GBP/USD has been declining for six weeks in a row, and reached its lowest point since August 12th. The exchange rate has fallen by nearly 4% since its peak this year, as traders are focused on the US elections and the Federal Reserve and Bank of England interest rate decisions.

US Bond yields increase after Trump’s win

After the US elections, the yields on US government bonds surged up to their highest levels since July of this year. The 10-year bond yield jumped up to 4.47% while the 5-year rose to 4.3%.

The bond yields have been falling since the September 11 attacks.

After Donald Trump’s election victory on Wednesday, bond yields increased. Trump’s campaign focused on tax cuts, tariffs, and deregulation. These measures will have a high inflationary effect, particularly tariffs. This could lead the Fed to adopt a more hawkish stance in the future.

Trump could lead to geopolitical problems, and this will benefit the US dollar.

The Federal Reserve’s interest rate announcement on Thursday will likely be the next major catalyst in the GBP/USD currency pair.

The Fed is expected to decide on a 0.25% cut in interest rates at this meeting, as they continue to create a soft landing of the American economy. In a prior meeting, the bank had already cut interest rates by 0.5%.

After the US released weak employment numbers Friday, odds of a further cut increased. The Bureau of Labor Statistics reports that the US economy only created 12,000 new jobs in October. However, the unemployment rate was still above 4.0%.

Bank of England to make a decision soon

Next, the Bank of England will make a decision. This comes one week after Rachel Reeves released her budget. Tax increases will be part of the budget, as well as more spending.

The BoE is expected to maintain its dovish tone at the next meeting, by reducing interest rates by 0.25 percent.

These cuts are hoped to lead to an economic recovery stronger in the months ahead. Recent data showed the economy doing better than anticipated.

In August, for example, after two months of contractions in a row the economy expanded. The manufacturing and service PMIs have also remained over 50 for the last few months.

The UK inflation rate has also continued to fall and is now below the target of 2%. Services inflation, which is closely watched by many economists, has continued to fall.

Market participants have already priced it in, so a BoE rate cut is unlikely to make a significant impact on the GBP/USD.

Seven members of ING’s analysts expect that the bank will cut. Two oppose it. They predict that the GBP/USD will fall by only 50 pips if this occurs. The authors wrote:

We believe that the upside risk to sterling is quite low, given that markets have priced in BoE’s landing point 75bp more since mid-September. Sterling could correct lower if the BoE focuses on the easing process this week.

Technical analysis of the GBP/USD

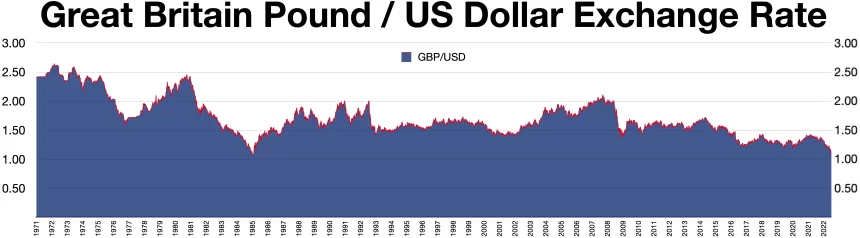

In the last few weeks, the GBP/USD rate was under intense pressure. The exchange rate has fallen from 1.3435, a September high to the current level of 1.2925.

This pair is consistently below both the 25-period average and 50-period average, which indicates that bears have control.

Also, it has moved under the Fibonacci Retracement of 61.8%. It has also formed a double bottom pattern of a smaller size at 1.2843.

There is therefore a possibility that the currency will make a return as Trump’s election worries ease. It could then rise up to its key resistance at 1,3050, which was the highest level on November 6th.

The post GBP/USD Forecast: Pound could rebound after Fed and BoE Decision may be updated as new developments unfold.

This site is for entertainment only. Click here to read more