned that Trump’s policy will lead to an increase in inflation, which would force the central bank into a pause on their easing cycle. Normally, the gold price is a lot higher in an environment with lower interest rates.

The PBoC purchase limits losses due to geopolitical tensions

Despite the price pressure on gold, purchases by China’s central banks have kept the bullion at or above $2,600. After putting off the purchases for 6 months, The People’s Bank of China upped their gold reserves in November by 160,000 fine troy-ounces. Prior to this hiatus, PBoC was accumulating its gold holdings 18 months in a line; a move which further fueled precious metal bull run.

It is interesting to note that the return of China’s purchasing coincided with a new record high for the asset. The central bank is demonstrating its commitment to strengthening reserves and protecting against Yuan depreciation. The growth in gold reserves by central banks around the world is one of the main factors that will boost gold prices for 2024.

In recent months, the demand for safe havens has been sustained by persistent conflicts in Eastern Europe and the Middle East. Gold price is supported by its traditional safe haven status, from Russia’s updated nucleonic doctrine to the recent overthrow of Syria’s president Bashar al-Assad.

The US dollar has also become a popular store of value during times of geopolitical and economic uncertainty. A stronger dollar makes gold more expensive for foreign currency buyers.

Gold Price Forecast

Gold’s price peaked at $2,790 per ounce in November, but has since dropped to $2.650 following Donald Trump’s victory. The price of gold has now consolidated between the 25-day and 50-day Exponential moving averages (EMA).

At $2,725 gold has also formed a pattern of a double top. Double-top patterns are one of the worst signs on the market. There is therefore a possibility that the market will experience a bearish break out after the Fed’s decision. This could cause gold to drop down to its next important support level of $2,538, which was its lowest level since November 14.

This post Gold Price Forecast: XAU Signal ahead of the Fed Decision may be updated as new information unfolds

This site is for entertainment only. Click here to read more