Matt Belloni is a founder partner of the digital media firm Puck and Matt Belloni believes that Netflix Inc.

Many top directors still want their films to be shown at theaters, despite the streaming giant’s decision.

Belloni cited the Margot Robbie-led adaptation of Wuthering Height as an example.

Netflix is willing to spend up to 150 million dollars for the adaptation of Emily Bronte’s novel from 1847, but filmmakers are still deciding whether they will prioritize streaming online over theater releases.

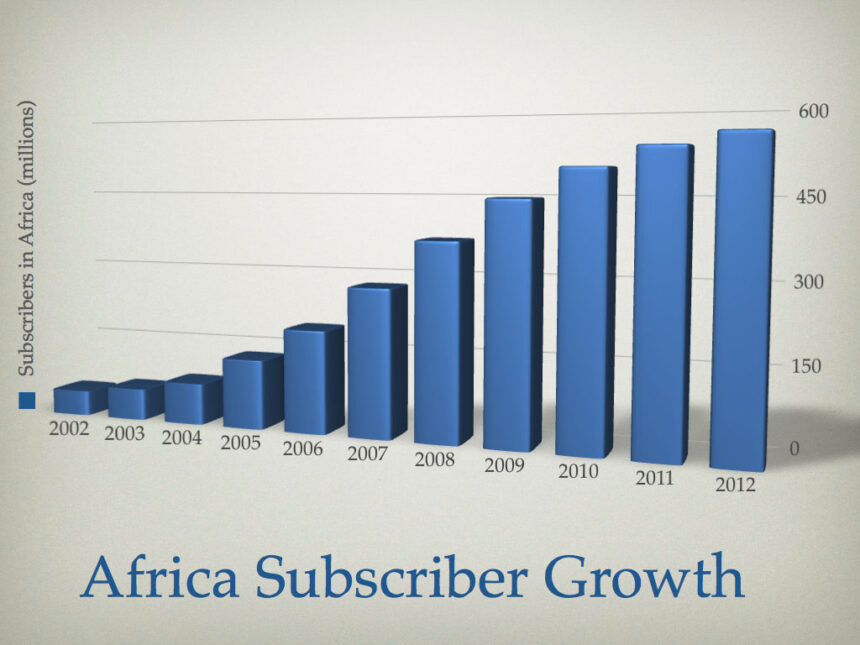

NFL can boost Netflix subscriber growth

Netflix plans to broadcast NFL games this Christmas on their platform.

Belloni claims that this new move to live events will help Belloni reduce the churn of subscribers and bring in more viewers.

He explained this in an interview with CNBC.

Belloni believes that investors are going to closely watch the subscriber growth metrics and the engagement metrics for the next earnings report. The NFL presence, Belloni says, could have a positive impact on both of these areas.

Analysts anticipate Netflix will report $9.77 Billion in Revenue for the Third Quarter, a 14.3% rise, and earnings per share at $5.07 representing a 358.9% increase.

In three out of four recent quarters, the streaming service exceeded expectations.

Analysts predict Netflix could be worth $795 per share.

Macquarie analyst Tim Nollen gave Netflix an “outperform rating” on Monday. He predicted that Netflix’s stock price could rise to $795 in the coming year.

He believes that his price target will result in a roughly 12% increase from the current level. Nollen suggests investing in NFLX because of its pricing power and continued monetization in advertising.

In a note of research to clients, the researcher noted that “Adtech integrations, the creation of an internal data stack, and the audience graph, should result in substantial growth in advertising over the next 2 years, or sooner.”

Analysts speculated that Netflix may announce an increase in price soon, which would be a catalyst to its stock value.

Nollen expects Netflix to benefit from the live event commitment in the near future.

Netflix does not currently pay out dividends, so it may not be appealing to investors who are looking for income.

The post Netflix’s Q3 Earnings Report: Find out More may change as new information becomes available.